Delta Airlines 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

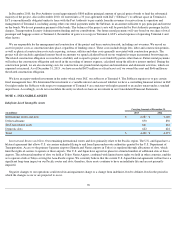

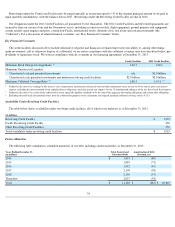

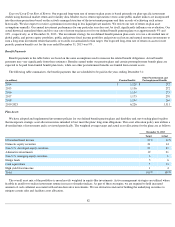

Borrowings under the Term Loan Facility must be repaid annually in an amount equal to 1% of the original principal amount (to be paid in

equal quarterly installments), with the balance due in 2017 . Borrowings under the Revolving Credit Facility are due in 2016 .

Our obligations under the 2011 Credit Facilities are guaranteed by the Guarantors. The 2011 Credit Facilities and the related guarantees are

secured by liens on certain of our and the Guarantors' assets, including accounts receivable, flight equipment, ground property and equipment,

certain aircraft, spare engines and parts, certain non-Pacific international routes, domestic slots, real estate and certain investments (the

“Collateral”). For a discussion of related financial covenants, see "Key Financial Covenants" below.

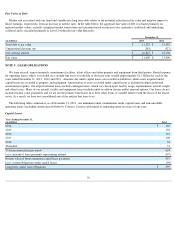

Key Financial Covenants

The credit facilities discussed above include affirmative, negative and financial covenants that restrict our ability to, among other things,

make investments, sell or otherwise dispose of collateral if we are not in compliance with the collateral coverage ratio tests described below, pay

dividends or repurchase stock. We were in compliance with all covenants in our financing agreements at December 31, 2013 .

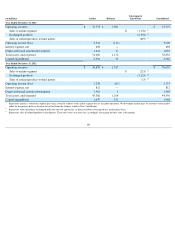

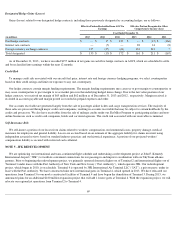

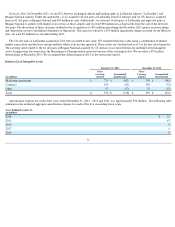

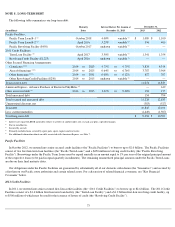

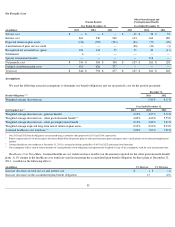

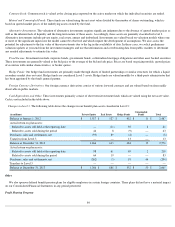

Availability Under Revolving Credit Facilities

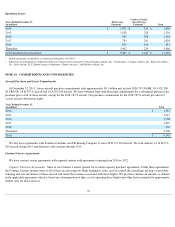

The table below shows availability under revolving credit facilities, all of which were undrawn, as of December 31, 2013 :

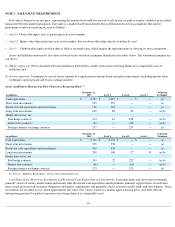

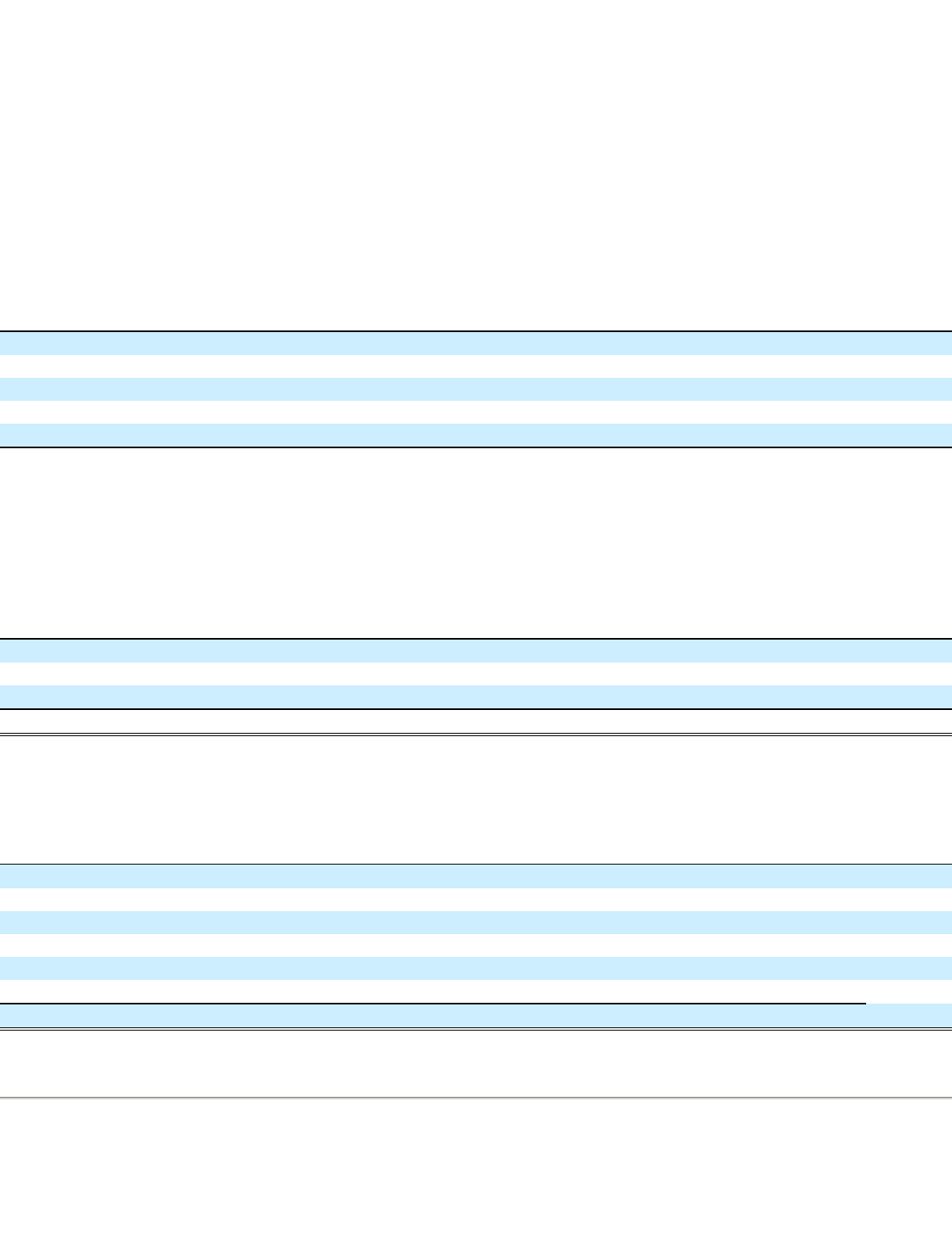

Future Maturities

The following table summarizes scheduled maturities of our debt, including current maturities, at December 31, 2013 :

74

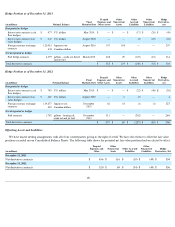

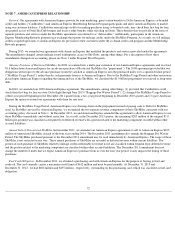

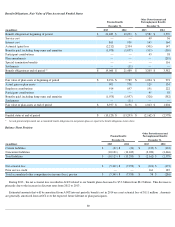

Pacific Facilities 2011 Credit Facilities

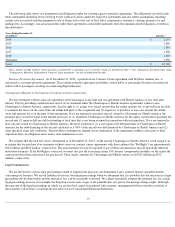

Minimum Fixed Charge Coverage Ratio

(1)

1.20:1 1.20:1

Minimum Unrestricted Liquidity

Unrestricted cash and permitted investments n/a $1.0 billion

Unrestricted cash, permitted investments and undrawn revolving credit facilities $2.0 billion $2.0 billion

Minimum Collateral Coverage Ratio

(2)

1.60:1 1.67:1

(3)

(1)

Defined as the ratio of (a) earnings before interest, taxes, depreciation, amortization and aircraft rent and other adjustments to net income to (b) the sum of gross cash interest

expense (including the interest portion of our capitalized lease obligations) and cash aircraft rent expense, for the 12-

month period ending as of the last day of each fiscal quarter.

(2)

Defined as the ratio of (a) certain of the collateral that meets specified eligibility standards to (b) the sum of the aggregate outstanding obligations and certain other obligations.

(3)

Excluding the non-

Pacific international routes from the collateral for purposes of the calculation, the required minimum collateral coverage ratio is 0.75:1

(in millions)

Revolving Credit Facility

$

1,225

Pacific Revolving Credit Facility

450

Other Revolving Credit Facilities

250

Total availability under revolving credit facilities

$

1,925

Years Ending December 31,

(in millions) Total Secured and

Unsecured Debt Amortization of Debt

Discount, net

2014

$

1,491

$

(80

)

2015

1,089

(73

)

2016

1,472

(67

)

2017

2,190

(58

)

2018

2,159

(47

)

Thereafter

2,827

(58

)

Total

$

11,228

$

(383

)

$

10,845