Delta Airlines 2013 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

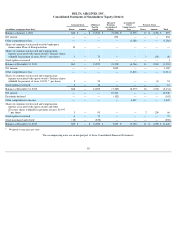

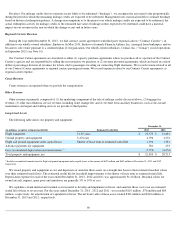

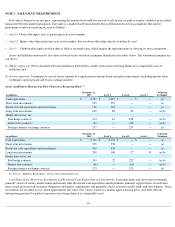

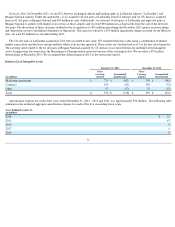

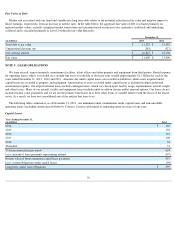

NOTE 3 . FAIR VALUE MEASUREMENTS

Fair value is defined as an exit price, representing the amount that would be received to sell an asset or paid to transfer a liability in an orderly

transaction between market participants. Fair value is a market-based measurement that is determined based on assumptions that market

participants would use in pricing an asset or liability.

Assets and liabilities measured at fair value are based on the valuation techniques identified in the tables below. The valuation techniques are

as follows:

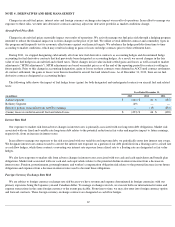

Assets (Liabilities) Measured at Fair Value on a Recurring Basis

(1)

Cash Equivalents, Short-term Investments and Restricted Cash Equivalents and Investments. Cash equivalents and short-term investments

generally consist of money market funds and treasury bills. Restricted cash equivalents and investments primarily support letters of credit that

meet certain projected self-

insurance obligations and airport commitments and generally consist of money market funds and time deposits. These

investments are recorded at cost, which approximates fair value. Fair value is based on a market approach using prices and other relevant

information generated by market transactions involving identical or comparable assets.

65

•

Level 1.

Observable inputs such as quoted prices in active markets;

•

Level 2

. Inputs, other than quoted prices in active markets, that are observable either directly or indirectly; and

•

Level 3

. Unobservable inputs in which there is little or no market data, which require the reporting entity to develop its own assumptions.

(a)

Market approach

. Prices and other relevant information generated by market transactions involving identical or comparable assets or

liabilities; and

(b)

Income approach.

Techniques to convert future amounts to a single present amount based on market expectations (including present value

techniques, option-pricing and excess earnings models).

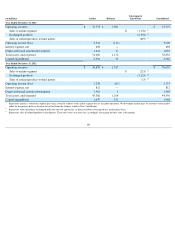

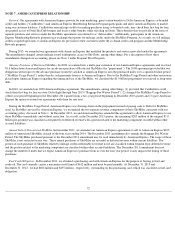

(in millions) December 31,

2013 Level 1 Level 2 Level 3 Valuation

Technique

Cash equivalents

$

2,487

$

2,487

$

—

$

—

(a)

Short-term investments

959

959

—

—

(a)

Restricted cash equivalents and investments

118

118

—

—

(a)

Long-term investments

109

80

29

—

(a)(b)

Hedge derivatives, net

Fuel hedge contracts

314

16

298

—

(a)(b)

Interest rate contracts

(67

)

—

(

67

)

—

(a)(b)

Foreign currency exchange contracts

257

—

257

—

(a)

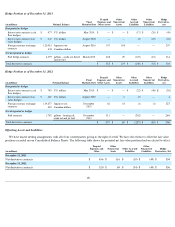

(in millions) December 31,

2012 Level 1 Level 2 Level 3 Valuation

Technique

Cash equivalents

$

2,176

$

2,176

$

—

$

—

(a)

Short-term investments

958

958

—

—

(a)

Restricted cash equivalents and investments

344

344

—

—

(a)

Long-term investments

208

100

27

81

(a)(b)

Hedge derivatives, net

Fuel hedge contracts

249

27

222

—

(a)(b)

Interest rate contracts

(66

)

—

(

66

)

—

(a)(b)

Foreign currency exchange contracts

123

—

123

—

(a)

(1)

See Note 11 , “Employee Benefit Plans”,

for fair value of benefit plan assets.