Delta Airlines 2013 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

measure and (ii) Delta’

s NPS performance attributable to international travel accounting for 40%

of the measure. The criteria and methodology used to determine Delta’

s NPS is described in a

document titled, “‘Net Promoter’: Measuring Customer Satisfaction at Delta,”

which was

previously reviewed by the Committee. Company management will periodically report to the

Company’s Board of Directors regarding Delta’s NPS.

A = Adjusted Total Operating Income; and

B = Average Invested Capital.

A = Adjusted Book Value of Equity; and

B = Adjusted Net Debt.

__________________________________________________________

4

For example, for determining Average Invested Capital for the 2014 calendar year, the trailing five calendar quarter average will be measured based on the

quarter ending December 31, 2013 and each of the subsequent four quarters of 2014.

6

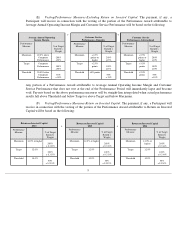

(D)

Return on Invested Capital.

(1) The “ Return on Invested Capital ” for Delta shall be calculated by using Delta’

s Adjusted Total

Operating Income and Average Invested Capital for each individual calendar year during the

Performance Period (2014, 2015, and 2016) and the following formula (AB), where:

(2) “ Adjusted Total Operating Income ” means, subject to Section 4(b)(v)(B) below, Delta’

s

consolidated operating income for the applicable periods based on its regularly prepared and

publicly available statements of operations prepared in accordance with GAAP, but excluding, (i)

items present in the line item “restructuring and other items” or such similar line item; (ii) mark-to-

market adjustments for fuel hedges recorded in periods other than the settlement period; (iii) other

special, unusual, or nonrecurring items which are disclosed in publicly available filings with the

SEC; and (iv) implied interest in aircraft rent expense, and amortized pension expense related to

gains/losses that impact accumulated other comprehensive income (“ AOCI ”).

(3) “ Average Invested Capital” means, subject to Section 4(b)(v)(B) below, Delta’

s total invested

capital determined based on the average of a trailing five calendar quarters measured from the last

calendar quarter preceding each calendar year of the Performance Period,

4

using the following

formula, (A+B), where:

(4) “Adjusted Book Value of Equity”

for Delta shall be calculated quarterly based on its regularly

prepared internal financial statements (i) with an initial starting value for the quarter ending

December 31, 2013 (the “ Initial Value ”)

equal to the book value of equity determined in

accordance with GAAP as of December 31, 2013, but excluding the