Delta Airlines 2013 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Pension Contributions. We sponsor defined benefit pension plans for eligible employees and retirees. These plans are closed to new entrants

and are frozen for future benefit accruals. Our funding obligations for these plans are governed by the Employee Retirement Income Security

Act, as modified by the The Pension Protection Act of 2006. We contributed $914 million in 2013, including $250 million above the minimum

funding levels, $697 million in 2012 and $598 million in 2011 to our defined benefit pension plans. We estimate the funding under these plans

will total approximately $925 million in 2014, including $250 million above the minimum funding requirements.

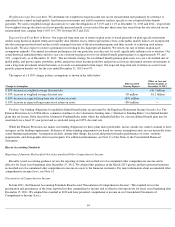

Undrawn Lines of Credit

We have available $1.9 billion in undrawn lines of credit. As described in Note 8 of the Notes to the Consolidated Financial Statements, we

have an undrawn $1.2 billion first-lien revolving credit facility, as part of our 2011 Credit Facilities. The revolving credit facility carries a

variable interest rate and expires in April 2016.

We also have an undrawn $450 million revolving credit facility included in the 2012 Pacific Facilities, as described in Note 8 of the Notes to

the Consolidated Financial Statements. The 2012 Pacific Facilities are secured by our Pacific routes and slots. This revolving credit facility

carries a variable interest rate and expires in October 2017. In addition, we have undrawn bank revolving credit facilities of $250 million.

The credit facilities mentioned above have covenants, such as collateral coverage ratios. If we are not in compliance with these covenants, we

may be required to repay amounts borrowed under the credit facilities and may not be able to draw on the revolving credit facilities.

Other

Our ability to obtain additional financing, if needed, on acceptable terms could be adversely affected by the fact that a significant portion of our

assets are subject to liens.

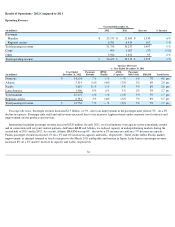

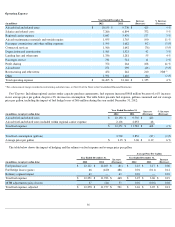

Investing and Financing

Investing Activities

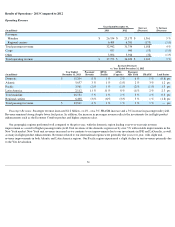

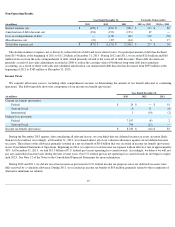

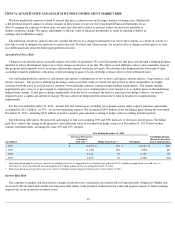

We incurred capital expenditures of $2.6 billion in 2013 , $2.0 billion in 2012 and $1.3 billion in 2011 . Our capital expenditures were

primarily for the purchase of aircraft and aircraft modifications that upgraded aircraft interiors and enhanced our product offering. Also during

2013, we purchased a 49% equity investment in Virgin Atlantic for $360 million .

We have committed to future aircraft purchases that will require significant capital investment, and have obtained long-term financing

commitments for a substantial portion of the purchase price of these aircraft. We expect that we will invest approximately $2.3 billion in 2014

primarily for aircraft and aircraft modifications. We expect that the 2014 investments will be funded through cash from operations and new

financings.

Financings

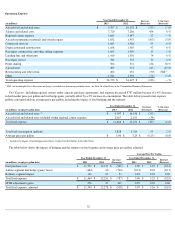

At December 31, 2013 , total debt and capital leases, including current maturities, was $11.3 billion , a $1.4 billion reduction from

December 31, 2012

and a $5.9 billion reduction from December 31, 2009. We have focused on reducing our total debt over the past few years as

part of our strategy to strengthen our balance sheet. In addition, we have refinanced previous financing transactions, which we expect to reduce

our total future interest expense.

In May 2013, we announced a plan to return more than $1 billion to shareholders over the next three years. As part of this plan, our Board of

Directors initiated a quarterly dividend program and declared a $0.06 per share dividend in both August 2013 and November 2013. These

dividends were paid in September 2013 and November 2013 and each totaled $51 million . In addition, the Board of Directors authorized a $500

million share repurchase program, to be completed no later than June 30, 2016 . During 2013 , we repurchased and retired approximately 10

million shares at a cost of approximately $250 million .

In 2013, we received $268 million in financing proceeds from long-term debt, which is secured by aircraft delivered in 2013. In 2012, we

received $480 million in financing proceeds from long-term debt secured by aircraft previously financed by debt. In 2012, we also refinanced

$1.7 billion in debt and undrawn revolving credit facilities secured by our Pacific routes and slots, which resulted in a lower interest rate.

39