Delta Airlines 2013 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

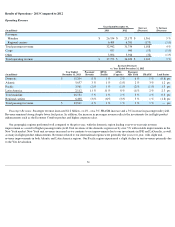

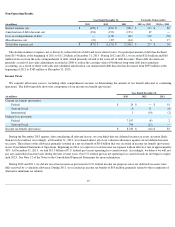

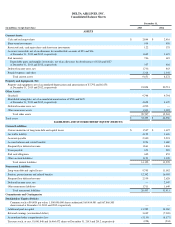

Critical Accounting Policies and Estimates

Our critical accounting policies and estimates are those that require significant judgments and estimates. Accordingly, the actual results may

differ materially from these estimates. For a discussion of these and other accounting policies, see Note 1 of the Notes to the Consolidated

Financial Statements.

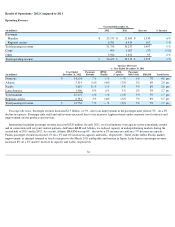

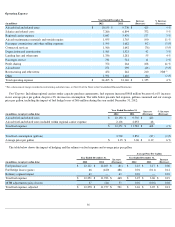

Frequent Flyer Program

Our frequent flyer program (the “SkyMiles Program”) offers incentives to travel on Delta. This program allows customers to earn mileage

credits by flying on Delta, regional air carriers with which we have contract carrier agreements and airlines that participate in the SkyMiles

Program, as well as through participating companies such as credit card companies, hotels and car rental agencies. We sell mileage credits to

non-airline businesses, customers and other airlines.

The SkyMiles Program includes two types of transactions that are considered revenue arrangements with multiple deliverables. As discussed

below, these are (1) passenger ticket sales earning mileage credits and (2) the sale of mileage credits to participating companies with which we

have marketing agreements. Mileage credits are a separate unit of accounting as they can be redeemed by customers in future periods for air

travel on Delta and participating airlines, membership in our Sky Club and other program awards.

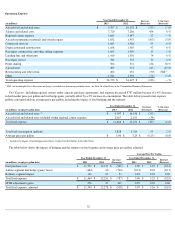

Passenger Ticket Sales Earning Mileage Credits. Passenger ticket sales earning mileage credits under our SkyMiles Program provide

customers with two deliverables: (1) mileage credits earned and (2) air transportation. We value each deliverable on a standalone basis. Our

estimate of the standalone selling price of a mileage credit is based on an analysis of our sales of mileage credits to other airlines and customers

and is re-evaluated at least annually. We use established ticket prices to determine the standalone selling price of air transportation. We allocate

the total amount collected from passenger ticket sales between the deliverables based on their relative selling prices.

We defer revenue for the mileage credits related to passenger ticket sales and recognize it as passenger revenue when miles are redeemed and

services are provided. We record the air transportation portion of the passenger ticket sales in air traffic liability and recognize these amounts in

passenger revenue when we provide transportation or when the ticket expires unused. A hypothetical 10% increase in our estimate of the

standalone selling price of a mileage credit would decrease passenger revenue by approximately $50 million, as a result of an increase in the

amount of revenue deferred from the mileage component of passenger ticket sales.

Sale of Mileage Credits. Customers may earn mileage credits through participating companies such as credit card companies, hotels and car

rental agencies with which we have marketing agreements to sell mileage credits. Our contracts to sell mileage credits under these marketing

agreements have multiple deliverables, as defined below.

Our most significant contract to sell mileage credits relates to our co-brand credit card relationship with American Express. In September

2013, we and American Express modified our SkyMiles agreements. This modification required that we use a different accounting standard for

recording SkyMiles sold. Prior to the modifications, we allocated consideration received from selling miles to American Express among two

primary deliverables: credit redeemable for future travel and marketing deliverables. We deferred revenue related to the portion of mileage

credits redeemable for future travel based on the rate at which we sell mileage credits to other airlines. We calculated the value of the marketing

component based on the residual method and recognize it as other revenue as related marketing services are provided.

The September 2013 modifications introduced new deliverables and modified existing deliverables. Because these modifications were

material to the SkyMiles agreements, we are required to use a different accounting standard that allocates the consideration received from selling

miles to all deliverables based on their relative standalone sales price. Accordingly, we determined our best estimate of selling prices by

considering discounted cash flows analysis using multiple inputs and assumptions, including: (1) the expected number of miles awarded and

number of miles redeemed, (2) the rate at which we sell mileage credits to other airlines, (3) published rates on our website for baggage fees,

access to Delta SkyClub lounges and other benefits while traveling on Delta and (4) brand value. The effect of this change in accounting

standard lowered the deferral rate we use to record miles sold under the agreements, which increases revenue we will record in future periods.

The revenue impact of the SkyMiles agreement modifications was insignificant for 2013 and is expected to increase 2014 revenue by

approximately $100 million . Additionally, upon application of this accounting standard, we were required to adjust the recorded value of miles

currently deferred in our Frequent Flyer Liability that originated through the American Express programs. Accordingly, we adjusted the liability

in the September 2013 quarter by less than $10 million .

41