Delta Airlines 2013 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

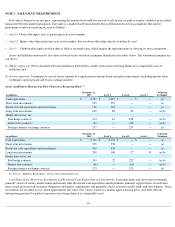

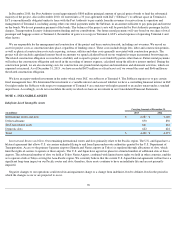

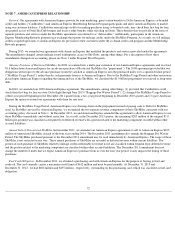

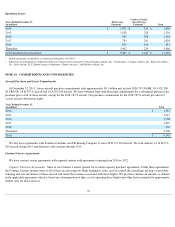

Long-term Investments. Our long-term investments that are measured at fair value primarily consist of equity investments in Grupo

Aeromexico, S.A.B. de C.V., the parent company of Aeromexico, and GOL Linhas Aereas Inteligentes, S.A, the parent company of GOL.

Shares of the parent companies of Aeromexico and GOL are traded on public exchanges and we have valued our investments based on quoted

market prices. The investments are classified in other noncurrent assets. In 2013, we sold our remaining auction rate securities, which were

previously classified as Level 3 instruments.

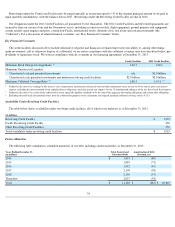

Hedge Derivatives. Our derivative contracts are generally negotiated with counterparties without going through a public exchange.

Accordingly, our fair value assessments give consideration to the risk of counterparty default (as well as our own credit risk).

66

•

Fuel Derivatives.

Our fuel hedge portfolio consists of call options; put options; combinations of two or more call options and put options;

swap contracts; and futures contracts. The products underlying the hedge contracts include crude oil, diesel fuel and jet fuel as these

commodities are highly correlated with the price of jet fuel that we consume. Option contracts are valued under an income approach using

option pricing models based on data either readily observable in public markets, derived from public markets or provided by

counterparties who regularly trade in public markets. Volatilities used in these valuations ranged from 9% to 25% depending on the

maturity dates, underlying commodities and strike prices of the option contracts. Swap contracts are valued under an income approach

using a discounted cash flow model based on data either readily observable or derived from public markets. Discount rates used in these

valuations vary with the maturity dates of the respective contracts and are based on LIBOR. Futures contracts and options on futures

contracts are traded on a public exchange and valued based on quoted market prices.

•

Interest Rate Derivatives.

Our interest rate derivatives consist primarily of swap contracts and are valued primarily based on data readily

observable in public markets.

•

Foreign Currency Derivatives.

Our foreign currency derivatives consist of Japanese yen and Canadian dollar forward contracts and are

valued based on data readily observable in public markets.