Delta Airlines 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

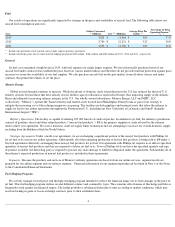

DELTA AIR LINES INC /DE/

FORM 10-K

(Annual Report)

Filed 02/24/14 for the Period Ending 12/31/13

Address HARTSFIELD ATLANTA INTL AIRPORT

1030 DELTA BLVD

ATLANTA, GA 30354-1989

Telephone 4047152600

CIK 0000027904

Symbol DAL

SIC Code 4512 - Air Transportation, Scheduled

Industry Airline

Sector Transportation

Fiscal Year 12/31

http://www.edgar-online.com

© Copyright 2014, EDGAR Online, Inc. All Rights Reserved.

Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use.

Table of contents

-

Page 1

... LINES INC /DE/ FORM 10-K (Annual Report) Filed 02/24/14 for the Period Ending 12/31/13 Address HARTSFIELD ATLANTA INTL AIRPORT 1030 DELTA BLVD ATLANTA, GA 30354-1989 4047152600 0000027904 DAL 4512 - Air Transportation, Scheduled Airline Transportation 12/31 Telephone CIK Symbol SIC Code Industry... -

Page 2

...: Title of each class Name of each exchange on which registered Common Stock, par value $0.0001 per share New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the... -

Page 3

-

Page 4

... General Fuel Frequent Flyer Program Other Businesses Distribution and Expanded Product Offerings Competition Regulatory Matters Employee Matters Executive Officers of the Registrant Additional Information ITEM 1A. RISK FACTORS Risk Factors Relating to Delta Risk Factors Relating to the Airline... -

Page 5

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE ITEM 9A. CONTROLS AND PROCEDURES ITEM 9B. OTHER INFORMATION 47 49 95 95 97 -

Page 6

...ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE OF THE REGISTRANT ITEM 11. EXECUTIVE COMPENSATION ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE... -

Page 7

.... Known material risk factors applicable to Delta are described in "Risk Factors Relating to Delta" and "Risk Factors Relating to the Airline Industry" in "Item 1A. Risk Factors" of this Form 10-K, other than risks that could apply to any issuer or offering. All forward-looking statements speak... -

Page 8

... in SkyTeam, a global airline alliance; our domestic marketing alliance with Alaska Airlines, which supplements our west coast service; and agreements with multiple domestic regional carriers, which operate as Delta Connection ® . • • • We are incorporated under the laws of the State of... -

Page 9

... the route networks of the other member airlines, providing opportunities for increased connecting traffic while offering enhanced customer service through reciprocal codesharing and frequent flyer arrangements and airport lounge access programs and coordinated cargo operations. Codeshare Agreements... -

Page 10

... increasing cost of the refining margin we are paying. The facilities include pipelines and terminal assets that allow the refinery to supply jet fuel to our airline operations throughout the Northeastern U.S., including our New York hubs at LaGuardia and John F. Kennedy International Airport ("JFK... -

Page 11

... SkyMiles program allows program members to earn mileage for travel awards by flying on Delta, Delta's regional carriers and other participating airlines. Mileage credit may also be earned by using certain services offered by program participants, such as credit card companies, hotels and car rental... -

Page 12

... class upgrades, Economy Comfort TM seating, WiFi access and SkyClub passes. We expect to benefit from increased traffic on delta.com through a combination of advertising revenue and sales of third party merchandise and services such as car rentals, hotels and trip insurance. Competition The airline... -

Page 13

... Labor Act. Environmental matters are regulated by various federal, state, local and foreign governmental entities. Privacy of passenger and employee data is regulated by domestic and foreign laws and regulations. Fares and Rates Airlines set ticket prices in all domestic and most international... -

Page 14

... we may operate in the future, it could result in significant costs for us and the airline industry. In addition to direct costs, such regulation may have a greater effect on the airline industry through increases in fuel costs that could result from fuel suppliers passing on increased costs that... -

Page 15

... our greenhouse gas emission levels since 2005. We have reduced the fuel needs of our aircraft fleet through the retirement and replacement of certain elements of our fleet and with newer, more fuel efficient aircraft. In addition, we have implemented fuel saving procedures in our flight and ground... -

Page 16

... 26, 2015. This agreement is governed by the National Labor Relations Act, which generally allows either party to engage in self-help upon the expiration of the agreement. Labor unions periodically engage in organizing efforts to represent various groups of our employees, including at our operating... -

Page 17

... 2005-July 2006); Senior Vice President-Human Resources and Labor Relations, Continental Airlines, Inc. (1997-2004); Partner, Ford & Harrison (1978-1996). Stephen E. Gorman, Age 58 : Executive Vice President and Chief Operating Officer of Delta since October 2008; Executive Vice PresidentOperations... -

Page 18

ITEM 1A. RISK FACTORS Risk Factors Relating to Delta Our business and results of operations are dependent on the price of aircraft fuel. High fuel costs or cost increases, including in the cost of crude oil, could have a materially adverse effect on our operating results. Our operating results are ... -

Page 19

... in the price of jet fuel. This fuel hedging program utilizes several different contract and commodity types. The economic effectiveness of this hedge portfolio is frequently tested against our financial targets. The hedge portfolio is rebalanced from time to time according to market conditions... -

Page 20

... increasingly dependent on technology initiatives to reduce costs and to enhance customer service in order to compete in the current business environment. For example, we have made and continue to make significant investments in delta.com, check-in kiosks, mobile device applications and related... -

Page 21

... use credit cards. Our primary credit card processing agreements provide that no holdback of receivables or reserve is required except in certain circumstances, including if we do not maintain a required level of unrestricted cash. If circumstances were to occur that would allow American Express or... -

Page 22

... price of RINs. Market prices for RINs have recently become volatile and increased significantly during 2013 before returning to more moderate levels. We cannot predict the future prices of RINs. Purchasing RINs at elevated prices could have a material impact on our results of operations and cash... -

Page 23

..., marked by significant competition with respect to routes, fares, schedules (both timing and frequency), services, products, customer service and frequent flyer programs. Our domestic operations are subject to competition from both traditional network and discount carriers, some of which may... -

Page 24

... affect us and the airline industry. The potential negative effects include increased security (including as a result of our global operations), insurance and other costs and lost revenue from increased ticket refunds and decreased ticket sales. Our financial resources might not be sufficient... -

Page 25

... war-risk insurance coverage commercially. Such commercial insurance could have substantially less desirable coverage than currently provided by the U.S. government, may not be adequate to protect our risk of loss from future acts of terrorism or, may result in a material increase to our operating... -

Page 26

...PROPERTIES Flight Equipment Our operating aircraft fleet, commitments and options at December 31, 2013 are summarized in the following table: Current Fleet (1) Aircraft Type Owned Capital Lease Operating Lease Total Average Age Commitments Purchase (2)(3) Lease Options B-717-200 B-737-700 B-737-800... -

Page 27

...debt service on special facility bonds issued to finance their construction. We also lease marketing, ticketing and reservations offices in certain locations for varying terms. Refinery Operations Our wholly-owned subsidiaries, Monroe and MIPC, own and operate the Trainer refinery and related assets... -

Page 28

... concerning alleged signaling by both Delta and AirTran based upon statements made to the investment community by both carriers relating to industry capacity levels during 2008-2009. The plaintiffs also added a new cause of action against Delta alleging attempted monopolization in violation... -

Page 29

..., RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES Market Information Our common stock is listed on the New York Stock Exchange. The following table sets forth for the periods indicated the highest and lowest sales price for our common stock as reported on the NYSE and dividends... -

Page 30

... "2013 Repurchase Program"). The 2013 Repurchase Program will terminate no later than June 2016. In addition, the table includes shares withheld from employees to satisfy certain tax obligations due in connection with grants of stock under the Delta Air Lines, Inc. 2007 Performance Compensation Plan... -

Page 31

...millions, except share data) 2013 2012 2011 2010 2009 Operating revenue Operating expense Operating income (loss) Other expense, net Income (loss) before income taxes Income tax benefit (provision) Net income (loss) Basic earnings (loss) per share Diluted earnings (loss) per share The following are... -

Page 32

December 31, (in millions) 2013 2012 2011 2010 2009 Total assets Long-term debt and capital leases (including current maturities) Stockholders' equity (deficit) Common stock outstanding $ $ $ 52,252 $ 11,342 $ 11,643 $ 851 44,550 $ 12,709 $ (2,131) $ 851 43,499 $ 13,791 $ (1,396) $ 845 43,188 ... -

Page 33

... purchase program. We also rejoined the Standard & Poor's 500 index of large companies. Revenue. Our passenger revenue increased $1.2 billion, despite a lower market price of fuel. We experienced positive market reaction to our first class upsell and Economy Comfort products. Our customers value... -

Page 34

...and sales, coordinated pricing and revenue management, network planning and scheduling with respect to operations on routes between North America and the United Kingdom. Virgin Atlantic has a significant presence at London's Heathrow airport, the airport of choice for business travelers traveling to... -

Page 35

... deliveries expected in 2015. These B-717-200 aircraft are 110-seat aircraft and feature new, fully upgraded interiors, with 12 First Class seats, 15 Economy Comfort seats and in-flight WiFi throughout the cabin. In 2011, we entered into an agreement with Boeing to purchase 100 new fuel efficient... -

Page 36

..."), operate the Trainer refinery and related assets located near Philadelphia, Pennsylvania as part of our strategy to mitigate the increasing cost of the refining margin we are paying. The facilities include pipelines and terminal assets that allow the refinery to supply jet fuel to our airline... -

Page 37

... in passenger mile yield. Revenue remained strong despite lower fuel prices. In addition, the increase in passenger revenue reflects the investments for in-flight product enhancements such as the Economy Comfort product and higher corporate sales. Our geographic regions performed well compared... -

Page 38

Operating Expense Year Ended December 31, (in millions) 2013 2012 Increase (Decrease) % Increase (Decrease) Aircraft fuel and related taxes Salaries and related costs Regional carrier expense Aircraft maintenance materials and outside repairs Contracted services Depreciation and amortization ... -

Page 39

... received base pay increases on July 1, 2012 and received additional increases on January 1, 2013. These increases are designed both to recognize changes to the profit sharing program described below and to accelerate the planned 2013 pay increase for non-pilot employees. Aircraft Maintenance... -

Page 40

... mile yield and unit revenue increased due to fare increases, higher revenue under corporate travel contracts and improvements in our products and services. International mainline passenger revenue increased $520 million. In early 2011, we faced industry overcapacity in the transatlantic market... -

Page 41

... 2012 2011 Increase (Decrease) % Increase (Decrease) Aircraft fuel and related taxes Salaries and related costs Regional carrier expense Aircraft maintenance materials and outside repairs Passenger commissions and other selling expenses Contracted services Depreciation and amortization Landing fees... -

Page 42

... received base pay increases on July 1, 2012 and received additional increases on January 1, 2013. These increases are designed both to recognize changes to the profit sharing program described below and to accelerate the planned 2013 pay increase for non-pilot employees. Aircraft Maintenance... -

Page 43

...Financial Statements for more information. During 2012 and 2011, we did not record an income tax provision for U.S. federal income tax purposes since our deferred tax assets were fully reserved by a valuation allowance. During 2011, we recorded an income tax benefit of $85 million, primarily related... -

Page 44

... valued at $333 million annually over three years beginning 2012 instead of paying cash to Delta for SkyMiles used. This draw down of $333 million in SkyMiles reduced cash flows from operations in 2012 compared to 2011. In December 2013, we and American Express amended this agreement to allow... -

Page 45

...and each totaled $51 million . In addition, the Board of Directors authorized a $500 million share repurchase program, to be completed no later than June 30, 2016 . During 2013 , we repurchased and retired approximately 10 million shares at a cost of approximately $250 million . In 2013, we received... -

Page 46

... our employee benefit obligations, see "Critical Accounting Policies and Estimates." Other Obligations. Represents estimated purchase obligations under which we are required to make minimum payments for goods and services, including but not limited to insurance, marketing, maintenance, technology... -

Page 47

... and other accounting policies, see Note 1 of the Notes to the Consolidated Financial Statements. Frequent Flyer Program Our frequent flyer program (the "SkyMiles Program") offers incentives to travel on Delta. This program allows customers to earn mileage credits by flying on Delta, regional air... -

Page 48

... revenues, expenses and cash flows more than offset the impact of fuel prices and other airline input costs. The stabilizing operating environment for U.S. airlines has resulted in annual yields increasing along with load factors, leading to improved financial results. Goodwill. Our goodwill balance... -

Page 49

... U.S. and global economies; (3) forecast of airline revenue trends; (4) estimate of future fuel prices; and (5) future impact of taxable temporary differences. Accordingly, at December 31, 2013, we released almost all of our valuation allowance against our net deferred income tax assets, primarily... -

Page 50

... investments and yield-to-maturity analysis specific to our estimated future benefit payments. We used a weighted average discount rate to value the obligations of 5.01% and 4.11% at December 31, 2013 and 2012 , respectively. Our weighted average discount rate for net periodic pension benefit cost... -

Page 51

... future value of the underlying hedge in the contract settlement period. Therefore, excluding these adjustments allows investors to better understand and analyze our costs for the periods reported. Year Ended December 31, 2013 2012 • • • CASM Items excluded: Aircraft fuel and related taxes... -

Page 52

... CASM - (Operating) Cost per Available Seat Mile. The amount of operating cost incurred per ASM during a reporting period. CASM-Ex - The amount of operating cost incurred per ASM during a reporting period, excluding aircraft fuel and related taxes, ancillary businesses, profit sharing, restructuring... -

Page 53

... net fuel hedge gains during the year ended December 31, 2013 , including $276 million of mark-to-market gains primarily relating to hedge contracts settling in future periods. The following table shows the projected cash impact to fuel cost assuming 10% and 20% increases or decreases in fuel prices... -

Page 54

... December 31, 2013 , we had open foreign currency forward contracts totaling a $257 million asset position. We estimate that a 10% depreciation or appreciation in the price of the Japanese yen and Canadian dollar in relation to the U.S. dollar would change the projected cash settlement value of our... -

Page 55

... TO CONSOLIDATED FINANCIAL STATEMENTS Page 50 51 52 53 54 55 56 Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets - December 31, 201 3 and 2012 Consolidated Statements of Operations for the years ended December 31, 201 3, 2012 and 2011 Consolidated Statements of... -

Page 56

... REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Stockholders of Delta Air Lines, Inc. We have audited the accompanying consolidated balance sheets of Delta Air Lines, Inc. (the Company) as of December 31, 2013 and 2012 , and the related consolidated statements of operations... -

Page 57

DELTA AIR LINES, INC. Consolidated Balance Sheets December 31, (in millions, except share data) 2013 2012 ASSETS Current Assets: Cash and cash equivalents Short-term investments Restricted cash, cash equivalents and short-term investments Accounts receivable, net of an allowance for uncollectible ... -

Page 58

Total stockholders' equity (deficit) Total liabilities and stockholders' equity (deficit) $ 11,643 52,252 $ (2,131) 44,550 The accompanying notes are an integral part of these Consolidated Financial Statements. 51 -

Page 59

..., except per share data) 2013 2012 2011 Operating Revenue: Passenger: Mainline Regional carriers Total passenger revenue Cargo Other Total operating revenue Operating Expense: Aircraft fuel and related taxes Salaries and related costs Regional carrier expense Aircraft maintenance materials and... -

Page 60

DELTA AIR LINES, INC. Consolidated Statements of Comprehensive Income (Loss) Year Ended December 31, (in millions) 2013 2012 2011 Net Income Other comprehensive income (loss): Net gain (loss) on derivatives Net change in pension and other benefit liabilities Total Other Comprehensive Income (Loss) ... -

Page 61

... millions) 2013 2012 2011 Cash Flows From Operating Activities: Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization Amortization of debt discount, net Fuel hedge derivative contracts Deferred income taxes Pension, postretirement... -

Page 62

The accompanying notes are an integral part of these Consolidated Financial Statements. 54 -

Page 63

... Balance at December 31, 2011 Net income Other comprehensive loss Shares of common stock issued and compensation expense associated with equity awards (Treasury shares withheld for payment of taxes, $10.91 (1) per share) Stock options exercised Balance at December 31, 2012 Net income Dividends... -

Page 64

...airlines to enhance our access to domestic and international markets. These arrangements may include codesharing, reciprocal frequent flyer program benefits, shared or reciprocal access to passenger lounges, joint promotions, common use of airport gates and ticket counters, ticket office co-location... -

Page 65

... receivable primarily consist of amounts due from credit card companies from the sale of passenger airline tickets, customers of our aircraft maintenance and cargo transportation services and other companies for the purchase of mileage credits under our SkyMiles Program. We provide an allowance... -

Page 66

...-term investments, with the offsetting obligation in accounts payable. The hedge margin we provide to counterparties is recorded in accounts receivable. All cash flows associated with purchasing and settling hedge contracts are classified as operating cash flows. Passenger Tickets We record sales of... -

Page 67

... Program participants and allow American Express to market using our customer database. Cardholders earn mileage credits for making purchases using co-branded cards, may check their first bag for free, are granted access to Delta SkyClub lounges and receive other benefits while traveling on Delta... -

Page 68

... the sale of mileage credits discussed above, (2) baggage fee revenue, (3) other miscellaneous service revenue, including ticket change fees and (4) revenue from ancillary businesses, such as the aircraft maintenance and repair and staffing services we provide to third parties. Long-Lived Assets The... -

Page 69

... whether impairments exist for aircraft used in operations, we group assets at the fleet-type level (the lowest level for which there are identifiable cash flows) and then estimate future cash flows based on projections of capacity, passenger mile yield, fuel costs, labor costs and other relevant... -

Page 70

... than leasing them from another airline at market rates), (3) the royalty method for the Delta tradename (which assumes hypothetical royalties generated from using our tradename) or (4) projected discounted future cash flows. We recognize an impairment charge if the asset's carrying value exceeds... -

Page 71

... for jet fuel. In June 2012 , we purchased an oil refinery as part of our strategy to mitigate the increasing cost of the refining margin we pay. Our wholly-owned subsidiaries, Monroe Energy, LLC and MIPC, LLC (collectively, "Monroe"), acquired the Trainer refinery and related assets located near... -

Page 72

..., valued on a market price basis, from the refinery to the airline segment for use in airline operations. We determine market price by reference to the market index for the primary delivery location for jet fuel from the refinery, which is New York Harbor. Represents value of products exchanged... -

Page 73

... projected self-insurance obligations and airport commitments and generally consist of money market funds and time deposits. These investments are recorded at cost, which approximates fair value. Fair value is based on a market approach using prices and other relevant information generated by market... -

Page 74

... companies of Aeromexico and GOL are traded on public exchanges and we have valued our investments based on quoted market prices. The investments are classified in other noncurrent assets. In 2013, we sold our remaining auction rate securities, which were previously classified as Level 3 instruments... -

Page 75

... of fuel hedge losses (gains) for both designated and undesignated contracts on aircraft fuel and related taxes: Year Ended December 31, (in millions) 2013 2012 2011 Airline segment Refinery Segment Effective portion reclassified from AOCI to earnings (Gains) losses recorded in aircraft fuel and... -

Page 76

...net (in millions) Notional Balance Designated as hedges Interest rate contracts (cash flow hedges) Interest rate contracts (fair value hedges) Foreign currency exchange contracts Not designated as hedges Fuel contracts Total derivative contracts 1,792 gallons - heating oil, crude oil and jet fuel... -

Page 77

... have receivables from the sale of mileage credits under our SkyMiles Program to participating airlines and nonairline businesses such as credit card companies, hotels and car rental agencies. The credit risk associated with our receivables is minimal. Self-Insurance Risk We self-insure a portion... -

Page 78

... we have an investment in our Consolidated Financial Statements. NOTE 6 . INTANGIBLE ASSETS Indefinite-Lived Intangible Assets Carrying Amount at December 31, (in millions) 2013 2012 International routes and slots Delta tradename SkyTeam related assets Domestic slots Total $ $ 2,287 $ 850 661... -

Page 79

...limited market transactions and the lease savings method, which is an income approach. These assets are classified in Level 3 of the fair value hierarchy. The carrying value related to the 42 slot pairs at Reagan National acquired by US Airways was removed from our indefinite-lived intangible assets... -

Page 80

... Program participants and allow American Express to market using our customer database. Cardholders earn mileage credits for making purchases using co-branded cards, may check their first bag for free, are granted access to Delta SkyClub lounges and receive other benefits while traveling on Delta... -

Page 81

...April 2016 Other Secured Financing Arrangements: Certificates (2)(3) 2014 to 2023 2014 to 2025 Aircraft financings (2)(3) Other financings (2)(4) 2014 to 2031 Other Revolving Credit Facilities ($250) 2014 to 2015 Total secured debt American Express - Advance Purchase of Restricted SkyMiles (5) Other... -

Page 82

.... The 2011 Credit Facilities and the related guarantees are secured by liens on certain of our and the Guarantors' assets, including accounts receivable, flight equipment, ground property and equipment, certain aircraft, spare engines and parts, certain non-Pacific international routes, domestic... -

Page 83

..., (in millions) 2013 2012 Total debt at par value Unamortized discount, net Net carrying amount Fair value NOTE 9 . LEASE OBLIGATIONS $ $ $ 11,228 $ (383) 10,845 $ 11,600 $ 12,633 (527) 12,106 13,000 We lease aircraft, airport terminals, maintenance facilities, ticket offices and other property... -

Page 84

... agreements, the Contract Carriers operate some or all of their aircraft using our flight designator codes, and we control the scheduling, pricing, reservations, ticketing and seat inventories of those aircraft and retain the revenues associated with those flights. We pay those airlines an amount... -

Page 85

...2014 2015 2016 2017 2018 Thereafter Total (1) $ $ 2,110 2,040 1,780 1,560 1,320 1,930 10,740 These amounts exclude Contract Carrier payments accounted for as operating leases of aircraft, which are described in Note 9. The contingencies described below under "Contingencies Related to Termination... -

Page 86

... purchased with VISA/MasterCard or American Express credit cards, as applicable, that had not yet been used for travel. There was no Reserve or amounts withheld as of December 31, 2013 and 2012 . Other Contingencies General Indemnifications We are the lessee under many commercial real estate leases... -

Page 87

...family members. Defined Benefit Pension Plans. We sponsor defined benefit pension plans for eligible employees and retirees. These plans are closed to new entrants and frozen for future benefit accruals. The Pension Protection Act of 2006 allows commercial airlines to elect alternative funding rules... -

Page 88

... Obligations, Fair Value of Plan Assets and Funded Status Pension Benefits December 31, (in millions) 2013 2012 2013 Other Postretirement and Postemployment Benefits December 31, 2012 Benefit obligation at beginning of period Service cost Interest cost Actuarial (gain) loss Benefits paid, including... -

Page 89

... 4.11% Net Periodic Cost (2) 2013 2012 2011 Weighted average discount rate - pension benefit Weighted average discount rate - other postretirement benefit (4) Weighted average discount rate - other postemployment benefit Weighted average expected long-term rate of return on plan assets Assumed... -

Page 90

... and natural resource investments to earn a long-term investment return that meets or exceeds our annualized return target. Our expected long-term rate of return on assets for net periodic pension benefit cost for the year ended December 31, 2013 was 9% . Benefit Payments Benefit payments in the... -

Page 91

... our benefit plan assets by asset class. These investments are presented net of the related benefit obligation in pension, postretirement and related benefits on the Consolidated Balance Sheets. December 31, 2013 (in millions) Total Level 1 Level 2 Level 3 Valuation Technique Total December 31, 2012... -

Page 92

... Purchases, sales and settlements, net Transfers from Level 3 Balance at December 31, 2012 Actual return on plan assets: Related to assets still held at the reporting date Related to assets sold during the period Purchases, sales and settlements, net Transfers to Level 3 Balance at December 31, 2013... -

Page 93

Our broad based employee profit sharing program provides that, for each year in which we have an annual pre-tax profit, as defined, we will pay a specified portion of that profit to employees. For the years ended December 31, 2013 , 2012 and 2011 , we accrued $506 million , $372 million and $264 ... -

Page 94

...liabilities: December 31, (in millions) 2013 2012 Deferred tax assets: Net operating loss carryforwards Pension, postretirement and other benefits AMT credit carryforward Deferred revenue Other Valuation allowance Total deferred tax assets Deferred tax liabilities: $ $ $ 6,024 $ 4,982 378 1,965... -

Page 95

... U.S. and global economies; (3) forecast of airline revenue trends; (4) estimate of future fuel prices; and (5) future impact of taxable temporary differences. Accordingly, at December 31, 2013, we released almost all of our valuation allowance against our net deferred income tax assets, resulting... -

Page 96

...321 million related to an income tax allocation as discussed below, resulting in a net income tax benefit of $8.0 billion in 2013. At December 31, 2013 , 2012 and 2011 , $13 million , $3.1 billion and $2.5 billion of deferred income tax expense was recorded in AOCI on our Consolidated Balance Sheets... -

Page 97

... which are payable in common stock or cash and are generally contingent upon our achieving certain financial goals. Other. There was no tax benefit recognized in 2013 , 2012 or 2011 related to equity-based compensation as a full valuation allowance was recorded against our deferred tax assets due to... -

Page 98

.... Our airline segment is managed as a single business unit that provides air transportation for passengers and cargo. This allows us to benefit from an integrated revenue pricing and route network. Our flight equipment forms one fleet, which is deployed through a single route scheduling system... -

Page 99

.... As a result of restructuring the fleet, we expect to benefit from improved operational and fuel efficiency, customer service and reduced future maintenance cost that we will experience over the life of the new aircraft. Severance and Related Costs . During 2012, we recognized a severance charge of... -

Page 100

...(in millions, except per share data) 2013 2012 2011 Net income Basic weighted average shares outstanding Dilutive effects of share based awards Diluted weighted average shares outstanding Basic earnings per share Diluted earnings per share Antidilutive common stock equivalents excluded from diluted... -

Page 101

... allows for joint marketing and sales, coordinated pricing and revenue management, networking planning and scheduling with respect to operations on routes between North America and the United Kingdom. As a result of this relationship, our customers have increased access and frequencies to London... -

Page 102

... 31, 2013 , we repurchased and retired approximately 10 million shares at a cost of approximately $250 million . On February 7, 2014 , the Board of Directors declared a $0.06 dividend for shareholders of record on February 21, 2014 , and payable on March 14, 2014 . NOTE 20 . QUARTERLY FINANCIAL DATA... -

Page 103

...and procedures were effective as of December 31, 2013 to ensure that material information was accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, as appropriate to allow timely decisions regarding required disclosure. Changes in Internal... -

Page 104

... of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Delta Air Lines, Inc. as of December 31, 2013 and 2012 , and the related consolidated statements of operations, comprehensive income (loss), stockholders' equity (deficit), and cash flows for... -

Page 105

... without delivery of shares (including shares surrendered or withheld for payment of the exercise price of an award or taxes related to an award), then such shares will again be available for issuance under the 2007 Plan. In addition to the 7,089,555 stock options outstanding, 6,785,327 shares of... -

Page 106

...the financial statements required by this item that are included in this Form 10-K: Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets- December 31, 2013 and 2012 Consolidated Statements of Operations for the years ended December 31, 2013 , 2012 and 2011 Consolidated... -

Page 107

... or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, on the 21st day of February 2014 . DELTA AIR LINES, INC. By: /s/ Richard H. Anderson Richard H. Anderson Chief Executive Officer 99 -

Page 108

...) Executive Vice President and Chief Financial Officer (Principal Financial Officer) Vice President and Chief Accounting Officer (Principal Accounting Officer) President and Director Director Director Chairman of the Board Director Director Director Director Director Director Director... -

Page 109

100 -

Page 110

... 2010 between JFK International Air Terminal LLC and Delta Air Lines, Inc. (Filed as Exhibit 10.4 to Delta's Annual Report on Form 10-K for the year ended December 31, 2010).* Supplemental Agreement No. 13 to Purchase Agreement Number 2022, dated August 24, 2011, between The Boeing Company and Delta... -

Page 111

... Certain Benefits of Members of the Board of Directors and Executive Officers (Filed as Exhibit 10.2 to Delta's Quarterly Report on Form 10-Q for the quarter ended June 30, 2011).* 10.12(a) Delta Air Lines, Inc. 2011 Long Term Incentive Program (Filed as Exhibit 10.10(a) to Delta's Annual Report on... -

Page 112

... Annual Report on Form 10-K for the year ended December 31, 2011).* Terms of 2012 Restricted Stock Awards for Non-Employee Directors (Filed as Exhibit 10.1 to Delta's Quarterly Report on Form 10-Q for the quarter ended June 30, 2012).* Terms of 2013 Restricted Stock Awards for Non-Employee Directors... -

Page 113

103 -

Page 114

... program sponsored by Delta Air Lines, Inc. (" Delta " or the " Company ") that is intended to closely: (a) link pay and performance by providing management employees with a compensation opportunity based on Delta achieving key business objectives and (b) align the interests of management employees... -

Page 115

... means, with respect to any portion of Restricted Stock that is subject to the Restrictions at the time of a Participant's Termination of Employment, the number of Shares with respect to which the Restrictions would have lapsed on each future RS Installment multiplied by a fraction (i) the numerator... -

Page 116

... without Cause. If, however, the employment of a Participant who is eligible for Retirement is terminated by the Company for Cause, then regardless of whether the Participant is considered as a retiree for purposes of any other program, plan or policy of the Company, for purposes of the 2014 LTIP... -

Page 117

...(A) the Average Annual Operating Income Margin during the Performance Period of the Company relative to the Composite Performance of the members of the Industry Composite Group; (B) Customer Service Performance during the Performance Period of the Company; and (C) Return on Invested Capital for each... -

Page 118

... any annual broad-based employee profit sharing plan, program or similar arrangement. " Total Operating Revenue " means, subject to Section 4(b)(v)(B) below, the subject company's total operating revenue for the applicable periods based on its regularly prepared and publicly available statements of... -

Page 119

..., "'Net Promoter': Measuring Customer Satisfaction at Delta," which was previously reviewed by the Committee. Company management will periodically report to the Company's Board of Directors regarding Delta's NPS. (D) Return on Invested Capital. (1) The " Return on Invested Capital " for Delta shall... -

Page 120

... applicable fees or charges associated therewith. (5) "Adjusted Net Debt" for Delta shall be calculated quarterly based on its regularly prepared internal financial statements using the following formula (A+B-C), subject to Section 4(b)(v)(B), where: A = Total gross long term debt and capital leases... -

Page 121

...Period between Delta and any regional carrier or between any member of the Industry Composite Group and any regional carrier (a " Regional Carrier Transaction "), Average Annual Operating Income Margin and, as applicable, Return on Invested Capital for any such company involved in a Regional Carrier... -

Page 122

... Return on Invested Capital. The payment, if any, a Participant will receive in connection with the vesting of the portion of the Performance Award attributable to Average Annual Operating Income Margin and Customer Service Performance will be based on the following: + Average Annual Operating... -

Page 123

.../Forfeiture upon Termination of Employment-Excluding Return on Invested Capital . The portion of the Performance Award attributable to Average Annual Operating Income Margin and Customer Service Performance is subject to the following terms and conditions. (A) Without Cause or For Good Reason. Upon... -

Page 124

...or Disability. Upon a Participant's Termination of Employment due to death or Disability, the portion of the Participant's Performance Award attributable to Average Annual Operating Income Margin and Customer Service Performance will immediately become vested at the target level and such amount will... -

Page 125

...than for Good Reason or Retirement) prior to the end of the workday on December 31, 2016, the Participant will immediately forfeit any unpaid portion of the Performance Award attributable to Return on Invested Capital, including any Earned Awards, as of the date of such Termination of Employment. In... -

Page 126

... a Participant's Termination of Employment by the Company for Cause, the Participant will immediately forfeit any unpaid portion of the Performance Award attributable to Return on Invested Capital, including any Earned Awards, as of the date of such Termination of Employment. (F) Retirement-Eligible... -

Page 127

...2016 (" Second RSU Installment ") and (C) February 1, 2017 (" Third RSU Installment "). 5 As soon as practicable after any RSUs become vested, the Company shall pay to Participant in cash a lump sum amount equal to the number of RSUs vesting multiplied by the closing price of a Share of Common Stock... -

Page 128

... without Cause. If, however, the employment of a Participant who is eligible for Retirement is terminated by the Company for Cause, then regardless of whether the Participant is considered a retiree for purposes of any other program, plan or policy of the Company, for purposes of this Agreement, the... -

Page 129

... Company's Equity Award Grant Policy, as in effect from time to time, and set forth in a Participant's Award Agreement. (iii) Exercise Price . The exercise price of the Option is the closing price of a Share on the New York Stock Exchange on the Grant Date. (iv) Exercise Period/Performance Measures... -

Page 130

...) the applicable Option Installment Vesting Date or (y) the Expiration Date. Upon a Participant's Termination of Employment by the Company without Cause or by the Participant for Good Reason, any portion of the Option that is not exercisable at the time of such Termination of Employment, other than... -

Page 131

... without Cause. If, however, the employment of a Participant who is eligible for Retirement is terminated by the Company for Cause, then regardless of whether the Participant is considered as a retiree for purposes of any other program, plan or policy of the Company, for purposes of the Agreement... -

Page 132

... president or more senior officer level Participant has engaged in fraud or misconduct that caused, in whole or in part, the need for a required restatement of Delta's financial statements filed with the Securities and Exchange Commission, the Committee will review all incentive compensation awarded... -

Page 133

... MIP ") is an annual incentive program sponsored by Delta Air Lines, Inc. (" Delta " or the " Company ") that is intended to closely: (a) link pay and performance by providing management employees with a compensation opportunity based on Delta achieving key business plan goals in 2014; and (b) align... -

Page 134

... to Section 8 below, a percentage of each Participant's Target MIP Award is allocated to one or more of Financial Performance, Operational Performance, Revenue Performance, Leadership Effectiveness Performance and/or Individual Performance based on the Participant's employment level, as follows: 2 -

Page 135

...levels of Financial, Operational, Revenue, Leadership Effectiveness, and Individual Performance, are based on the achievement of the target performance level with respect to each applicable performance measure (except that Financial Performance also requires a payout under the Profit Sharing Program... -

Page 136

... and award payout levels for 2014 Operational Performance, subject to Section 4(c) above: _____ 1 The Profit Sharing Program for 2014 defines "Pre-Tax Income" as follows: for any calendar year, the Company's consolidated pre-tax income calculated in accordance with Generally Accepted Accounting... -

Page 137

... award payout levels for 2014 Revenue Performance, subject to Section 4(c) above: Threshold % of Target Revenue Performance Measure Paid 50% Target 100% Maximum 200% 2013 TRASM + 0.5% points or more Delta's 2014 TRASM over 2013 TRASM relative to 2013 TRASM minus 0.50% 2013 TRASM Industry Group... -

Page 138

...Available Seat Miles of all members of the Industry Group. " Total Operating Revenue " means, for Delta and each member of the Industry Group, the applicable company's total operating revenue for a calendar year based on its regularly prepared and publicly available statements of operations prepared... -

Page 139

... for 2014 under the Profit Sharing Program, any MIP Awards that are payable based on Operational Performance, Revenue Performance, Leadership Effectiveness Performance or Individual Performance will be paid as soon as practicable thereafter, but in no event later than March 15, 2015, unless it is... -

Page 140

... at the time the Company sells or otherwise divests itself of such Affiliate) or (2) Retirement, the Restrictions shall lapse and be of no further force or effect on the date there is a payout under the Profit Sharing Program as if such Executive Officer Participant's employment had continued... -

Page 141

... who incurs a Termination of Employment prior to January 1, 2015 due to either (1) a Termination of Employment by the Company without Cause or (2) for any other reason that entitles such Participant to benefits under the Delta Air Lines, Inc. 2009 Officer and Director Severance Plan (the " Severance... -

Page 142

... annual performance evaluation will apply. Any MIP Awards payable under this Section 8(b) will be paid at the same time and in the same manner as such awards are paid to active Participants, subject to Section 7(b) above. (i) New Hires. With respect to any individual who becomes employed by Delta... -

Page 143

... to the five-year limit on uniformed service as set forth in USERRA. 9. Treatment of Payments Under Benefit Plans or Programs . MIP payments, which for an Executive Officer Participant who receives MIP Restricted Stock means the amount of the payout to the Executive Officer Participant under the MIP... -

Page 144

... president or more senior officer level Participant has engaged in fraud or misconduct that caused, in whole or in part, the need for a required restatement of Delta's financial statements filed with the Securities and Exchange Commission, the Committee will review all incentive compensation awarded... -

Page 145

... source of reported metrics used to calculate performance will be each Delta Connection carrier's data which flows into Delta's data warehouse. B. All domestic and international Delta Connection carrier system operations subject to capacity purchase agreements and/or revenue proration agreements... -

Page 146

..., except for ratio data) 2013 2012 2011 2010 2009 Earnings (loss) before income taxes Add (deduct): Fixed charges from below Capitalized interest Earnings (loss) as adjusted Fixed charges: Interest expense, including capitalized amounts and amortization of debt costs Portion of rental expense... -

Page 147

... Services, LLC Delta Private Jets, Inc. Delta Sky Club, Inc. Epsilon Trading, LLC MIPC, LLC MLT Inc. Monroe Energy, LLC New Sky, Ltd. Vermont Delaware Kentucky Wisconsin Delaware Delaware Minnesota Delaware Bermuda None of Delta's subsidiaries do business under any names other than their corporate... -

Page 148

... on Form S-8 pertaining to Delta Air Lines, Inc. 2007 Performance Compensation Plan, Registration Statement No. 333-151060 on Form S-8 pertaining to Northwest Airlines Corporation 2007 Stock Incentive Plan, and Registration Statement No. 333-167811 on Form S-3 pertaining to Pass Through Certificates... -

Page 149

... and report financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in Delta's internal control over financial reporting. /s/ Richard H. Anderson Richard H. Anderson Chief Executive Officer 3. 4. 5. February... -

Page 150

... and report financial information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in Delta's internal control over financial reporting. /s/ Paul A. Jacobson Paul A. Jacobson Executive Vice President and Chief Financial Officer... -

Page 151

...with the Securities and Exchange Commission of the annual report on Form 10-K of Delta Air Lines, Inc. ("Delta") for the fiscal year ended December 31, 2013 (the "Report"). Each of the undersigned, the Chief Executive Officer and the Executive Vice President and Chief Financial Officer, respectively...