DIRECTV 2003 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

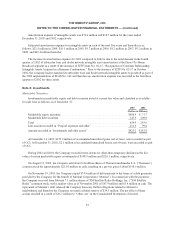

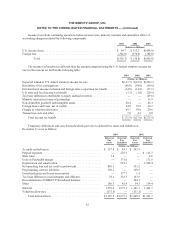

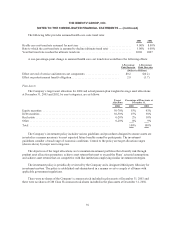

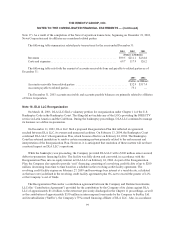

Components of net periodic benefit cost for the years ended December 31:

Pension Benefits

Other

Postretirement

Benefits

2003 2002 2001 2003 2002 2001

(Dollars in Millions)

Components of net periodic benefit cost

Benefits earned during the year ........................... $23.0 $21.7 $16.0 $0.5 $0.5 $0.5

Interest accrued on benefits earned in prior years ............. 35.4 33.8 32.7 1.9 2.2 1.9

Expected return on assets ................................ (32.4) (36.5) (41.0) — — —

Amortization components

Amount resulting from changes in plan provisions ........ 2.2 2.2 2.1 — — —

Net amount resulting from changes in plan experience and

actuarial assumptions ............................. 4.4 3.0 0.4 — — (0.5)

Net periodic benefit cost ........................ $32.6 $24.2 $10.2 $2.4 $2.7 $1.9

Additional information

Increase in minimum liability included in other comprehensive

income ............................................ $26.8 $25.2 $ 2.0 — — —

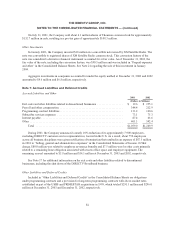

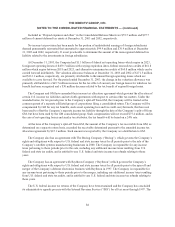

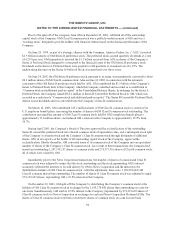

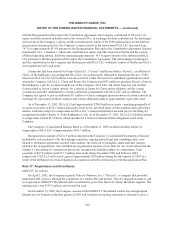

Assumptions

Weighted-average assumptions used to determine benefit obligations at December 31:

Pension

Benefits

Other

Postretirement

Benefits

2003 2002 2003 2002

Discount rate .................................................... 6.14% 7.00% 5.89% 6.75%

Rate of compensation increase ...................................... 4.50% 5.00% 4.50% 5.00%

Weighted-average assumptions used to determine net periodic benefit cost for the years ended

December 31:

Pension Benefits

Other

Postretirement

Benefits

2003 2002 2001 2003 2002 2001

Discount rate ..................................... 7.00% 7.25% 7.75% 6.75% 7.00% 7.50%

Expected long-term return on plan assets ............... 9.00% 9.50% 9.50% — — —

Rate of compensation increase ........................ 5.00% 5.00% 5.00% 5.00% 5.00% 5.00%

The Company’s expected long-term return on plan assets assumption is based on a periodic review and

modeling of the plans’ asset allocation and liability structure over a long-term horizon. Expectations of returns

for each asset class are the most important of the assumptions used in the review and modeling and are based on

comprehensive reviews of historical data and economic/financial market theory.

91