DIRECTV 2003 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

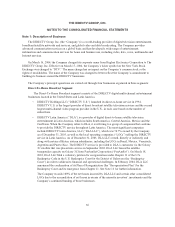

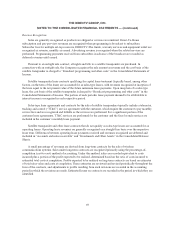

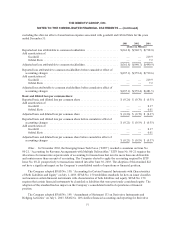

The cost of installation and hardware under the direct customer acquisition program is deferred when a

customer commits to 12 months of service. The amount deferred is amortized to expense over the commitment

period and limited to the estimated gross margin (equal to the contractual revenues to be earned from the

subscriber over 12 months, less the related cost of programming) expected to be earned over the contract term,

less a reserve for estimated unrecoverable amounts. The cost of installation and hardware in excess of the

estimated gross margin and where no customer commitment is obtained is expensed immediately.

The Company actively monitors the recoverability of prepaid commissions and deferred installation and

hardware costs. To the extent the Company charges back a retailer or dealer for a prepaid commission, the

Company offsets the amount due against amounts payable to the retailers/dealers, and therefore, recoverability of

prepaid commissions, net of existing reserves, is reasonably assured. Generally, new subscribers secure their

accounts by providing a credit card or other identifying information and agree that a pro-rated early termination

fee of $150 will be assessed if the subscriber cancels service prior to the end of the commitment period. As a

result, the ability to charge the subscriber an early termination fee, together with existing reserves, reasonably

assures the recoverability of deferred installation and hardware costs.

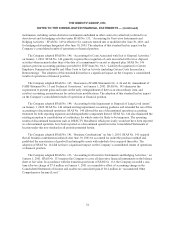

Cash and Cash Equivalents

Cash equivalents consist of highly liquid investments purchased with original maturities of three months or

less.

Contracts in Process

Contracts in process are stated at costs incurred plus estimated profit, less amounts billed to customers and

advances and progress payments applied. Engineering, tooling, manufacturing, and applicable overhead costs,

including administrative, research and development and selling expenses, are charged to costs and expenses

when incurred. Advances offset against contract related receivables amounted to $30.5 million and $38.2 million

at December 31, 2003 and 2002, respectively.

Inventories

Inventories are stated at the lower of cost or market principally using the average cost method.

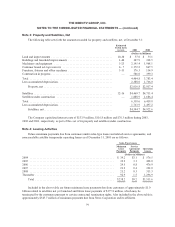

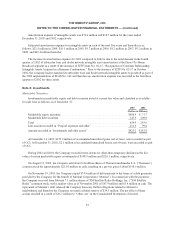

The following table sets forth the amounts recorded for inventories, net, at December 31:

2003 2002

(Dollars in Millions)

Productive material and supplies ................................................. $ 64.2 $ 34.7

Work in process ............................................................... 81.8 70.0

Finished goods ................................................................ 158.4 160.1

Total ....................................................................... 304.4 264.8

Less provision for excess or obsolete inventory ...................................... 33.3 34.5

Inventories, net ........................................................... $271.1 $230.3

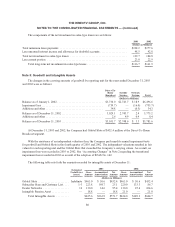

Property, Satellites and Depreciation

Property and satellites are carried at cost. Satellite costs include construction costs, launch costs, launch

insurance, incentive obligations, direct development costs and capitalized interest. Capitalized satellite costs

71