DIRECTV 2003 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

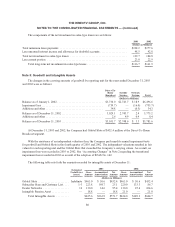

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

Broadcast Programming and Other Costs

The cost of television programming broadcast rights is recognized when the related programming is

distributed. The cost of television programming rights to distribute live sporting events for a season or

tournament is charged to expense using the straight-line method over the course of the season or tournament.

However, for live sporting events with multi-year contracts and minimum guarantee payments, the Company

charges the costs of these events to expense based on the ratio of each period’s revenues to the estimated total

contract revenues to be earned over the contract period. Estimated total contract revenues are evaluated by

management at least annually. If the minimum guarantee on an individual contract exceeds the estimated total

contract revenues, a loss equal to the amount of such difference is recognized immediately. Programming costs

are included in “Broadcast programming and other costs” in the Consolidated Statements of Income.

Advance payments in the form of cash and equity instruments from programming content providers for

carriage of their signal are deferred and recognized as a reduction of programming costs on a straight-line basis

over the related contract term. Equity instruments are recorded at fair value based on quoted market prices or

values determined by management based in part on independent third-party valuations. Also recorded as a

reduction of programming costs is the amortization of a provision for above-market programming contracts that

was recorded in connection with the United States Satellite Broadcasting Company, Inc. (“USSB”) transaction in

May 1999. The provision was based upon an independent third-party appraisal and recorded at its net present

value, with interest expense recognized over the remaining term of the contract. The current and long-term

portions of these deferred credits are recorded in the Consolidated Balance Sheets in “Accrued liabilities and

other” and “Other Liabilities and Deferred Credits” and are being amortized using the interest method over the

related contract terms.

Subscriber Acquisition Costs

Subscriber acquisition costs in the Consolidated Statements of Income consist of costs incurred to acquire

new subscribers through third parties and the direct customer acquisition program. The deferred portion of the

costs are included in “Prepaid expenses and other” in the Consolidated Balance Sheets.

Subscriber acquisition costs primarily consist of amounts paid for third-party customer acquisitions, which

consist of the cost of commissions paid to authorized retailers and dealers for subscribers added through their

respective distribution channels which are included in the Consolidated Statements of Income in “Selling,

general and administrative expenses,” and the cost of hardware and installation subsidies for subscribers added

through the direct customer acquisition program which are included in the Consolidated Statements of Income in

“Broadcast programming and other costs.” Additional components of subscriber acquisition costs include

subsidies paid to manufacturers of set-top receivers, if any, and the cost of print, radio and television advertising.

The cost of advertising and manufacturer subsidies is expensed as incurred.

Substantially all commissions paid to retailers and dealers for third-party customer acquisitions, although

paid in advance, are earned by the retailer or dealer over 12 months from the date of subscriber activation and

may be recouped by the Company on a pro-rata basis should the subscriber cancel the service during the 12

month service period. Accordingly, prepaid commissions are deferred and amortized to expense over the 12

month service period. The amount deferred is limited to the estimated average gross margin (equal to an average

subscriber’s revenue to be earned over 12 months, less the related cost of programming) to be derived from the

subscriber over the 12 month period. As of December 31, 2003 and 2002, included in “Prepaid expenses and

other” in the Consolidated Balance Sheets are $334.3 million and $371.6 million, respectively, related to

commissions to retailers and dealers. The excess commissions over the estimated gross margin and non-

refundable commissions are expensed immediately.

70