DIRECTV 2003 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

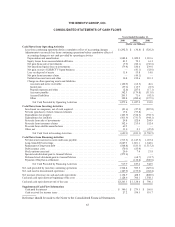

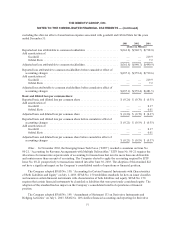

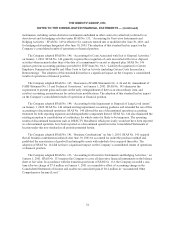

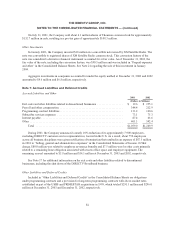

The following table presents the effect on earnings of recognizing compensation cost as if the fair value

based method had been applied to all outstanding and unvested stock options and other stock-based awards for

the years ended December 31:

2003 2002 2001

(Dollars in Millions Except Per

Share Amounts)

Reported net loss attributable to common stockholders ..................... $(361.8) $ (940.7) $(718.0)

Add: Stock compensation cost, net of taxes, included in net loss attributable to

common stockholders ............................................. 13.0 3.2 0.6

Deduct: Total stock compensation cost, net of taxes, under the fair value based

method......................................................... (108.9) (174.9) (232.4)

Pro forma net loss attributable to common stockholders .................... $(457.7) $(1,112.4) $(949.8)

Basic and diluted loss per common share:

As reported ....................................................... $ (0.26) $ (0.70) $ (0.55)

Proformalosspercommonshare ...................................... (0.33) (0.83) (0.73)

The 2003 total stock compensation expense amount includes a charge of $15.2 million, net of tax, resulting

from the acceleration of vesting for 11.5 million stock options as a result of the completion of the News

Corporation transactions. All outstanding options to purchase GM Class H common stock were converted to

options to acquire the Company’s common stock as a result of the completion of the News Corporation

transactions on December 22, 2003. See Note 13 for further information.

The pro forma amounts for compensation cost are not necessarily indicative of the amounts that will be

reported in future periods.

Advertising and Research and Development Costs

Advertising and research and development costs are expensed as incurred and included in “Selling, general

and administrative expenses” in the Consolidated Statements of Income. Advertising expenses were $201.5

million in 2003, $192.3 million in 2002 and $163.0 million in 2001. Expenditures for research and development

were $57.7 million in 2003, $71.7 million in 2002 and $85.8 million in 2001.

Market Concentrations and Credit Risk

The Company provides services and extends credit to a number of wireless communications equipment

customers and to a large number of consumers, both in the U.S. and Latin America. DIRECTV U.S. has

significant accounts receivable from the NRTC and the NRTC’s largest affiliate, Pegasus Satellite Television,

Inc. (“Pegasus”), arising from arrangements granting the NRTC and Pegasus the exclusive right to distribute

certain programming in certain areas. The Company monitors its exposure to credit losses and maintains, as

necessary, allowances for anticipated losses.

Accounting Changes

Variable Interest Entities. In January 2003, the Financial Accounting Standards Board (“FASB”) issued

Interpretation No. 46 (revised December 2003), “Consolidation of Variable Interest Entities—an interpretation of

ARB No. 51” (“FIN 46”). FIN 46 requires the consolidation of a variable interest entity (“VIE”) where an equity

investor achieves a controlling financial interest through arrangements other than voting interests, and it is

determined that the investor will absorb a majority of the expected losses and/or receive the majority of residual

returns of the VIE. The Company applied this interpretation beginning on July 1, 2003 for entities created prior

75