DIRECTV 2003 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

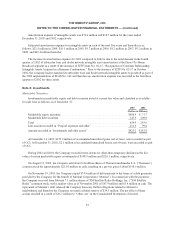

to February 1, 2003. The Company determined that the partially-owned LOCs providing DIRECTV

programming services in Venezuela and Puerto Rico, of which the Company owned 19.5% and 40.0%,

respectively, are VIEs. As a result, on July 1, 2003, the Company began consolidating the Venezuelan and Puerto

Rican LOCs resulting in an increase in total assets of $55.1 million, which included $29.1 million of cash. The

adoption of this interpretation resulted in the Company recording an after-tax charge of $64.6 million to

cumulative effect of accounting changes in the Consolidated Statements of Income.

Prior to July 1, 2003, the Company accounted for its investments in the Venezuelan and Puerto Rican LOCs

under the equity method of accounting and, through June 30, 2003, reflected approximately 75.0% of their net

income or loss in “Other, net” in the Consolidated Statements of Income due to the accumulation of net losses in

excess of other investors’ investments.

Stock-Based Compensation. As discussed above, beginning on January 1, 2003, the Company adopted the

fair value based method of accounting for stock-based employee compensation for stock options and other stock-

based awards granted to employees or modified on or after January 1, 2003. Stock options and other stock-based

awards granted prior to January 1, 2003 continue to be accounted for under the intrinsic value method of APB

Opinion No. 25, “Accounting for Stock Issued to Employees.”

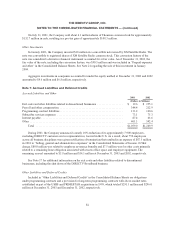

Goodwill and Other Intangible Assets. The Company adopted SFAS No. 142, “Goodwill and Other

Intangible Assets” on January 1, 2002. SFAS No. 142 required that the Company perform step one of a two-part

transitional impairment test to compare the fair value of each reporting unit with its respective carrying value,

including goodwill. If the carrying value exceeded the fair value, step two of the transitional impairment test was

required to measure the amount of the impairment loss, if any. SFAS No. 142 also required that intangible assets

be reviewed as of the date of adoption to determine if they continue to qualify as intangible assets under the

criteria established under SFAS No. 141, “Business Combinations,” and to the extent previously recorded

intangible assets do not meet the criteria that they be reclassified to goodwill.

In the first quarter of 2002, the Company completed the required transitional impairment test for Orbital

Slots and determined that no impairment existed because the fair value of these assets exceeded the carrying

value as of January 1, 2002.

In the second quarter of 2002, with the assistance of an independent valuation firm, the Company completed

step one of the transitional impairment test to determine whether a potential impairment existed for goodwill

recorded at January 1, 2002. Primarily based on the present value of expected future cash flows, it was

determined that the carrying values for DLA and DIRECTV Broadband exceeded their fair values, therefore

requiring performance of step two of the impairment test.

The Company completed step two of the impairment test for DLA and DIRECTV Broadband in the fourth

quarter of 2002. As a result of completing step two, the Company determined that the carrying value of reporting

unit goodwill exceeded the fair value of that goodwill and that all of the goodwill recorded at DLA and

DIRECTV Broadband, $631.8 million and $107.9 million, respectively, was impaired. In the fourth quarter of

2002, the Company also recorded a $16.0 million charge representing its share of the goodwill impairment of an

equity method investee. As a result, the Company recorded a charge to “Cumulative effect of accounting

changes, net of taxes,” of $681.3 million ($755.7 million pre-tax) as of January 1, 2002 in the Consolidated

Statements of Income.

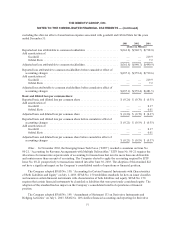

The following represents the Company’s reported net loss attributable to common stockholders and reported

loss attributable common stockholders before cumulative effect of accounting changes on a comparable basis

76