DIRECTV 2003 Annual Report Download - page 62

Download and view the complete annual report

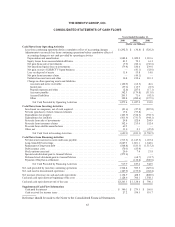

Please find page 62 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

ACCOUNTING CHANGES

Variable Interest Entities. In January 2003, the FASB issued FIN 46, which requires the consolidation of a

variable interest entity, or VIE, where an equity investor achieves a controlling financial interest through

arrangements other than voting interests, and it is determined that the investor will absorb a majority of the

expected losses and/or receive the majority of residual returns of the VIE. We applied this interpretation

beginning on July 1, 2003 for entities created prior to February 1, 2003. We determined that the partially-owned

LOCs providing DIRECTV programming services in Venezuela and Puerto Rico, of which we owned 19.5% and

40.0%, respectively, are VIEs. As a result, on July 1, 2003, we began consolidating the Venezuelan and Puerto

Rican LOCs resulting in an increase in total assets of $55.1 million, which included $29.1 million of cash. The

adoption of this interpretation resulted in us recording an after-tax charge of $64.6 million to cumulative effect of

accounting changes in the Consolidated Statements of Income.

Prior to July 1, 2003, we accounted for our investments in the Venezuelan and Puerto Rican LOCs under the

equity method of accounting and, through June 30, 2003, reflected approximately 75.0% of their net income or

loss in “Other, net” in the Consolidated Statements of Income due to the accumulation of net losses in excess of

other investors’ investments.

Stock-Based Compensation. We issue common stock options to our employees with exercise prices equal to

the fair value of the underlying security at the date of grant. We also grant restricted stock units to our employees.

Beginning on January 1, 2003, we adopted the fair value based method of accounting for stock-based employee

compensation of SFAS No. 123, “Accounting for Stock-Based Compensation” as amended by SFAS No. 148,

“Accounting for Stock-Based Compensation—Transition and Disclosure—an Amendment of SFAS No. 123.”

Under this method, compensation expense equal to the fair value of the stock-based award at grant is recognized

over the course of its vesting period. We elected to follow the prospective method of adoption, which results in the

recognition of fair value based compensation cost in the Consolidated Statements of Income for stock options and

other stock-based awards granted to employees or modified on or after January 1, 2003. Stock options and other

stock-based awards granted prior to January 1, 2003 continue to be accounted for under the intrinsic value method

of Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to Employees.” See Note 2 to the

Consolidated Financial Statements in Item 8 for additional information.

Goodwill and Other Intangible Assets. We adopted SFAS No. 142, “Goodwill and Other Intangible

Assets” on January 1, 2002. SFAS No. 142 required that existing and future goodwill and intangible assets with

indefinite lives not be amortized, but written-down, as needed, based upon an impairment analysis that must

occur at least annually, or sooner if an event occurs or circumstances change that would more likely than not

result in an impairment loss.

We completed the two part impairment test in the fourth quarter of 2002 which indicated that the carrying

value of reporting unit goodwill exceeded the fair value of that goodwill and that all of the goodwill recorded at

DLA and DIRECTV Broadband, $631.8 million and $107.9 million, respectively, was impaired. In the fourth

quarter of 2002, we also recorded a $16.0 million charge representing our share of the goodwill impairment of an

equity method investee. As a result, we recorded a charge to “Cumulative effect of accounting changes, net of

taxes,” of $681.3 million ($755.7 million pre-tax) as of January 1, 2002 in the Consolidated Statements of

Income.

Derivative Financial Instruments. We adopted SFAS No. 133, “Accounting for Derivative Instruments

and Hedging Activities,” on January 1, 2001. SFAS No. 133 requires us to carry all derivative financial

instruments on the balance sheet at fair value. In accordance with the transition provisions of SFAS No. 133, we

recorded a one-time after-tax charge of $7.4 million on January 1, 2001 as a cumulative effect of accounting

change in the Consolidated Statements of Income and an after-tax unrealized gain of $0.4 million in

“Accumulated Other Comprehensive Income (Loss).”

55