DIRECTV 2003 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

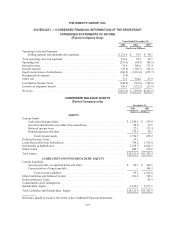

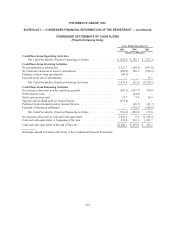

THE DIRECTV GROUP, INC.

SCHEDULE II — VALUATION AND QUALIFYING ACCOUNTS

Description

Balance at

beginning

of year

Additions

charged to

costs and

expenses

Additions charged

to other

accounts Deductions

Balance

at end of

year

(Dollars in Millions)

For the Year Ended December 31, 2003

Allowances Deducted from Assets

Accounts and notes receivable (for doubtful

receivables) .......................... $(102.4) $(181.9) $(80.9)(a) $243.3(b) $(121.9)

Net investment in sales-type leases (for

doubtful receivables) ................... (10.7) — — 1.8(b) (8.9)

Inventories (principally for obsolescence of

service parts) ......................... (34.5) (6.7) — 7.9(c) (33.3)

Total Allowances Deducted from

Assets .......................... $(147.6) $(188.6) $(80.9) $253.0 $(164.1)

For the Year Ended December 31, 2002

Allowances Deducted from Assets

Accounts and notes receivable (for doubtful

receivables) .......................... $(113.6) $(161.2) $(70.7)(a) $243.1(b) $(102.4)

Net investment in sales-type leases (for

doubtful receivables) ................... (5.7) (5.0) — — (10.7)

Inventories (principally for obsolescence of

service parts) ......................... (27.1) (14.5) (1.9)(d) 9.0(c) (34.5)

Total Allowances Deducted from

Assets .......................... $(146.4) $(180.7) $(72.6) $252.1 $(147.6)

For the Year Ended December 31, 2001

Allowances Deducted from Assets

Accounts and notes receivable (for doubtful

receivables) .......................... $ (88.3) $(188.8) $(72.4)(a) $235.9(b) $(113.6)

Net investment in sales-type leases (for

doubtful receivables) ................... (10.3) — — 4.6(b) (5.7)

Inventories (principally for obsolescence of

service parts) ......................... (34.8) (7.6) — 15.3(c) (27.1)

Total Allowances Deducted from

Assets .......................... $(133.4) $(196.4) $(72.4) $255.8 $(146.4)

(a) Primarily reflects the recovery of accounts previously written-off and increases resulting from acquisitions

or consolidation of LOCs previously accounted for under the equity method.

(b) Primarily relates to accounts written-off.

(c) Relates to obsolete parts and/or discontinued product lines written-off and reduction in reserves based on

physical inventory adjustments.

(d) Primarily relates to purchase accounting adjustments.

Reference should be made to the Notes to the Consolidated Financial Statements.

122