DIRECTV 2003 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

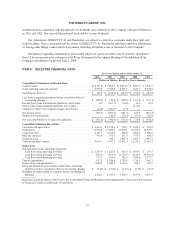

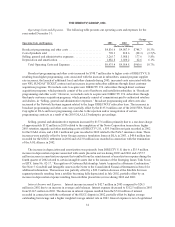

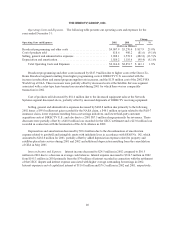

Revenues

Our revenue increases over the last three years have been driven by the growing subscriber base and

increasing ARPU at DIRECTV U.S. DIRECTV U.S. has added more than one million net new owned and

operated subscribers in each of the last three years. DIRECTV U.S. expects to add more than one million net new

owned and operated subscribers in 2004 mostly through the introduction of local channels in additional markets,

continued competitive offers to new customers, the introduction of new services and the expected reduction of

churn to slightly below the level of churn in 2003. DIRECTV U.S.’ ARPU increased 6.9% in 2003 and 1.9% in

2002. DIRECTV U.S. expects ARPU for 2004 to increase slightly above the planned March 2004 price increase

of 3.0%-3.5% per month.

In addition to the revenue growth at DIRECTV U.S., we expect our other business units to have 2004

revenues that are slightly higher or relatively unchanged compared to 2003 revenues.

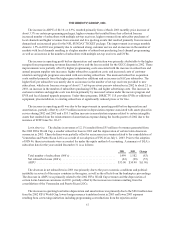

Operating Costs and Expenses

Over the last three years, operating costs and expenses at DIRECTV U.S. have decreased as a percentage of

revenues from 104% in 2001 to 94% in 2003. DIRECTV U.S. expects operating costs and expenses as a

percentage of revenues to continue to improve in 2004 due to lower general and administrative expenses,

subscriber service expenses and depreciation and amortization expense as a percentage of revenues, partially

offset by an increase in the cost of customer retention and upgrade programs associated with their existing

subscribers. Although DIRECTV U.S. believes subscriber acquisition costs will remain fairly constant as a

percentage of revenues due to its revenue growth, DIRECTV U.S. believes that cost per gross subscriber

addition, or SAC, will be higher in 2004 compared to 2003. The expected increases in SAC and the cost of

customer retention and upgrade programs associated with their existing subscribers are due to an expected

increase in the number of set-top receivers and DVRs per subscriber, partially offset by lower set-top receiver

costs.

In 2004, we expect PanAmSat’s operating profit to remain relatively unchanged from 2003. We expect

HNS’ operating profit to improve mostly from the added efficiencies and gross profit provided by a larger

DIRECWAY subscriber base. We also expect improvement in DLA’s operations, largely as a result of the

renegotiation of its significant programming contracts prior to its emergence from bankruptcy in February 2004

and an expected improvement in the economic conditions in several major countries in the region.

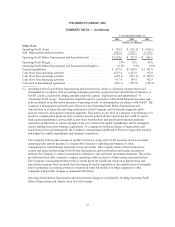

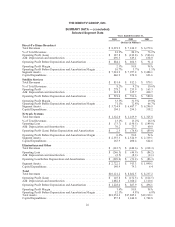

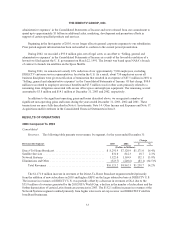

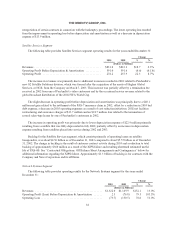

SIGNIFICANT EVENTS AFFECTING THE COMPARABILITY OF THE RESULTS OF OPERATIONS

In addition to the items described above, the following events had a significant effect on the comparability

of our operating results for the three years ended December 31, 2003:

Direct-To-Home Broadcast Segment

On June 4, 2002, DIRECTV U.S. and General Electric Capital Corporation, or GECC, executed an

agreement to settle, for $180 million, a claim arising from a contractual arrangement whereby GECC managed a

credit program for consumers who purchased DIRECTV programming and related hardware. As a result, in

2002, the provision for loss related to this matter was increased by $122.0 million, of which $48.0 million was

recorded as a charge to “Selling, general and administrative expenses” and $74.0 million was recorded as a

charge to “Interest expense” in the Consolidated Statements of Income.

In December 2002, DIRECTV U.S. announced a five-year agreement with the NFL for the exclusive DBS

television rights to the NFL SUNDAY TICKET through 2007 and exclusive multi-channel television rights

through 2005. DIRECTV U.S.’ agreement with the NFL allows it to distribute expanded programming on the

31