DIRECTV 2003 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

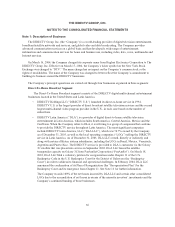

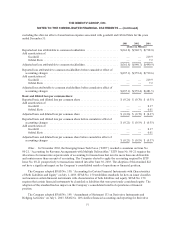

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

Satellite Services Segment

PanAmSat, a publicly-held company of which the Company owns approximately 80.5%, constitutes

the Satellite Services segment. Currently, PanAmSat owns and operates 25 satellites that are capable of

transmitting signals to geographic areas covering over 98% of the world’s population. PanAmSat provides

satellite capacity for the transmission of cable and broadcast television programming from the content

source to the cable operator or to the consumer’s home. PanAmSat’s satellites serving the U.S. are able to

reach cable operators representing nearly all cable subscribers. PanAmSat’s global fleet also serves as the

transmission platform for eight direct-to-home (sometimes referred to as DTH) services worldwide,

including DLA. In addition, PanAmSat provides satellite services to telecommunications carriers,

government agencies, corporations and Internet service providers for the provision of satellite-based

communication networks, including private business networks employing very small aperture terminals.

Network Systems Segment

Hughes Network Systems, Inc. (“HNS”), a wholly-owned subsidiary of the Company, constitutes the

Network Systems segment. HNS is a leader in the global market for VSAT private business networks. HNS

operates a satellite-based consumer broadband Internet access service marketed under the DIRECWAY®

brand. In addition, HNS is one of the two largest manufacturers of DIRECTV®set-top receivers. HNS is

also developing SPACEWAY®, a more advanced satellite broadband communications platform that is

expected to provide customers with high-speed, two-way data communications on a more cost-efficient

basis than systems that are currently available. The first SPACEWAY satellite is expected to be launched in

2004 and service is expected to be introduced in 2005.

News Corporation Transactions

On December 22, 2003, General Motors Corporation (“GM”), the Company and The News Corporation

Limited (“News Corporation”) completed a series of transactions that resulted in the split-off of the Company

from GM and the simultaneous sale of GM’s 19.8% interest in the Company to News Corporation. GM received

approximately $3.1 billion in cash and 28.6 million News Corporation Preferred American Depository Shares

(“ADSs”) in these transactions. GM split-off the Company by distributing the Company’s common stock to the

holders of the GM Class H common stock in exchange for their GM Class H common shares on a one-for-one

basis. Immediately after the split-off, News Corporation acquired an additional 14.2% of outstanding common

stock of the Company from the former GM Class H common stockholders, which provided News Corporation

with a total of 34% of the outstanding common stock of the Company. GM Class H common stockholders

received about 0.8232 shares of the Company’s common stock and about 0.09207 News Corporation Preferred

ADSs for each share of GM Class H common stock held immediately prior to the closing of the transactions. In

addition, the Company paid to GM a special cash dividend of $275 million in connection with the transactions.

Upon completing these transactions, News Corporation transferred its 34% interest in the Company to its 82%

owned subsidiary, Fox Entertainment Group, Inc. As a result of these transactions, the Company is now publicly

traded.

67