DIRECTV 2003 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

DIRECTV U.S., we continue to consider alternatives to resolve remaining outstanding issues with the NRTC and

to resolve our disputes with Pegasus.

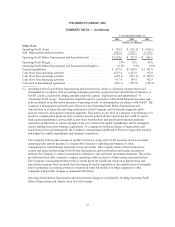

As a result, during the first quarter of 2004, the Company announced the reduction of corporate office

headcount by over half and the consolidation of Corporate and DIRECTV U.S. support functions. DLA LLC also

announced headcount reductions during the first quarter of 2004, subsequent to its emergence from bankruptcy

and the completion of certain transactions that were anticipated under its Reorganization Plan as more fully

discussed above in “DLA Reorganization.” As a result, during the first quarter of 2004, the Company will record

a charge of about $43 million, including $19 million relating to severance and other benefits provided to

employees and $24 million in curtailment and settlement charges related to the Company’s pension benefit plans.

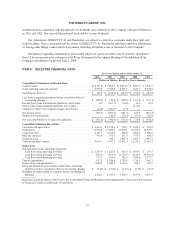

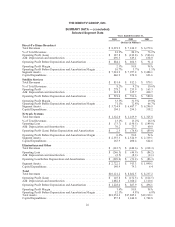

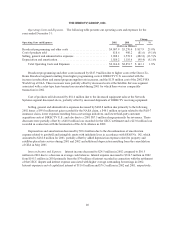

RESULTS OF OPERATIONS—EXECUTIVE OVERVIEW AND OUTLOOK

The following discussion relates primarily to DIRECTV U.S., which generates over 80% of our revenues

and is the source of most of our revenue growth.

Competition and Industry Highlights

DIRECTV U.S.’ competitors within the MVPD industry include cable television, DBS and wireless cable

companies. The FCC recently reported that approximately 90 million, or 84%, of approximately 107 million U.S.

television households subscribe to MVPD services, of which more than 21 million subscribe to DBS. DIRECTV

U.S. believes there continues to be significant demand for its high-quality television programming service, which it

plans to continue to differentiate from other MVPDs with new content, interactivity, HDTV programming, DVR

content and more. Therefore, DIRECTV U.S. believes there is substantial opportunity for continued subscriber

revenue, earnings and cash flow growth.

Although there is substantial opportunity for revenue and earnings growth, the industry is subject to

increasing programming costs due to average annual programming rate increases that significantly exceed

inflation and the high cost of subscriber acquisitions due to significant competition. DIRECTV U.S. believes that

there is an opportunity to reduce the average annual increase of its programming costs by leveraging its large

subscriber base in renegotiations with its program suppliers. DIRECTV U.S. also believes there is an opportunity

to reduce its subscriber acquisition costs through simplification and standardization of its set-top receiver design,

and through streamlining its ordering, distribution, inventory management and sales processes, as well as through

technological advances.

The industry is also subject to high levels of subscriber churn, which requires significant investment for

DIRECTV U.S. to manage. DIRECTV U.S. believes that the cost of managing churn is well worth the

investment since it is more costly to add new subscribers. DIRECTV U.S. manages its churn by providing a high

level of customer service and by providing loyalty and retention offers to its existing subscribers. The loyalty and

retention offers include such offers as the additional set-top receiver, DVR and local channel upgrade programs.

DIRECTV U.S. finds that subscribers that have advanced products, multiple set-top receivers or receive local

channels remain DIRECTV subscribers longer than other subscribers. DIRECTV U.S. believes that it can reduce

retention costs by improving its cost structure similar to that described above for its subscriber acquisition costs.

DIRECTV U.S. is also subject to the additional cost of adding more local channels and HDTV

programming, which requires significant capital expenditures for satellites, broadcast equipment and additional

orbital frequencies to increase its programming content capacity. As part of the approval of the News

Corporation transactions, the FCC required DIRECTV U.S. to provide local channels in an additional 30 local

U.S. markets, subject to certain conditions, for a total of up to 130 local markets by the end of 2004. DIRECTV

U.S. believes its continued expansion will require significant capital investment over the next several years,

which it believes is necessary to remain competitive with other MVPD companies.

30