DIRECTV 2003 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

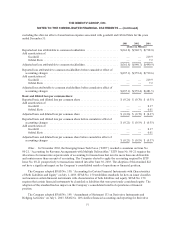

Credit Facilities

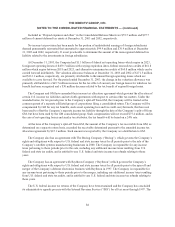

On March 6, 2003, DIRECTV entered into a $1,675.0 million senior secured credit facility, comprised of a

$375.0 million Term Loan A, of which $175.0 million was drawn, a $1,050.0 million Term Loan B, which was

fully drawn, and a $250.0 million revolving credit facility, which was undrawn. DIRECTV distributed to the

Company the $2.56 billion of proceeds, net of debt issuance costs, from the initial borrowings under the senior

secured credit facility and the sale of senior notes described above.

In August 2003, DIRECTV amended the senior secured credit facility to replace the $1,050.0 million Term

Loan B with a new $1,225.0 million Term Loan B-1 and to reduce the size of the Term Loan A from $375.0

million to $200.0 million, repaying the $175.0 million that was previously outstanding under the Term Loan A

with the additional borrowings from the Term Loan B-1. Borrowings under the Term Loan B-1 bear interest at a

rate equal to the London Interbank Offered Rate (“LIBOR”) plus 2.75%, which may be increased or decreased

under certain conditions. The revolving credit facility was not affected by the amendment. DIRECTV is required

to pay a commitment fee of 0.50% per year on the unused commitment under the revolving credit facility. The

revolving credit facility expires in 2008 and the Term Loan B-1 matures in 2010. However, as defined by the

senior secured credit facility agreement, under certain circumstances as described below, DIRECTV could be

required to make a prepayment on the Term Loan B-1. As of December 31, 2003, the revolving credit facility

was undrawn and the Term Loan B-1 was fully drawn. The revolving portion of the senior secured credit facility

is available to fund DIRECTV’s working capital and other requirements. The senior secured credit facility is

secured by substantially all of DIRECTV’s assets and is fully and unconditionally guaranteed, jointly and

severally, by DIRECTV.

Principal payments under the Term Loan B-1 are due primarily in 2008 to 2010. However, at each year end

DIRECTV may be required to make a computation of excess cash flows for the year, as defined by the senior

secured credit facility agreement, which could result in DIRECTV making a prepayment, under the Term Loan

B-1 on April 15th. The amount payable to DIRECTV’s credit holders is equal to one-half of DIRECTV’s excess

cash flows, if any, with up to $150 million of the remaining amount available for distribution to the Company.

DIRECTV has calculated approximately $401.8 million of excess cash flows at December 31, 2003. As a result,

$200.9 million was reclassified from “Long-Term Debt” to “Short-term borrowings and current portion of long-

term debt” in the Consolidated Balance Sheets. However, under the terms of the senior secured credit facility

agreement, at DIRECTV’s request, the lenders under the credit facility may elect to forego all or a portion of the

prepayment, if required, prior to April 15th of each year.

The $200 million Term Loan A was undrawn and was terminated on December 1, 2003. Borrowings under the

Term Loan B bore interest at LIBOR plus 3.50% until it was replaced by the Term Loan B-1 in August 2003. In

March 2004, DIRECTV’s senior secured credit facility was amended to replace the Term Loan B-1 with a Term

Loan B-2, with substantially the same terms except that the interest rate was reduced to LIBOR plus 2.25%.

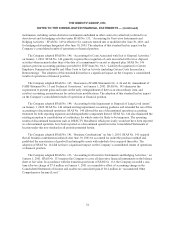

In February 2002, PanAmSat entered into a bank facility in the amount of $1,250.0 million. The bank

facility was originally comprised of a $250.0 million revolving credit facility, which was undrawn as of

December 31, 2003, a $300.0 million Tranche A Term Loan and a $700.0 million Tranche B Term Loan. This

bank facility replaced a previously existing and undrawn $500.0 million unsecured multi-year revolving credit

facility. PanAmSat is required to pay a commitment fee on the unused commitments under the revolving credit

facility at a rate that is subject to adjustment based on PanAmSat’s total leverage ratio. As of December 31, 2003,

the commitment fee rate was 0.375% per year. The Tranche A Term Loan and Tranche B Term Loan bore

interest at LIBOR plus 2.75% (which may have been increased or decreased based upon changes in PanAmSat’s

total leverage ratio as defined by the credit agreement) and LIBOR plus 3.50%, respectively, at the time of

replacement in October 2003, as discussed below. The revolving credit facility bears interest at LIBOR plus

2.50% and this interest rate may be increased or decreased based upon changes in PanAmSat’s total leverage

84