DIRECTV 2003 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

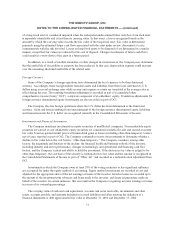

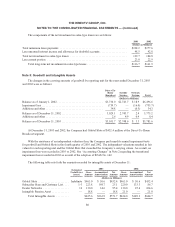

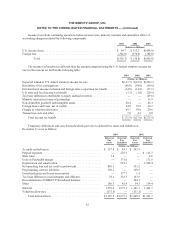

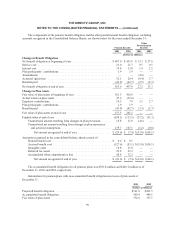

Note 8: Short-Term Borrowings and Long-Term Debt

Short-Term Borrowings and Current Portion of Long-Term Debt

Interest Rates at

December 31,

2003 2003 2002

(Dollars in Millions)

Short-term borrowings ....................................... 4.00%-13.50% $ 10.6 $ 21.5

Current portion of long-term debt .............................. 3.96%-12.10% 219.1 706.3

Total short-term borrowings and current portion of long-term

debt ................................................ $229.7 $727.8

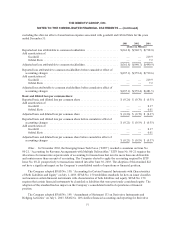

Long-Term Debt

Interest Rates at

December 31,

2003 2003 2002

(Dollars in Millions)

Notespayable ............................................... 6.13%- 8.50% $2,750.0 $1,550.0

Credit facilities .............................................. 3.96%- 4.22% 1,575.0 1,506.3

Otherdebt .................................................. 3.29%-12.10% 25.4 40.0

Totaldebt................................................... 4,350.4 3,096.3

Less current portion ........................................... 219.1 706.3

Total long-term debt ...................................... $4,131.3 $2,390.0

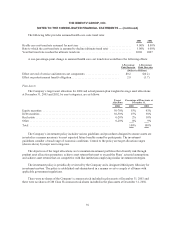

Notes Payable

On February 28, 2003, DIRECTV U.S., which is referred to in this Note as DIRECTV, issued $1,400.0

million in senior notes due in 2013 in a private placement transaction. The ten-year senior notes bear interest at

8.375%. Principal on the senior notes is payable upon maturity, while interest is payable semi-annually beginning

September 15, 2003. The senior notes have been fully and unconditionally guaranteed, jointly and severally, by

each of DIRECTV’s domestic subsidiaries on a senior unsecured basis. These senior notes were exchanged for

registered notes with substantially identical terms in September 2003.

In February 2002, PanAmSat completed an $800.0 million private placement notes offering, which notes

were exchanged for registered notes with substantially identical terms in November 2002. These unsecured notes

bear interest at an annual rate of 8.5%. Interest is payable semi-annually and the unsecured notes mature in 2012.

PanAmSat issued five, seven, ten and thirty-year fixed rate notes totaling $750.0 million in January 1998.

The $200.0 million five-year notes were repaid in January 2003. The outstanding principal balances and interest

rates as of December 31, 2003 were $275.0 million at 6.125% due in 2005, $150.0 million at 6.375% due in 2008

and $125.0 million at 6.875% due in 2028. Principal is payable at maturity, while interest is payable semi-

annually. In connection with a secured bank facility entered into by PanAmSat in February 2002, described

below, these notes were ratably secured with the bank facility by substantially all of PanAmSat’s assets,

including its satellites.

The fair value of the Company’s notes payable was approximately $3,057 million and $1,491 million at

December 31, 2003 and 2002, respectively, based on quoted market prices on those dates.

83