DIRECTV 2003 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

interest of $133.9 million and $116.8 million in 2003 and 2002, respectively. Changes in cash and cash

equivalents and debt are discussed in more detail below under “Liquidity and Capital Resources.”

Reorganization Expense. As part of DLA LLC’s bankruptcy proceedings, the Company and DLA

recognized reorganization expenses of $212.3 million in 2003 resulting from settlement agreements reached with

creditors, the write-off of intangible assets and legal and consulting costs. See “DLA LLC Reorganization” above

for additional information.

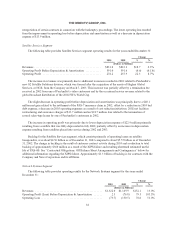

Other, Net. Other, net decreased to zero in 2003 from income of $425.5 million in 2002. The significant

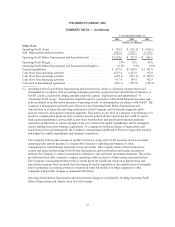

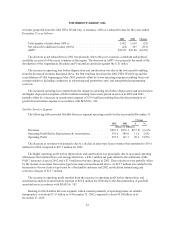

components of “Other, net” were as follows for the years ended December 31:

2003 2002 Change

(Dollars in Millions)

Equity losses from unconsolidated affiliates ................................ $(81.5) $ (70.1) $ (11.4)

EchoStar merger termination payment ..................................... — 600.0 (600.0)

Net unrealized gain (loss) on investments .................................. 79.4 (180.6) 260.0

Net gain from sale of investments ........................................ 7.5 84.1 (76.6)

NetgainonexitofDIRECTVJapanbusiness............................... — 41.1 (41.1)

Other............................................................... (5.4) (49.0) 43.6

Total ........................................................... $ — $425.5 $(425.5)

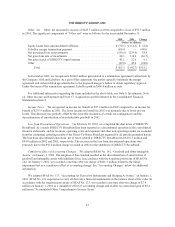

In December 2002, we recognized a $600.0 million gain related to a termination agreement entered into by

the Company, GM and EchoStar. As a part of this agreement, the parties agreed to terminate the merger

agreement and certain related agreements due to the proposed merger’s failure to obtain regulatory approval.

Under the terms of the termination agreement, EchoStar paid us $600.0 million in cash.

For additional information regarding the items included in the above table, see Note 6: Investments, Note

14: Other Income and Expenses and Note 17: Acquisitions and Divestitures to the Consolidated Financial

Statements in Item 8.

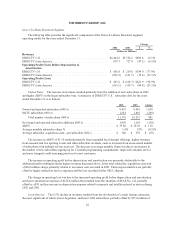

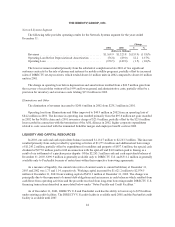

Income Taxes. We recognized an income tax benefit of $71.9 million for 2003 compared to an income tax

benefit of $27.6 million for 2002. The higher income tax benefit for 2003 was primarily due to higher pre-tax

losses in the current year. This increase was partially offset by losses in foreign jurisdictions where we do not

currently recognize the tax benefit associated with such losses and favorable audit resolutions and refund claim

settlements with various tax authorities in 2002.

Loss from Discontinued Operations. We reported a loss from discontinued operations of $4.7 million for

2003 compared to a loss of $181.7 million for 2002.

On July 15, 2003, the Company and Boeing settled all matters related to the previously reported dispute

arising out of the 2000 sale by the Company of our satellite systems manufacturing businesses to Boeing. As a

result of the settlement, we recorded an after-tax charge of $6.3 million in discontinued operations in 2003.

On February 28, 2003, we completed the shut down of DIRECTV Broadband, Inc., or DIRECTV

Broadband. As a result, DIRECTV Broadband has been reported as a discontinued operation in the consolidated

financial statements, and its revenues, operating costs and expenses and other non-operating results are excluded

from the continuing operating results of the Direct-To-Home Broadcast segment for all periods presented herein.

Income from discontinued operations, net of taxes, was $1.6 million in 2003 compared to a loss of $181.7 million

in 2002. The loss from discontinued operations in 2002 includes a $92.8 million charge recorded for the

shutdown of DIRECTV Broadband.

35