DIRECTV 2003 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

Other, Net. Other, net increased to income of $425.5 million in 2002 compared to a loss of $92.7 million

in 2001. The significant components of “Other, net” were as follows for the years ended December 31:

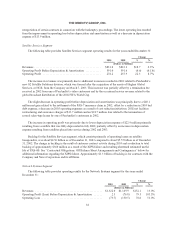

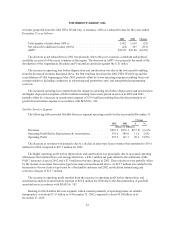

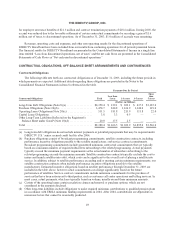

2002 2001 Change

(Dollars in Millions)

Equity losses from unconsolidated affiliates ........................ $ (70.1) $ (61.3) $ (8.8)

EchoStar merger termination payment ............................ 600.0 — 600.0

Net unrealized loss on investments ............................... (180.6) (239.0) 58.4

Net gain from sale of investments ................................ 84.1 130.6 (46.5)

NetgainonexitofDIRECTVJapanbusiness ...................... 41.1 32.0 9.1

Other ...................................................... (49.0) 45.0 (94.0)

Total................................................... $425.5 $ (92.7) $518.2

In December 2002, we recognized a $600.0 million gain related to a termination agreement entered into by

the Company, GM and EchoStar. As a part of this agreement, the parties agreed to terminate the merger

agreement and certain related agreements due to the proposed merger’s failure to obtain regulatory approval.

Under the terms of the termination agreement, EchoStar paid us $600.0 million in cash.

For additional information regarding the items included in the above table, see Note 6: Investments, Note

14: Other Income and Expenses and Note 17: Acquisitions and Divestitures in the Consolidated Financial

Statements in Item 8.

Income Taxes. We recognized an income tax benefit of $27.6 million in 2002 compared to an income tax

benefit of $275.9 million in 2001. The lower income tax benefit in 2002 was primarily due to lower pre-tax

losses. This decrease was partially offset by the favorable resolution of certain tax contingencies and the

discontinuation of amortization of non-deductible goodwill in 2002.

Loss from Discontinued Operations. On February 28, 2003, we completed the shut down of DIRECTV

Broadband. As a result, DIRECTV Broadband has been reported as a discontinued operation in the consolidated

financial statements, and its revenues, operating costs and expenses and other non-operating results are excluded

from the continuing operating results of the Direct-To-Home Broadcast segment for all periods presented herein.

The loss from discontinued operations, net of taxes, related to DIRECTV Broadband was $181.7 million and

$94.0 million in 2002 and 2001, respectively. The increase in the loss from discontinued operations was

primarily due to the $92.8 million charge recorded in 2002 for the shutdown of DIRECTV Broadband.

Cumulative Effect of Accounting Changes. We adopted SFAS No. 142, “Goodwill and Other Intangible

Assets,” on January 1, 2002. The adoption of this standard resulted in the discontinuation of amortization of

goodwill and intangible assets with indefinite lives. In accordance with the transition provisions of SFAS No.

142, on January 1 2002, we recorded a one-time after-tax charge of $681.3 million related to the initial

impairment test as a cumulative effect of accounting change. See “Accounting Changes” below for additional

information.

We adopted SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities,” on January 1,

2001. SFAS No. 133 required us to carry all derivative financial instruments on the balance sheet at fair value. In

accordance with the transition provisions of SFAS No. 133, we recorded a one-time after-tax charge of $7.4

million on January 1, 2001 as a cumulative effect of accounting change and an after-tax unrealized gain of $0.4

million in “Accumulated Other Comprehensive Income (Loss).”

41