DIRECTV 2003 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

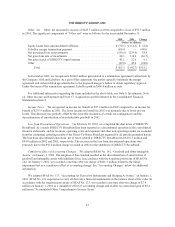

We are a publicly-traded company with our common stock listed as “DTV” on the NYSE. As part of the

News Corporation transactions completed on December 22, 2003, our certificate of incorporation was amended

to provide for the following capital stock: common stock, par value $0.01 per share, 3,000,000,000 shares

authorized; Class B common stock, par value $0.01 per share, 275,000,000 shares authorized; excess stock, par

value $0.01 per share, 800,000,000 shares authorized; and preferred stock, par value $0.01 per share, 9,000,000

shares authorized. As of December 31, 2003, there were no outstanding shares of the Class B common stock,

excess stock or preferred stock.

Prior to our split-off from GM on December 22, 2003, GM held all of our outstanding capital stock. GM

Class H common stock was a publicly-traded security of GM and was a “tracking stock” designed to provide

holders with financial returns based on our financial performance.

During April 2003, our Board of Directors approved the reclassification of our outstanding Series B

convertible preferred stock into Class B common stock of equivalent value, and a subsequent stock split of

common stock and Class B common stock through dividends of additional shares. GM, in its capacity as the

holder of all of our outstanding capital stock, approved the reclassification. Shortly thereafter, GM converted

some of its shares of our common stock into an equivalent number of shares of our Class B common stock. As a

result of these transactions, we had issued and outstanding 1,207,518,237 shares of common stock and

274,373,316 shares of Class B common stock, all of which were owned by GM.

Immediately prior to the completion of the News Corporation transactions and as provided in an amendment

to the GM Certificate of Incorporation filed on December 22, 2003, the number of shares of common and Class B

common stock were adjusted to assure that the stock outstanding and the stock representing GM’s interest

accurately reflected the interests to be sold directly by GM to News Corporation and the interests to be

distributed to holders of GM Class H common stock. After the adjustment, there were 1,109,270,842 GM Class

H common shares then outstanding. The number of shares of Class B common stock was adjusted to equal

274,319,607 shares, representing GM’s 19.8% interest in us.

On December 22, 2003, GM split-off the Company by distributing our common stock to the holders of GM

Class H common stock in exchange for the 1,109,270,842 shares then outstanding on a one-for-one basis.

Simultaneously, GM sold its 19.8% interest in us (represented by 274,319,607 shares of our Class B common

stock) to News Corporation in exchange for cash and News Corporation Preferred ADSs. The shares of our Class

B common stock were then converted to shares of our common stock on a one-for-one basis.

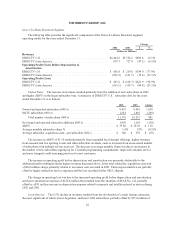

Divestitures

On April 3, 2001, we acquired Telocity Delaware, Inc., or Telocity, a company that provided land-based

DSL services, through the completion of a tender offer and merger. Telocity changed its name to and was

operated as DIRECTV Broadband and was included as part of the Direct-To-Home Broadcast segment. The

purchase price was $197.8 million and was paid in cash.

On December 13, 2002, we announced that DIRECTV Broadband would close its high-speed Internet

service business in the first quarter of 2003 and transition its existing customers to alternative service providers.

As a result, in December 2002, we notified approximately half of DIRECTV Broadband’s 400 employees of a

layoff, with a minimum of 60 days notice during which time they were paid, followed by receipt of a severance

package. The remaining employees worked with customers during the transition and assisted with the closure of

the business. On February 28, 2003, DIRECTV Broadband completed the transition of its customers to

alternative service providers and shut down its high-speed Internet service business. In the fourth quarter of 2002,

we recorded a charge of $92.8 million related to accruals for employee severance benefits, contract termination

payments and the write-off of customer premise equipment. Included in the $92.8 million charge were accruals

48