DIRECTV 2003 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

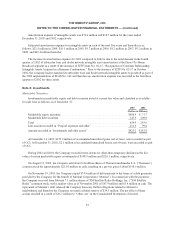

On July 31, 2001, the Company sold about 4.1 million shares of Thomson common stock for approximately

$132.7 million in cash, resulting in a pre-tax gain of approximately $108.3 million.

Other Investments

In January 2003, the Company invested $10 million in a convertible note issued by XM Satellite Radio. The

note was convertible to registered shares of XM Satellite Radio common stock. This conversion feature of the

note was considered a derivative financial instrument accounted for at fair value. As of December 31, 2003, the

fair value of the note, including the conversion feature, was $90.5 million and was included in “Prepaid expenses

and other” in the Consolidated Balance Sheets. See Note 21 regarding the sale of this investment in January

2004.

Aggregate investments in companies accounted for under the equity method at December 31, 2003 and 2002

amounted to $4.6 million and $6.8 million, respectively.

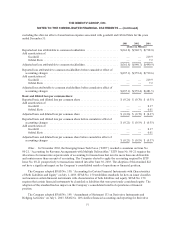

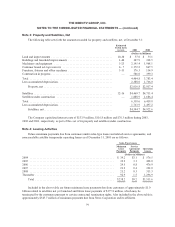

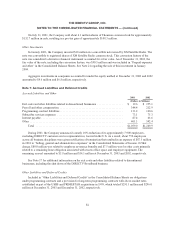

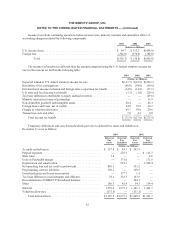

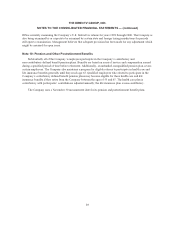

Note 7: Accrued Liabilities and Deferred Credits

Accrued Liabilities and Other

2003 2002

(Dollars in Millions)

Exit costs and other liabilities related to discontinued businesses .................. $ 19.6 $ 255.1

Payroll and other compensation ............................................ 344.4 212.9

Programming contract liabilities ............................................ 133.2 120.6

Subscriber services expenses .............................................. 73.1 75.3

Interest payable ......................................................... 87.4 63.6

Other ................................................................. 401.3 542.4

Total ............................................................. $1,059.0 $1,269.9

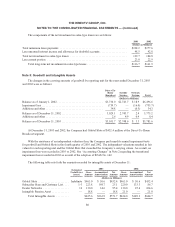

During 2001, the Company announced a nearly 10% reduction of its approximately 7,900 employees,

excluding DIRECTV customer service representatives, located in the U.S. As a result, about 750 employees

across all business disciplines were given notification of termination that resulted in an expense of $87.5 million

in 2001 to “Selling, general and administrative expenses” in the Consolidated Statements of Income. Of that

charge, $80.0 million was related to employee severance benefits and $7.5 million was for other costs primarily

related to a remaining lease obligation associated with excess office space and employee equipment. The

remaining accrual amounted to $3.8 million and $14.1 million at December 31, 2003 and 2002, respectively.

See Note 17 for additional information on the exit costs and other liabilities related to discontinued

businesses, including the shut down of the DIRECTV Broadband business.

Other Liabilities and Deferred Credits

Included in “Other Liabilities and Deferred Credits” in the Consolidated Balance Sheets are obligations

under programming contracts and a provision for long-term programming contracts with above-market rates,

established as part of the USSB and PRIMESTAR acquisitions in 1999, which totaled $291.1 million and $296.0

million at December 31, 2003 and December 31, 2002, respectively.

82