DIRECTV 2003 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

PART II

ITEM 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER

MATTERS

On March 16, 2004, we changed our corporate name from Hughes Electronics Corporation to The

DIRECTV Group, Inc. The name change has no impact on the Company’s common stock or the rights of our

stockholders. Effective on March 17, 2004, our ticker symbol on the NYSE was changed to “DTV.” From

December 23, 2003 through March 16, 2004, the Company’s common stock was traded under the ticker symbol

“HS.” Prior to December 23, 2003, our financial performance was tracked by the GM Class H common stock

issued by GM, which was listed on the NYSE under the ticker symbol “GMH.” The GM Class H common stock

was a “tracking stock” designed to provide holders with financial returns based on our financial performance.

Holders of GM Class H common stock had no direct rights in our equity or assets, but rather had rights in the

equity and assets of GM (which included 100% of the stock of the Company). In the split-off of the Company

from GM that occurred as part of the News Corporation transactions completed on December 22, 2003, GM

distributed the Company’s common stock to holders of the GM Class H common stock in exchange for their

shares of GM Class H common stock on a one-for-one basis.

For purposes of setting forth, for the calendar periods indicated, the high and low closing sales price per

share for the Company’s common stock, the information below is based on the GMH per share price through

December 22, 2003 and the HS per share price from December 23, 2003 through December 31, 2003, as reported

by the NYSE:

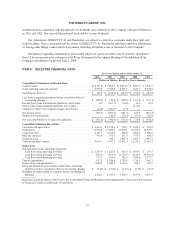

2003 High Low

First Quarter ................................. $12.41 $ 9.40

Second Quarter ............................... 13.56 10.17

Third Quarter ................................. 15.10 12.74

Fourth Quarter ................................ 16.91 14.25

2002 High Low

First Quarter ................................. $17.55 $12.50

Second Quarter ............................... 17.00 8.49

Third Quarter ................................. 11.25 8.35

Fourth Quarter ................................ 12.00 8.00

As of March 11, 2004, there were approximately 137,117 holders of record of the Company’s common

stock.

Subject to the preferential and other dividend rights of any outstanding series of the Company’s Preferred

Stock, holders of the Company’s common stock are entitled to such dividends and other distributions in cash,

stock or property of the Company as may be declared by our Board of Directors in its sole discretion. There were

no shares of the Company’s Preferred Stock outstanding at December 31, 2003. Since the split-off from GM, the

Company’s Board of Directors has not paid, and does not currently intend to pay in the foreseeable future, cash

dividends on its common stock. The Company paid a $275 million special cash dividend to GM in connection

with the split-off. Future earnings of the Company, if any, are expected to be retained for the development of the

businesses of the Company.

Prior to the completion of the News Corporation transactions on December 22, 2003, all of the Company’s

common stock and convertible preferred stock were owned by GM. Accordingly, there was no public trading

market for the Company’s common or convertible preferred stock. Dividends on the common stock were to be

paid when and if declared by the Company’s Board of Directors. Except for the $275 million special cash

22