DIRECTV 2003 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

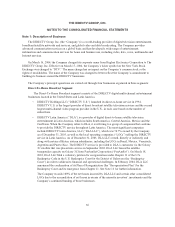

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

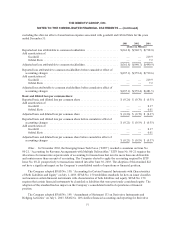

represent satellites under construction and the costs of successful satellite launches. The proportionate cost of a

satellite, net of accumulated depreciation and insurance proceeds, is written-off in the period a full or partial loss

of the satellite occurs. Capitalized customer leased set-top receiver costs include the cost of hardware and

installation. Depreciation is computed generally using the straight-line method over the estimated useful lives of

the assets. Leasehold improvements are amortized over the lesser of the life of the asset or term of the lease.

Goodwill and Intangible Assets

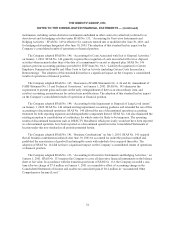

As discussed below, with the adoption of Statement of Financial Accounting Standards (“SFAS”) No. 142,

“Goodwill and Other Intangible Assets” on January 1, 2002, the Company ceased amortization of goodwill and

intangible assets with indefinite lives. Intangible assets with indefinite lives consist of Federal Communications

Commission (“FCC”) licenses for direct-to-home broadcasting frequencies (“Orbital Slots”). Goodwill and

Orbital Slots are subject to write-down, as needed, based upon an impairment analysis that occurs at least

annually, or sooner if an event occurs or circumstances change that would more likely than not result in an

impairment loss. Prior to January 1, 2002, goodwill, which represents the excess of the cost over the net tangible

and identifiable intangible assets of acquired businesses, and Orbital Slots were amortized using the straight-line

method over periods not exceeding 40 years. Other intangible assets are amortized using the straight-line method

over their estimated useful lives, which range from 1 to 12 years.

Step one of the annual two-part goodwill impairment test requires a comparison of the fair value of each

reporting unit with its respective carrying amount, including goodwill. If the reporting unit carrying value

exceeds the fair value, step two of the impairment test is performed to measure the amount of the impairment

loss, if any. Step two requires the comparison of the implied value of the reporting unit goodwill with the

carrying amount of that goodwill. The implied value of goodwill is equal to the excess of the fair value of the

reporting unit determined in step one over the fair value of its net tangible and intangible assets. If the carrying

amount of reporting unit goodwill exceeds the implied fair value of that goodwill, an impairment loss will be

recognized in an amount equal to that excess. For Orbital Slots, the annual impairment test is completed by

comparing the fair value of Orbital Slots to their carrying values. If the carrying amount of the Orbital Slots

exceeds its fair value, an impairment loss will be recognized in an amount equal to that excess.

The Company performs its annual impairment test for goodwill and Orbital Slots during the fourth quarter

of each year, primarily using the present value of expected future cash flows. Changes in estimates of future cash

flows could result in a write-down of the asset in a future period. If an impairment loss results from the annual

impairment test, the loss will be recorded as a pre-tax charge to operating income.

Software Development Costs

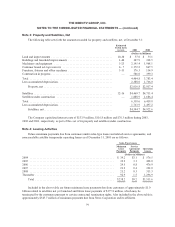

Other assets include certain software development costs capitalized in accordance with SFAS No. 86,

“Accounting for the Costs of Computer Software to be Sold, Leased, or Otherwise Marketed.” Capitalized

software development costs at December 31, 2003 and 2002, net of accumulated amortization of $134.9 million

and $208.0 million, respectively, totaled $88.1 million and $88.0 million, respectively. The software is amortized

using the greater of the units of revenue method or the straight-line method over its estimated useful life, not in

excess of five years. Software program reviews are conducted at least annually to ensure that capitalized software

development costs are properly treated and costs associated with programs that are not generating revenues are

expensed.

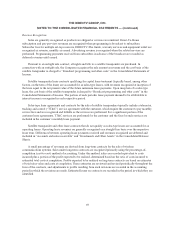

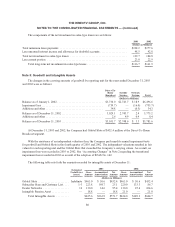

Valuation of Long-Lived Assets

The Company evaluates the carrying value of long-lived assets to be held and used, other than goodwill and

intangible assets with indefinite lives, when events and circumstances warrant such a review. The carrying value

72