DIRECTV 2003 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

On May 5, 1997, PanAmSat adopted a stock option incentive plan with terms similar to the Plan. As of

December 31, 2003, PanAmSat had 6,297,823 options outstanding to purchase its common stock with exercise

prices ranging from $14.12 per share to $63.25 per share. The options vest ratably over three to four years and

have a remaining life ranging from 3.3 to 10 years. At December 31, 2003, 4,115,726 options were exercisable at

a weighted average exercise price of $34.23 per share. During the year ended December 31, 2003, PanAmSat

granted 400,500 restricted stock units to its employees with a weighted average grant-date fair value of

approximately $17.32 per share.

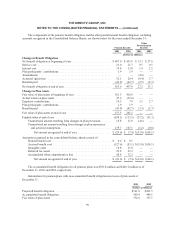

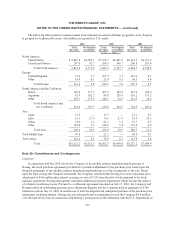

Note 14: Other Income and Expenses

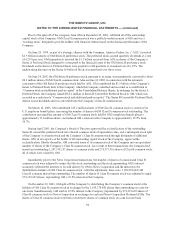

The following table summarizes the components of other income and expenses for the years ended

December 31:

2003 2002 2001

(Dollars in Millions)

Equity losses from unconsolidated affiliates ................................ $(81.5) $ (70.1) $ (61.3)

EchoStar Merger termination payment .................................... — 600.0 —

Net unrealized gain (loss) on investments .................................. 79.4 (180.6) (239.0)

Net gain from sale of investments ........................................ 7.5 84.1 130.6

NetgainonexitofDIRECTVJapanbusiness(Note17) ...................... — 41.1 32.0

Other............................................................... (5.4) (49.0) 45.0

TotalOther,net .................................................. $ — $425.5 $ (92.7)

For the years ended December 31, 2003 and 2002, equity losses from unconsolidated affiliates are primarily

comprised of losses at the DLA LOCs. Also included in 2003 are equity losses from the XM Satellite Radio

investment. For the year ended December 31, 2001, equity losses from unconsolidated affiliates are primarily

comprised of losses at the DLA LOCs and Hughes Tele.com (India) Limited (“HTIL”).

In December 2002, the Company recognized a $600.0 million gain related to a termination agreement

entered into by the Company, GM and EchoStar Communications Corporation (“EchoStar”). As a part of this

agreement, the parties agreed to terminate the merger agreement and certain related agreements due to the

proposed merger’s failure to obtain regulatory approval. Under the terms of the termination agreement, EchoStar

paid the Company $600 million in cash.

Net unrealized gain on investments for 2003 includes a $79.6 million gain resulting from an increase in the

fair market value of an investment in an XM Satellite Radio convertible note. Net unrealized loss on investments

for 2002 is primarily comprised of other-than-temporary declines in fair value of the Company’s investment in

XM Satellite Radio and Crown Media Holdings. Net unrealized loss on investments for 2001 are primarily

comprised of a write-down of $212.0 million related to the Company’s investment in Sky Perfect

Communications, Inc.

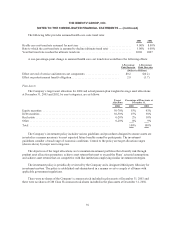

Note 15: Related-Party Transactions

In the ordinary course of its operations, the Company enters into transactions with related parties to

purchase and/or sell telecommunication services, advertising, broadcast programming, equipment and inventory.

Transactions entered into with GM and its affiliates prior to December 23, 2003 were considered related party

transactions. Other related parties include DLA’s Puerto Rican, Venezuelan and Argentine LOCs until their

respective dates of consolidation with the Company and HTIL until it was sold on December 6, 2002 (see

98