DIRECTV 2003 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

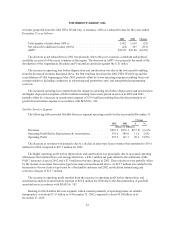

with the fixed rate notes described above by substantially all of PanAmSat’s assets, including its satellites.

PanAmSat repaid a $1,725.0 million intercompany loan from us in February 2002, using proceeds from the bank

facility and the 8.5% notes described above.

On July 14, 2003, PanAmSat made an optional prepayment of $350.0 million under its $1,250.0 million

bank facility from available cash on hand. The prepayment was applied pro rata against PanAmSat’s then fully

drawn Tranche A Term Loan and Tranche B Term Loan.

On October 29, 2003, PanAmSat amended its bank facility to provide for the refinancing of its Tranche A

Term Loan and Tranche B Term Loan under a new Term Loan B-1 facility with an interest rate of LIBOR plus

2.5% and scheduled annual maturities of principal in varying amounts from 2004 through 2010. As a result of

this amendment, the amount of the revolving credit facility, its termination date and the provisions relating to the

commitment fee remain unchanged. This amendment also adjusted certain operating covenants under the bank

facility to provide greater operational flexibility to PanAmSat. On December 29, 2003, PanAmSat made an

optional prepayment under the Term Loan B-1 of $300.0 million from available cash on hand. As of December

31, 2003, the outstanding amount under the Term Loan B-1 facility was $350.0 million and the revolving credit

facility was undrawn.

On October 1, 2001, we entered into a $2.0 billion revolving credit facility with General Motors Acceptance

Corporation, or GMAC. The facility was subsequently amended in February and November 2002, and March

2003. The amendments reduced the size of the facility to $1,500.0 million and provided for a commitment

through March 31, 2004. On June 18, 2003, we voluntarily prepaid amounts owed thereunder and terminated the

facility. The facility was comprised of a $1,500.0 million tranche secured by a $1,500.0 million cash deposit

from us. Borrowings under the facility bore interest at GMAC’s cost of funds plus 0.125%, and the $1,500.0

million cash deposit earned interest at a rate equivalent to GMAC’s cost of funds. We had the legal right of setoff

with respect to the $1,500.0 million GMAC cash deposit and accordingly offset it against amounts borrowed

from GMAC under the $1,500.0 million tranche in the Consolidated Balance Sheets.

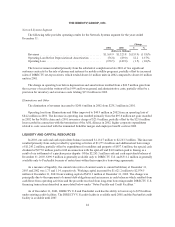

Covenants and Restrictions

DIRECTV U.S. and PanAmSat are required to meet certain financial covenants and are also subject to

restrictive covenants under their borrowings. These covenants limit the ability of DIRECTV U.S., PanAmSat and

their respective subsidiaries to, among other things: incur or guarantee additional indebtedness; make restricted

payments, including dividends; create or permit to exist certain liens; enter into business combinations and asset

sale transactions; make investments; enter into transactions with affiliates; and enter into new businesses. If

DIRECTV U.S. or PanAmSat fails to comply with their respective covenants, all or a portion of their respective

borrowings could become immediately payable. The terms of the DIRECTV U.S. and PanAmSat debt and credit

facilities restrict DIRECTV U.S. and PanAmSat from transferring funds to us in the form of cash dividends,

loans or advances. At December 31, 2003, DIRECTV U.S. and PanAmSat were in compliance with all such

covenants.

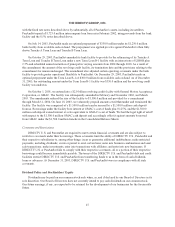

Dividend Policy and Stockholders’ Equity

Dividends may be paid on our common stock only when, as, and if declared by our Board of Directors in its

sole discretion. Our Board of Directors does not currently intend to pay cash dividends on our common stock.

Our future earnings, if any, are expected to be retained for the development of our businesses for the foreseeable

future.

47