DIRECTV 2003 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

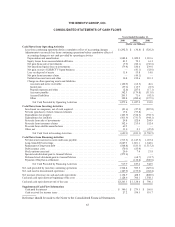

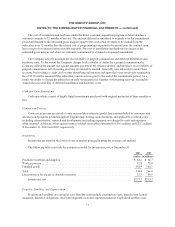

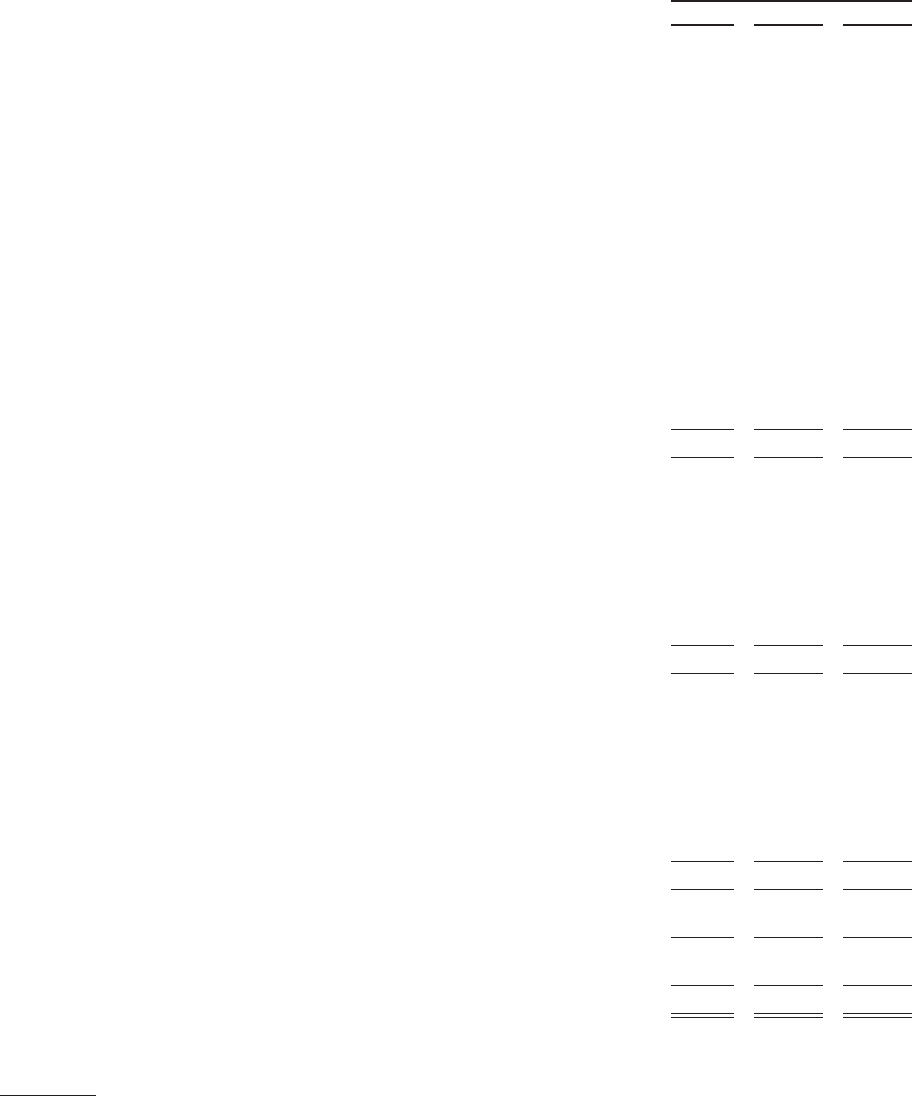

THE DIRECTV GROUP, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

Years Ended December 31,

2003 2002 2001

(Dollars in Millions)

Cash Flows from Operating Activities

Loss from continuing operations before cumulative effect of accounting changes ..... $ (292.5) $ (30.8) $ (520.2)

Adjustments to reconcile loss from continuing operations before cumulative effect of

accounting changes to net cash provided by operating activities

Depreciation and amortization ............................................ 1,082.8 1,020.2 1,110.6

Equity losses from unconsolidated affiliates ................................. 81.5 70.1 61.3

Net gain from sale of investments ......................................... (7.5) (84.1) (130.6)

Net unrealized (gain) loss on investments ................................... (79.4) 180.6 239.0

Net gain on exit of DIRECTV Japan business ............................... — (41.1) (32.0)

Loss on disposal of assets ............................................... 11.4 53.8 14.0

Net gain from insurance claim ............................................ — (40.1) —

Deferred income taxes and other .......................................... 10.8 212.6 110.3

Change in other operating assets and liabilities

Accounts and notes receivable ......................................... (140.5) (64.3) 46.6

Inventories ......................................................... (39.6) 113.9 (8.5)

Prepaid expenses and other ............................................ (2.0) 227.0 (17.1)

Accounts payable .................................................... 342.3 (179.8) (311.0)

Accrued liabilities ................................................... 205.3 71.6 (92.5)

Other ............................................................. 102.8 (282.6) (137.9)

Net Cash Provided by Operating Activities ............................. 1,275.4 1,227.0 332.0

Cash Flows from Investing Activities

Investment in companies, net of cash acquired ................................. (23.6) (27.0) (287.8)

Net sale (purchase) of short-term investments ................................. 17.4 (99.8) —

Expenditures for property ................................................. (443.9) (512.3) (758.7)

Expenditures for satellites ................................................. (413.9) (731.7) (944.1)

Proceeds from sale of investments .......................................... 29.8 322.4 204.9

Proceeds from insurance claims ............................................ 102.6 215.0 132.4

Proceeds from satellite manufacturer ........................................ 69.5 — —

Other, net .............................................................. 33.0 0.3 (47.2)

Net Cash Used in Investing Activities .................................. (629.1) (833.1) (1,700.5)

Cash Flows from Financing Activities

Net (decrease) increase in notes and loans payable .............................. (515.3) (1,147.3) 1,187.4

Long-term debt borrowings ................................................ 2,627.3 1,801.1 1,642.6

Repayment of long-term debt .............................................. (868.8) (183.3) (1,515.2)

Debt issuance costs ...................................................... (70.3) (85.4) —

Stock options exercised ................................................... 20.0 7.4 21.8

Special cash dividend paid to General Motors ................................. (275.0) — —

Preferred stock dividends paid to General Motors .............................. — (68.7) (93.7)

Payment of Raytheon settlement ............................................ — (134.2) (500.0)

Net Cash Provided by Financing Activities ............................. 917.9 189.6 742.9

Net cash provided by (used in) continuing operations ............................. 1,564.2 583.5 (625.6)

Net cash used in discontinued operations ....................................... (429.5) (155.0) (182.4)

Net increase (decrease) in cash and cash equivalents .............................. 1,134.7 428.5 (808.0)

Cash and cash equivalents at beginning of the year ............................... 1,128.6 700.1 1,508.1

Cash and cash equivalents at end of the year .................................... $2,263.3 $ 1,128.6 $ 700.1

Supplemental Cash Flow Information

Cash paid for interest ..................................................... $ 340.1 $ 279.5 $ 160.0

Cash received for income taxes ............................................. 27.2 354.5 310.7

Reference should be made to the Notes to the Consolidated Financial Statements.

65