DIRECTV 2003 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

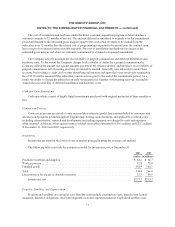

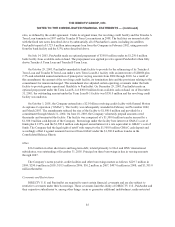

excluding the after-tax effect of amortization expense associated with goodwill and Orbital Slots for the years

ended December 31:

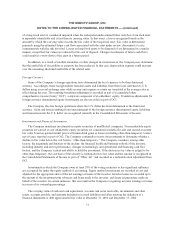

2003 2002 2001

(Dollars in Millions)

Reported net loss attributable to common stockholders ...................... $(361.8) $(940.7) $(718.0)

Add amortization of:

Goodwill ....................................................... — — 219.9

Orbital Slots .................................................... — — 7.2

Adjusted net loss attributable to common stockholders ....................... $(361.8) $(940.7) $(490.9)

Reported loss attributable to common stockholders before cumulative effect of

accountingchanges ................................................ $(297.2) $(259.4) $(710.6)

Add amortization of:

Goodwill ....................................................... — — 219.9

Orbital Slots .................................................... — — 7.2

Adjusted loss attributable to common stockholders before cumulative effect of

accountingchanges ................................................ $(297.2) $(259.4) $(483.5)

Basic and diluted loss per common share:

Reported basic and diluted loss per common share .......................... $ (0.26) $ (0.70) $ (0.55)

Add amortization of:

Goodwill ....................................................... — — 0.17

Orbital Slots .................................................... — — 0.01

Adjusted basic and diluted loss per common share .......................... $ (0.26) $ (0.70) $ (0.37)

Reported basic and diluted loss per common share before cumulative effect of

accountingchanges ................................................ $ (0.21) $ (0.19) $ (0.55)

Add amortization of:

Goodwill ....................................................... — — 0.17

Orbital Slots .................................................... — — 0.01

Adjusted basic and diluted loss per common share before cumulative effect of

accountingchanges ................................................ $ (0.21) $ (0.19) $ (0.37)

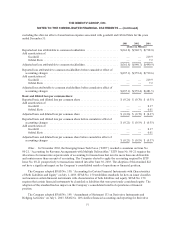

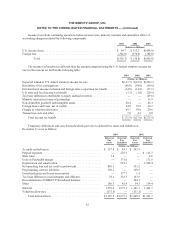

Other. In November 2002, the Emerging Issues Task Force (“EITF”) reached a consensus on Issue No.

00-21, “Accounting for Revenue Arrangements with Multiple Deliverables.” EITF Issue No. 00-21 requires the

allocation of revenues into separate units of accounting for transactions that involve more than one deliverable

and contain more than one unit of accounting. The Company elected to apply the accounting required by EITF

Issue No. 00-21 prospectively to transactions entered into after June 30, 2003. The adoption of this standard did

not have a significant impact on the Company’s consolidated results of operations or financial position.

The Company adopted SFAS No. 150, “Accounting for Certain Financial Instruments with Characteristics

of Both Liabilities and Equity” on July 1, 2003. SFAS No. 150 establishes standards for how an issuer classifies

and measures certain financial instruments with characteristics of both liabilities and equity. SFAS No. 150

requires that certain financial instruments be classified as liabilities that were previously considered equity. The

adoption of this standard had no impact on the Company’s consolidated results of operations or financial

position.

The Company adopted SFAS No. 149, “Amendment of Statement 133 on Derivative Instruments and

Hedging Activities” on July 1, 2003. SFAS No. 149 clarifies financial accounting and reporting for derivative

77