DIRECTV 2003 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

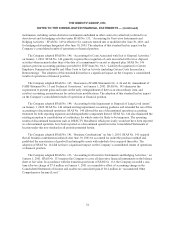

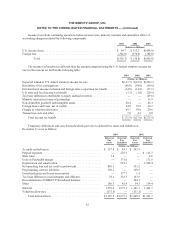

Amortization expense of intangible assets was $74.6 million and $18.5 million for the years ended

December 31, 2003 and 2002, respectively.

Estimated amortization expense for intangible assets in each of the next five years and thereafter is as

follows: $32.5 million in 2004; $10.5 million in 2005; $9.7 million in 2006; $9.2 million in 2007; $9.2 million in

2008; and $49.4 million thereafter.

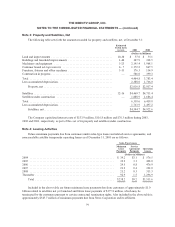

The increase in amortization expense for 2003 compared to 2002 is due to the reinstatement in the fourth

quarter of 2002 of subscriber base and dealer network intangible asset amortization at the Direct-To-Home

Broadcast segment as a result of the issuance of EITF Issue No. 02-17, “Recognition of Customer Relationship

Intangible Assets Acquired in a Business Combination.” Prior to the issuance of EITF No. 02-17 in October

2002, the Company had reclassified its subscriber base and dealer network intangible assets to goodwill as part of

the 2002 implementation of SFAS No. 142 and therefore no amortization expense was recorded in the first three

quarters of 2002 for these assets.

Note 6: Investments

Marketable Securities

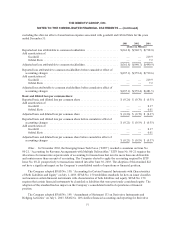

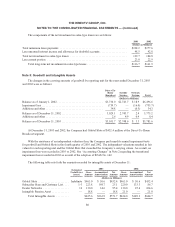

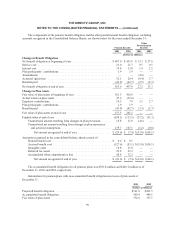

Investments in marketable equity and debt securities stated at current fair value and classified as available-

for-sale were as follows as of December 31:

2003 2002

(Dollars in Millions)

Marketable equity securities ............................................. $486.9 $ 73.7

Marketable debt securities ............................................... 147.5 209.9

Total ............................................................... 634.4 283.6

Less amount recorded in “Prepaid expenses and other” ........................ 211.3 99.8

Amount recorded in “Investments and other assets” .......................... $423.1 $183.8

At December 31, 2003, $273.9 million of accumulated unrealized gains, net of taxes, were recorded as part

of OCI. At December 31, 2002, $2.1 million of accumulated unrealized losses, net of taxes, were recorded as part

of OCI.

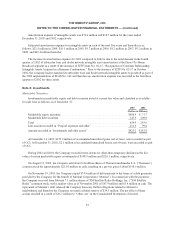

During 2002 and 2001, the Company recorded write-downs for other-than-temporary declines in the fair

value of certain marketable equity investments of $148.9 million and $226.1 million, respectively.

On August 21, 2002, the Company sold about 8.8 million shares of Thomson multimedia S.A. (“Thomson”)

common stock for approximately $211.0 million in cash, resulting in a pre-tax gain of about $158.6 million.

On November 19, 2001, the Company repaid $74.9 million of debt pursuant to the terms of a debt guarantee

provided by the Company for the benefit of Motient Corporation (“Motient”). In connection with the payment,

the Company received from Motient 7.1 million shares of XM Satellite Radio Holdings, Inc. (“XM Satellite

Radio”) common stock, with a market value as of November 2001 of $67.9 million and $3.6 million in cash. The

repayment of Motient’s debt released the Company from any further obligations related to Motient’s

indebtedness and therefore the Company reversed a related reserve of $39.5 million. The net effect of these

actions resulted in a credit of $36.1 million to “Other, net” in the Consolidated Statements of Income.

81