DIRECTV 2003 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

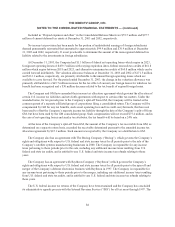

instruments, including certain derivative instruments embedded in other contracts (collectively referred to as

derivatives) and for hedging activities under SFAS No. 133, “Accounting for Derivative Instruments and

Hedging Activities.” SFAS No. 149 is effective for contracts entered into or modified after June 30, 2003, and

for hedging relationships designated after June 30, 2003. The adoption of this standard had no impact on the

Company’s consolidated results of operations or financial position.

The Company adopted SFAS No. 146, “Accounting for Costs Associated with Exit or Disposal Activities,”

on January 1, 2003. SFAS No. 146 generally requires the recognition of costs associated with exit or disposal

activities when incurred rather than at the date of a commitment to an exit or disposal plan. SFAS No. 146

replaces previous accounting guidance provided by EITF Issue No. 94-3, “Liability Recognition for Certain

Employee Termination Benefits and Other Costs to Exit an Activity (including Certain Costs Incurred in a

Restructuring).” The adoption of this standard did not have a significant impact on the Company’s consolidated

results of operations or financial position.

The Company adopted SFAS No. 145, “Rescission of FASB Statements No. 4, 44 and 64, Amendment of

FASB Statement No. 13 and Technical Corrections,” on January 1, 2003. SFAS No. 145 eliminates the

requirement to present gains and losses on the early extinguishment of debt as an extraordinary item, and

resolves accounting inconsistencies for certain lease modifications. The adoption of this standard had no impact

on the Company’s consolidated results of operations or financial position.

The Company adopted SFAS No. 144, “Accounting for the Impairment or Disposal of Long-Lived Assets”

on January 1, 2002. SFAS No. 144 refined existing impairment accounting guidance and extended the use of this

accounting to discontinued operations. SFAS No. 144 allowed the use of discontinued operations accounting

treatment for both reporting segments and distinguishable components thereof. SFAS No. 144 also eliminated the

existing exception to consolidation of a subsidiary for which control is likely to be temporary. The operating

results of discontinued businesses such as DIRECTV Broadband, which previously would not have been reported

as a discontinued operation, have been reported as a discontinued operation in the Consolidated Statements of

Income under this new standard in all periods presented herein.

The Company adopted SFAS No. 141, “Business Combinations” on July 1, 2001. SFAS No. 141 required

that all business combinations initiated after June 30, 2001 be accounted for under the purchase method and

prohibited the amortization of goodwill and intangible assets with indefinite lives acquired thereafter. The

adoption of SFAS No. 141 did not have a significant impact on the Company’s consolidated results of operations

or financial position.

The Company adopted SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities,” on

January 1, 2001. SFAS No. 133 requires the Company to carry all derivative financial instruments on the balance

sheet at fair value. In accordance with the transition provisions of SFAS No. 133, the Company recorded a one-

time after-tax charge of $7.4 million on January 1, 2001 as a cumulative effect of accounting change in the

Consolidated Statements of Income and an after-tax unrealized gain of $0.4 million in “Accumulated Other

Comprehensive Income (Loss).”

78