DIRECTV 2003 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

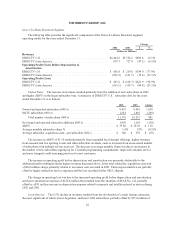

Cumulative Effect of Accounting Changes. As a result of our adoption of FIN 46, we began consolidating

the Venezuelan and Puerto Rican LOCs on July 1, 2003. The adoption of this standard resulted in an after-tax

charge of $64.6 million in the third quarter of 2003, which was recorded as a cumulative effect of accounting

change in the Consolidated Statements of Income. See “Accounting Changes” below for additional information.

We adopted Statement of Financial Accounting Standards, or SFAS, No. 142, “Goodwill and Other

Intangible Assets,” on January 1, 2002. The adoption of this standard resulted in the discontinuation of

amortization of goodwill and intangible assets with indefinite lives. In accordance with the transition provisions

of SFAS No. 142, on January 1, 2002, we recorded a one-time after-tax charge of $681.3 million related to the

initial impairment test as a cumulative effect of accounting change in the Consolidated Statements of Income.

See “Accounting Changes” below for additional information.

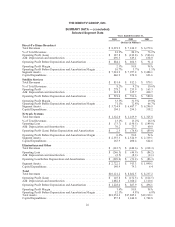

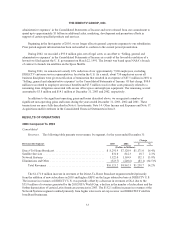

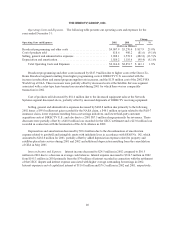

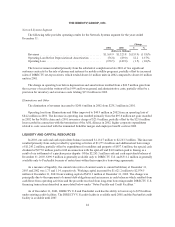

Direct-To-Home Broadcast Segment

The following table provides the significant components of the Direct-To-Home Broadcast segment

operating results for the years ended December 31:

Change

2003 2002 $ %

(Dollars in Millions)

Revenues

DIRECTVU.S.............................................. $7,695.6 $6,444.6 $1,251.0 19.4%

DIRECTV Latin America .................................... 597.7 679.7 (82.0) (12.1)%

Operating Profit (Loss) Before Depreciation & Amortization

DIRECTVU.S.............................................. $ 970.2 $ 608.8 $ 361.4 59.4%

DIRECTV Latin America .................................... (85.3) (201.9) 116.6 57.8%

Operating Profit (Loss)

DIRECTVU.S.............................................. $ 473.2 $ 203.2 $ 270.0 132.9%

DIRECTV Latin America .................................... (284.6) (415.1) 130.5 31.4%

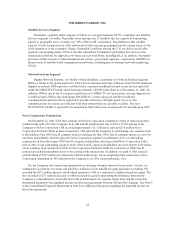

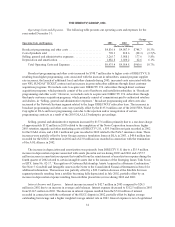

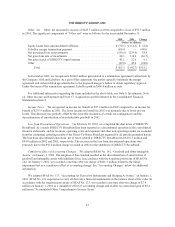

United States. The 19.4% increase in revenues resulted primarily from the addition of new subscribers in

2003 and higher ARPU on the larger subscriber base. A summary of DIRECTV U.S.’ subscriber data for the

years ended December 31 is as follows:

2003 2002 Change

Owned and operated subscribers (000’s) .............................. 10,680 9,493 1,187

NRTC subscribers (000’s) ......................................... 1,532 1,683 (151)

Total number of subscribers (000’s) ............................. 12,212 11,176 1,036

Net owned and operated subscriber additions (000’s) .................... 1,187 1,050 137

ARPU(1) ...................................................... $ 63.90 $ 59.80 $ 4.10

Average monthly subscriber churn %(2) .............................. 1.5% 1.6% (0.1)%

Average subscriber acquisition costs—per subscriber (SAC) .............. $ 595 $ 540 $ 55

(1) ARPU is calculated by dividing average monthly revenues for the period (total revenues during the period

divided by the number of months in the period) by average DIRECTV U.S. owned and operated subscribers

for the period, which excludes subscribers who receive DIRECTV service from members and affiliates of

the NRTC.

(2) Average monthly subscriber churn represents the number of DIRECTV U.S. subscribers whose service is

disconnected, expressed as a percentage of the average total number of DIRECTV U.S. subscribers. It is

calculated by dividing the average monthly number of disconnected DIRECTV U.S. owned and operated

subscribers for the period (total subscribers disconnected during the period divided by the number of months

in the period) by average DIRECTV U.S. owned and operated subscribers for the period.

36