DIRECTV 2003 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

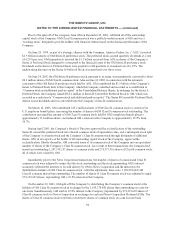

consisted of a 3.98% ownership interest in DLA and a put option that under certain circumstances would have

allowed Clarin to sell its 3.98% interest back to DLA in November 2003 for $195 million (see further discussion

of this item in Note 16). As a result of the transaction, the Company’s interest in DLA decreased from 77.8% to

74.7% and the Company’s ownership in GEA increased from 20% to 58.1%. The Company’s portion of the

purchase price, which amounted to about $130 million, was recorded as an increase to “Common stock and

additional paid-in capital” in the Consolidated Balance Sheets.

The financial information included herein reflects the operations of GEA discussed above from its date of

acquisition. The acquisition was accounted for by the purchase method of accounting and, accordingly, the

purchase price has been allocated to the assets acquired and the liabilities assumed based on their estimated fair

values at the date of acquisition.

DIRECTV Japan

On March 1, 2000, the Company announced that the operations of DIRECTV Japan would be discontinued.

Pursuant to an agreement with Japan Digital Broadcasting Services Inc. (now named Sky Perfect), qualified

subscribers to the DIRECTV Japan service were offered the opportunity to migrate to the Sky Perfect service.

DIRECTV Japan was paid a commission for each subscriber who actually migrated. The Company also acquired

a 6.6% interest in Sky Perfect. As a result, the Company wrote-off its net investment in DIRECTV Japan of

$164.6 million and accrued exit costs of $403.7 million and involuntary termination benefits of $14.5 million.

The write-off and accrual were partially offset by the difference between the cost of the Sky Perfect shares

acquired and the estimated fair value of the shares ($428.8 million), as determined by an independent appraisal,

and by $40.2 million for anticipated contributions from other DIRECTV Japan stockholders. The net effect of the

transaction was a charge to “Other, net” in the Consolidated Statements of Income of $170.6 million at March 31,

2000.

In the fourth quarter of 2000, $106.6 million of accrued exit costs were reversed and $0.6 million of

involuntary termination benefits were added, resulting in a net credit adjustment to “Other, net” in the

Consolidated Statements of Income of $106.0 million. In the third quarter of 2001, $32.0 million of accrued exit

costs were reversed as a credit adjustment to “Other, net.” The third quarter of 2001 and fourth quarter of 2000

adjustments made to the exit cost accrual were primarily attributable to earlier than anticipated cessation of the

DIRECTV Japan broadcasting service, greater than anticipated commission payments for subscriber migration

and favorable settlements of various contracts and claims. During 2002, $41.1 million of accrued liabilities

related to the exit costs were reversed upon the resolution of the remaining claims, resulting in a credit

adjustment to “Other, net” in the Consolidated Statements of Income.

In the fourth quarter of 2000, Sky Perfect completed an initial public offering, at which date the fair value of

the Company’s interest (diluted by the public offering to approximately 5.3%) in Sky Perfect was approximately

$343 million. In the third quarter of 2001 and fourth quarter of 2000, a portion of the decline in the value of the

Sky Perfect investment was determined to be “other-than-temporary,” resulting in a write-down of the carrying

value of the investment by $212 million and $86 million, respectively. At December 31, 2001, the investment’s

market value approximated its carrying value. In October 2002, the Company sold all of its interest in Sky

Perfect for approximately $105 million in cash, resulting in a pre-tax loss of about $24.5 million.

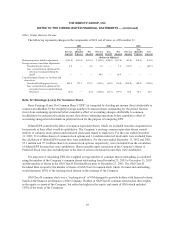

Note 18: Derivative Financial Instruments and Risk Management

The Company’s cash flows and earnings are subject to fluctuations resulting from changes in foreign

currency exchange rates, interest rates and changes in the market value of its equity investments. The Company

manages its exposure to these market risks through internally established policies and procedures and, when

102