DIRECTV 2003 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

deemed appropriate, through the use of derivative financial instruments. The Company enters into derivative

instruments only to the extent considered necessary to meet its risk management objectives, and does not enter

into derivative contracts for speculative purposes.

The Company generally conducts its business in U.S. dollars with some business conducted in a variety of

foreign currencies and therefore is exposed to fluctuations in foreign currency exchange rates. The Company’s

objective in managing its exposure to foreign currency changes is to reduce earnings and cash flow volatility

associated with foreign exchange rate fluctuations. Accordingly, the Company enters into foreign exchange

contracts to mitigate risks associated with foreign currency denominated assets, liabilities, commitments and

anticipated foreign currency transactions. By policy, the Company maintains coverage between minimum and

maximum percentages of its anticipated foreign exchange exposures. The gains and losses on derivative foreign

exchange contracts offset changes in value of the related exposures.

The Company is exposed to interest rate changes from its outstanding fixed rate and floating rate

borrowings. The Company manages its fixed to floating rate debt mix to mitigate the impact of adverse changes

in interest rates on earnings and cash flows and on the market value of its borrowings. In accordance with policy,

from time to time the Company may enter into interest rate hedging contracts which effectively convert floating

rate borrowings to fixed rate borrowings, or fixed rate borrowings to floating rate borrowings.

The Company is exposed to credit risk in the event of non-performance by the counterparties to its

derivative financial instrument contracts. While the Company believes this risk is remote, credit risk is managed

through the periodic monitoring and approval of financially sound counterparties.

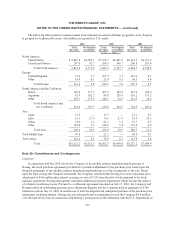

Note 19: Segment Reporting

The Company’s segments, which are differentiated by their products and services, include Direct-To-Home

Broadcast, Satellite Services and Network Systems. Direct-To-Home Broadcast is engaged in acquiring,

promoting, selling and/or distributing digital entertainment programming via satellite to residential and

commercial customers. Satellite Services is engaged in the selling, leasing and operating of satellite transponders

and providing services for cable television systems, news companies, Internet service providers and private

business networks. The Network Systems segment is a provider of satellite-based private business networks and

broadband Internet access, and a supplier of DIRECTV receiving equipment (set-top receivers and dishes). Other

includes the corporate office and other entities.

Beginning in 2003, the Company no longer allocates general corporate expenses to its subsidiaries. Prior

period segment information has been reclassified to conform to the current period presentation.

103