DIRECTV 2003 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

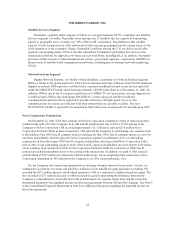

DLA LLC Reorganization

On March 18, 2003, DLA LLC filed a voluntary petition for reorganization under Chapter 11 of the U.S.

Bankruptcy Code in the Bankruptcy Court. The filing did not include any of the LOCs providing the DIRECTV

service in Latin America and the Caribbean. During the bankruptcy proceedings, DLA LLC continued to manage

its business as a debtor-in-possession.

On December 11, 2003, DLA LLC filed a proposed Reorganization Plan that reflected an agreement

reached between DLA LLC, its owners and unsecured creditors. On February 13, 2004, the Bankruptcy Court

confirmed DLA LLC’s Reorganization Plan, which became effective on February 24, 2004. The Bankruptcy

Court has retained jurisdiction to resolve certain remaining matters primarily related to the enforcement and

interpretation of the Reorganization Plan. However, it is anticipated that resolution of these matters will not have

a material impact on DLA LLC’s operations.

While the bankruptcy was proceeding, we provided DLA LLC with a $300 million senior secured debtor-in-

possession financing facility. The facility was fully drawn and converted, in accordance with the Reorganization

Plan, into an equity interest in DLA LLC on February 24, 2004. As part of the Reorganization Plan, we also

agreed to provide “exit” financing, consisting of a revolving credit facility of up to $200 million, decreasing from

time to time based on a schedule in the revolving credit facility agreement. The revolving credit facility expires

on February 27, 2009 and borrowings bear interest at a variable rate, calculated as the base rate (as defined in the

revolving credit facility agreement) plus 6%, not to exceed the greater of 12% or the Company’s cost of funds.

The Reorganization Plan and/or contribution agreement between the Company and Darlene, or the

Contribution Agreement, provided for the contribution by the Company of our claims against DLA LLC of

approximately $1.4 billion, to the extent not previously discharged in the Chapter 11 proceedings, as well as the

contribution of approximately $530 million in intercompany loans made by the Company to SurFin Ltd. and its

subsidiaries, or SurFin, our 75% owned financing affiliate of DLA LLC. Also, in accordance with the

Reorganization Plan and/or Contribution Agreement, we contributed to DLA LLC our equity and other interests

in SurFin and in the various LOCs. In exchange for these contributions, the discharges and waivers of our claims

and the conversion into equity of the $300 million senior secured debt-in-possession financing facility, our equity

interest in the restructured DLA LLC increased from 74.7% to approximately 85.9% pursuant to the

Reorganization Plan and/or the Contribution Agreement. Darlene, which also contributed its equity and other

interests in SurFin and the various affiliated operating entities, holds the remaining approximately 14.1% equity

interest in the restructured DLA LLC pursuant to the Reorganization Plan and/or the Contribution Agreement.

The restructuring in bankruptcy and the contributions by the Company and Darlene provided DLA LLC with

direct control of SurFin and DLA’s most significant LOCs and assets.

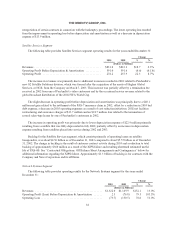

Reorganization expense of $212.3 million reported in our Consolidated Statements of Income includes the

costs incurred to file the bankruptcy petition, ongoing related legal and consulting costs, costs related to

settlement agreements reached with creditors, the write-off of intangible assets and other charges related to the

reorganization. Also included in reorganization expense are accruals for any claims allowed in the Chapter 11

proceeding for amounts not previously recognized as liabilities subject to compromise. Cash payments of

$27.8 million and $137.7 million were made during December 2003 and February 2004, respectively. DLA LLC

will record a gain of approximately $50 million during the first quarter of 2004 as a result of the settlement of

certain obligations in connection with the confirmation of the Reorganization Plan.

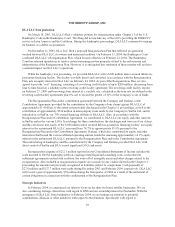

Strategic Initiatives

In February 2004, we announced our intent to focus on the direct-to-home satellite businesses. We are

also considering strategic alternatives with regard to HNS and our ownership interest in PanAmSat. With the

emergence of DLA LLC from bankruptcy in February 2004, we are turning our attention to potential

combinations, alliances or other initiatives with respect to that business. Specifically with regard to

29