DIRECTV 2003 Annual Report Download - page 39

Download and view the complete annual report

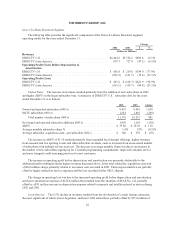

Please find page 39 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

DIRECTV service to its NFL SUNDAY TICKET subscribers, including games broadcast in HDTV and the NFL

CHANNEL™. In 2003, DIRECTV U.S. increased the price charged for the NFL SUNDAY TICKET package in

order to cover the increased costs under the new agreement.

On July 1, 2003, as more fully discussed in “Accounting Changes” below, DLA began consolidating the

Venezuelan and Puerto Rican LOCs with the adoption of Financial Accounting Standards Board, or FASB,

Interpretation No. 46 (revised December 2003), “Consolidation of Variable Interest Entities—an interpretation of

ARB No. 51,” or FIN 46. Prior to July 1, 2003, DLA accounted for its investments in the Venezuelan and Puerto

Rican LOCs under the equity method of accounting and reflected approximately 75.0% of their net income or

loss in “Other, net” in the Consolidated Statements of Income. In addition, in May 2001, due to the acquisition of

a majority interest of Galaxy Entertainment Argentina S.A., or GEA, DLA began consolidating the results of

GEA. Previously, DLA’s interest in GEA was accounted for under the equity method.

Also in 2001, DLA secured a contract for the exclusive rights to broadcast and re-sell the FIFA World Cup

soccer tournaments occurring in Argentina, Chile, Colombia, Mexico, Uruguay and Venezuela in 2002 and 2006.

The cost of the 2002 rights of $135.0 million was charged to operations in 2002 when the live events were

broadcast. DLA was unable to recover the entire cost of the programming, resulting in an $80.0 million loss on

the contract in 2002. The 2006 contract was rejected in conjunction with DLA LLC’s bankruptcy and

renegotiated under substantially different terms.

DLA’s 2003 and 2002 operating results have been adversely affected by the economic and political

instability throughout Latin America. In particular, revenues and operating profit have been significantly affected

by a loss in net subscribers and the ongoing depreciation of certain local currencies.

Satellite Services Segment

In June and July 2003, two of PanAmSat’s satellites experienced secondary XIPS failures. As a result of

these failures, PanAmSat reduced the estimated useful lives of these satellites during the third quarter of 2003

resulting in $14.3 million of additional depreciation expense in the second half of 2003. See “Contractual

Obligations, Off Balance Sheet Arrangements and Contingencies” below for further information regarding the

XIPS failures and related insurance claim.

In October 2001, PanAmSat filed a proof of loss under an insurance policy on PAS-7 related to circuit

failures, which occurred in September 2001 and resulted in a reduction of 28.9% of the satellite’s total power

available for communications. During 2002, PanAmSat’s insurers settled the claim by payment to PanAmSat of

$215.0 million. PanAmSat recorded a net gain of approximately $40.1 million related to this insurance claim in

2002.

Other

During December 2003, upon completion of the News Corporation transactions discussed above, the

Company expensed related costs of about $132 million that primarily included investment advisor fees of about

$49 million, retention benefits of about $65 million and severance benefits of about $15 million to “Selling,

general and administrative expenses” in the Consolidated Statements of Income. In addition, certain employees

of the Company are expected to earn about $36 million in additional retention benefits during the 12 month

period subsequent to the completion of the transactions.

During the first quarter of 2003, the Company and America Online, Inc., or AOL, agreed to terminate the

strategic alliance, which the companies had entered into in June 1999. In connection with the termination of the

alliance, we recorded a charge of $23.0 million in the fourth quarter of 2002 to “Selling, general and

32