DIRECTV 2003 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

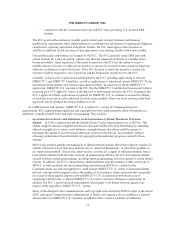

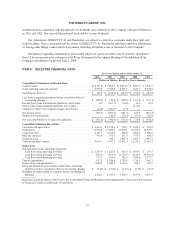

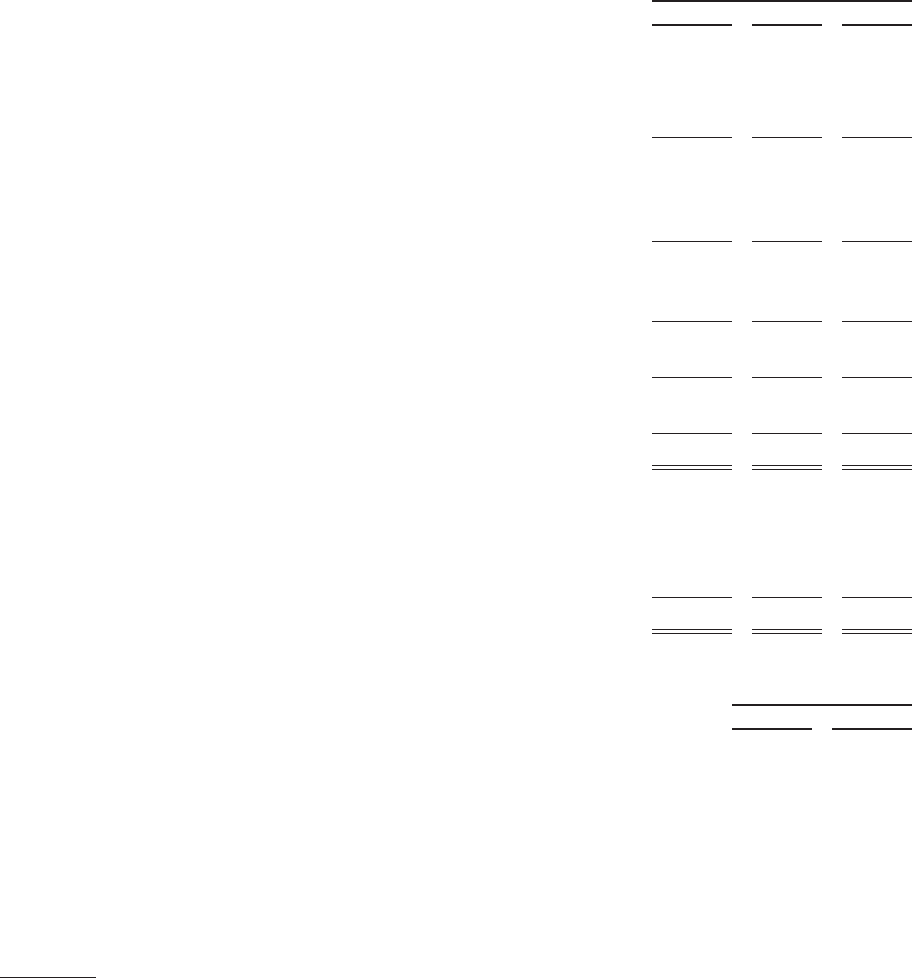

THE DIRECTV GROUP, INC.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

SUMMARY DATA

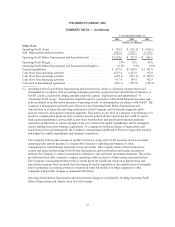

Years Ended December 31,

2003 2002 2001

(Dollars in Millions, Except Per

Share Amounts)

Consolidated Statements of Income Data:

Totalrevenues ................................................... $10,121.2 $8,862.5 $8,237.2

Total operating costs and expenses ................................... 9,975.4 9,014.8 8,851.7

Operating profit (loss) ............................................. 145.8 (152.3) (614.5)

Other income (expenses), net ....................................... (482.1) 115.5 (231.5)

Income tax benefit ................................................ 71.9 27.6 275.9

Minority interests in net (earnings) losses of subsidiaries ................. (28.1) (21.6) 49.9

Loss from continuing operations before cumulative effect of accounting

changes ...................................................... (292.5) (30.8) (520.2)

Loss from discontinued operations, net of taxes ......................... (4.7) (181.7) (94.0)

Loss before cumulative effect of accounting changes .................... (297.2) (212.5) (614.2)

Cumulative effect of accounting changes, net of taxes .................... (64.6) (681.3) (7.4)

Netloss ........................................................ (361.8) (893.8) (621.6)

Preferred stock dividends .......................................... — (46.9) (96.4)

Net Loss Attributable to Common Stockholders ........................ $ (361.8) $ (940.7) $ (718.0)

Basic and Diluted Loss Per Common Share:

Loss from continuing operations before cumulative effect of accounting

changes ...................................................... $ (0.21) $ (0.06) $ (0.47)

Loss from discontinued operations, net of taxes ......................... — (0.13) (0.07)

Cumulative effect of accounting changes, net of taxes .................... (0.05) (0.51) (0.01)

LossPerCommonShare ........................................... $ (0.26) $ (0.70) $ (0.55)

Weighted average number of common shares outstanding (in millions) ...... 1,382.5 1,343.1 1,300.0

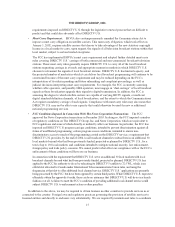

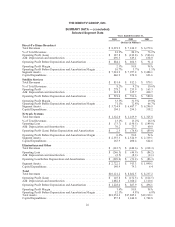

December 31,

2003 2002

(Dollars in Millions)

Consolidated Balance Sheet Data:

Cash and cash equivalents .................................................. $ 2,263.3 $ 1,128.6

Total current assets ....................................................... 4,934.9 3,656.4

Total assets ............................................................. 18,954.2 17,885.1

Total current liabilities .................................................... 2,860.4 3,203.1

Long-term debt .......................................................... 4,131.3 2,390.0

Minority interests ........................................................ 592.4 555.3

Convertible preferred stock ................................................. — 914.1

Total stockholders’ equity .................................................. 9,631.1 9,977.1

Reference should be made to the Notes to the Consolidated Financial Statements.

24