DIRECTV 2003 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2003 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (continued)

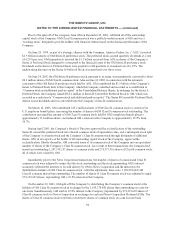

with the Reorganization Plan and/or the Contribution Agreement, the Company contributed to DLA LLC its

equity and other interests in SurFin and in the various LOCs. In exchange for these contributions, the discharges

and waivers of the Company’s claims and the conversion into equity of the $300 million senior secured debtor-

in-possession financing facility, the Company’s equity interest in the restructured DLA LLC increased from

74.7% to approximately 85.9% pursuant to the Reorganization Plan and/or the Contribution Agreement. Darlene

Investments, LLC (“Darlene”), which also contributed its equity and other interests in SurFin and the various

affiliated operating entities, holds the remaining approximately 14.1% equity interest in the restructured DLA

LLC pursuant to the Reorganization Plan and/or the Contribution Agreement. The restructuring in bankruptcy

and the contributions by the Company and Darlene provided DLA LLC with direct control of SurFin and DLA’s

most significant LOCs and assets.

Claims that had been asserted by Grupo Clarín S.A. (“Clarin”) and Raven Media (“Raven”), an affiliate of

Clarin, in the bankruptcy proceeding that DLA LLC was contractually obligated to repurchase Raven’s 3.98%

interest in DLA LLC for $195 million were also resolved. Under the terms of a settlement agreement executed

among the Company, DLA LLC, Clarin and Raven, the Company paid $45 million to purchase Raven’s claim in

the bankruptcy case; for a release from Raven of the Company, DLA LLC and others from any and all other

claims related to Raven’s equity interest; for a release of claims by Clarin and its affiliates; and for certain

concessions and other adjustments to certain contractual arrangements with DLA LLC and its affiliates. The

Company has agreed to pay an additional $11 million to Clarin contingent upon execution of certain contracts in

exchange for concessions in those contracts and certain additional rights of approximately equivalent value.

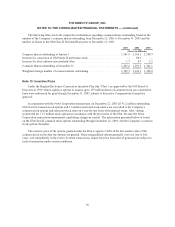

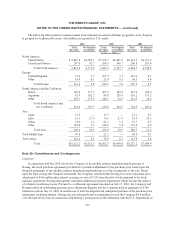

As of December 31, 2003, DLA LLC had approximately $784.8 million in assets, consisting principally of

accounts receivable of $728.7 million principally from LOCs, net fixed assets of $40.4 million and cash of $4.4

million. Liabilities subject to compromise are DLA LLC’s unsecured liabilities incurred prior to the filing for

reorganization under Chapter 11 of the Bankruptcy Code. As of December 31, 2003, DLA LLC liabilities subject

to compromise totaled $1.6 billion, which includes $1.4 billion of unsecured debt obligations owed to the

Company.

The Company’s Consolidated Balance Sheet as of December 31, 2003 includes liabilities subject to

compromise of DLA LLC of approximately $206.7 million.

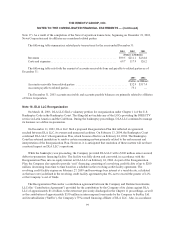

Reorganization expense of $212.3 million reported in the Company’s Consolidated Statements of Income

includes the costs incurred to file the bankruptcy petition, ongoing related legal and consulting costs, costs

related to settlement agreements reached with creditors, the write-off of intangible assets and other charges

related to the reorganization. Also included in reorganization expense are accruals for any claims allowed in the

Chapter 11 proceeding for amounts not previously recognized as liabilities subject to compromise. Cash

payments of $27.8 million and $137.7 million were made during December 2003 and February 2004,

respectively. DLA LLC will record a gain of approximately $50 million during the first quarter of 2004 as a

result of the settlement of certain obligations in connection with the confirmation of the Reorganization Plan.

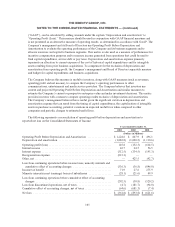

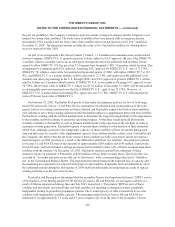

Note 17: Acquisitions and Divestitures

DIRECTV Broadband

On April 3, 2001, the Company acquired Telocity Delaware, Inc. (“Telocity”), a company that provided

land-based DSL services, through the completion of a tender offer and merger. Telocity changed its name to and

was operated as DIRECTV Broadband and was included as part of the Direct-To-Home Broadcast segment. The

purchase price was $197.8 million and was paid in cash.

On December 13, 2002, the Company announced that DIRECTV Broadband would close its high-speed

Internet service business in the first quarter of 2003 and transition its existing customers to alternative service

100