Clearwire 2008 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.o

f

t

h

e

l

ease,

i

nc

l

u

di

ng t

h

e expecte

d

renewa

l

per

i

o

d

s as appropr

i

ate. For

l

eases conta

i

n

i

ng tenant

i

mprovemen

t

a

ll

owances an

d

rent

i

ncent

i

ves, we recor

dd

e

f

erre

d

rent, w

hi

c

hi

sa

li

a

bili

ty, an

d

t

h

at

d

e

f

erre

d

rent

i

s amort

i

ze

d

over

t

he term of the lease, includin

g

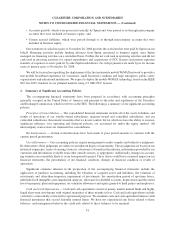

the expected renewal periods as appropriate, as a reduction to rent expense.

F

oreign

C

urrenc

y

— Our

i

nternat

i

ona

l

su

b

s

idi

ar

i

es

g

enera

lly

use t

h

e

i

r

l

oca

l

currenc

y

as t

h

e

i

r

f

unct

i

ona

l

c

urrenc

y

. Assets and liabilities are translated at exchan

g

e rates in effect at the balance sheet date. Resultin

g

translation adjustments are recorded within accumulated other comprehensive income (loss). Income and expense

accounts are trans

l

ate

d

at t

h

e average mont

hl

yexc

h

ange rates. T

h

ee

ff

ects o

f

c

h

anges

i

nexc

h

ange rates

b

etween t

h

e

desi

g

nated functional currenc

y

and the currenc

y

in which a transaction is denominated are recorded as forei

g

n

c

urrency transact

i

on ga

i

ns (

l

osses) an

d

recor

d

e

di

nt

h

e conso

lid

ate

d

statement o

f

operat

i

ons.

C

oncentration of Ris

k

—We

b

e

li

eve t

h

at t

h

e

g

eo

g

rap

hi

c

di

vers

i

t

y

o

f

our customer

b

ase an

d

reta

il

nature o

f

our

product minimizes the risk of incurring material losses due to concentrations of credit risk

.

R

ecent Accounting Pronouncement

s

SFAS No.

141(

R

)

—

In December 2007, the FASB issued SFAS No. 141 (revised 2007)

,

Business

C

ombi-

nat

i

ons

,

w

hi

c

h

we re

f

er to as SFAS No. 141

(

R

)

. In SFAS No. 141

(

R

)

,t

h

e FASB reta

i

ne

d

t

h

e

f

un

d

amenta

l

requ

i

rements o

f

SFAS No. 141 to account

f

or a

ll b

us

i

ness com

bi

nat

i

ons us

i

n

g

t

h

e acqu

i

s

i

t

i

on met

h

o

d

(

f

ormer

ly

t

h

e

purc

h

ase met

h

o

d

)an

df

or an acqu

i

r

i

n

g

ent

i

t

y

to

b

e

id

ent

ifi

e

di

na

ll b

us

i

ness com

bi

nat

i

ons. T

h

e new stan

d

ar

d

requires the acquiring entity in a business combination to recognize all (and only) the assets acquired and liabilities

assume

di

nt

h

e Transact

i

ons; esta

bli

s

h

es t

h

e acqu

i

s

i

t

i

on-

d

ate

f

a

i

rva

l

ue as t

h

e measurement o

bj

ect

i

ve

f

or a

ll

assets

ac

q

u

i

re

d

an

dli

a

bili

t

i

es assume

d

;re

q

u

i

res transact

i

on costs to

b

eex

p

ense

d

as

i

ncurre

d

;an

d

re

q

u

i

res t

h

eac

q

u

i

rer to

d

isclose to investors and other users all of the information the

y

need to evaluate and understand the nature an

d

fi

nanc

i

a

l

e

ff

ect o

f

t

h

e

b

us

i

ness com

bi

nat

i

on. SFAS No. 141(R)

i

se

ff

ect

i

ve

f

or annua

l

per

i

o

d

s

b

eg

i

nn

i

ng on or a

f

te

r

D

ecember 1

5

, 2008. Accordin

g

l

y

,an

y

business combinations we en

g

a

g

e in will be recorded and disclose

d

followin

g

existin

gg

enerall

y

accepted accountin

g

principles, which we refer to as GAAP, until Januar

y

1, 2009. W

e

e

xpect SFAS No. 141(R) w

ill h

ave an

i

mpact on our

fi

nanc

i

a

l

pos

i

t

i

on an

d

resu

l

ts o

f

operat

i

ons w

h

en e

ff

ect

i

ve,

b

u

t

the nature and ma

g

nitude of the specific effects will depend upon the nature, terms and size of the acquisitions we

c

onsummate after the effective date.

SFAS No. 1

6

0

—

In December 2007

,

the FASB issued SFAS No. 1

6

0

,

Noncontro

ll

ing Interests in Conso

l

i

d

ate

d

F

inancial

S

tatement

s

,

which we refer to as SFAS No. 160. SFAS No. 160 amends Accountin

g

Researc

h

B

ulletin No. 51

,

C

onso

l

i

d

ate

d

Financia

l

Statements,an

d

requ

i

res a

ll

ent

i

t

i

es to report non-contro

lli

ng (m

i

nor

i

ty

)

i

nterests

i

nsu

b

s

idi

ar

i

es w

i

t

hi

n equ

i

ty

i

nt

h

e conso

lid

ate

dfi

nanc

i

a

l

statements,

b

ut separate

f

rom t

h

e paren

t

shareholders’ equit

y

. SFAS No. 160 also requires an

y

acquisitions or dispositions of non-controllin

g

interests that

d

o not result in a change of control to be accounted for as equity transactions. Further, SFAS No. 160 requires that a

parent recognize a gain or loss in net income when a subsidiary is deconsolidated. SFAS No. 1

6

0 is effective for

a

nnual periods be

g

innin

g

on or after December 1

5

, 2008. We will adopt SFAS No. 160 on Januar

y

1, 2009 as w

e

h

ave significant non-controlling interests. In our statements of operations as currently presented, we subtract losse

s

a

ttributable to non-controlling interests before arriving at net loss. SFAS No. 160 will require us to include amounts

a

ttr

ib

uta

bl

eto

b

ot

h

our

i

nterests an

d

our non-contro

lli

n

gi

nterests w

i

t

hi

n net

l

oss an

d

to present our non-contro

lli

n

g

i

nterests as a component of stockholders’ equity.

S

FA

S

No. 1

61

— In March 2008, the FASB issued SFAS No. 1

6

1

,

Disclosures about Deri

v

ati

v

e Instruments

a

nd Hed

g

in

g

Activities,

w

hich we refer to as SFAS No. 161. SFAS No. 161 is intended to im

p

rove financia

l

report

i

ng a

b

out

d

er

i

vat

i

ve

i

nstruments an

dh

e

d

g

i

ng act

i

v

i

t

i

es

b

y requ

i

r

i

ng en

h

ance

ddi

sc

l

osures to ena

bl

e

i

nvestor

s

to

b

etter un

d

erstan

d

t

h

e

i

re

ff

ects on an ent

i

t

y

’s

fi

nanc

i

a

l

pos

i

t

i

on,

fi

nanc

i

a

l

per

f

ormance, an

d

cas

hfl

ows. It

is

e

ffective for financial statements issued for fiscal

y

ears and interim periods be

g

innin

g

after November 1

5

, 2008. W

e

d

o not expect the adoption of SFAS No. 161 will have a material effect on our financial statement disclosures.

87

C

LEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)