Clearwire 2008 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

m

arg

i

n

i

ncreases w

ill b

e paya

bl

e

i

n cas

h

or paya

bl

e

i

n

ki

n

db

y cap

i

ta

li

z

i

ng t

h

ea

ddi

t

i

ona

li

nterest an

d

a

ddi

ng

i

ttot

he

outstan

di

ng pr

i

nc

i

pa

l

amount o

f

t

h

e Sen

i

or Term Loan Fac

ili

ty. On t

h

e secon

d

ann

i

versary o

f

t

h

eC

l

os

i

ng, t

h

e

applicable mar

g

in rate will increase to 14.00% per annum for LIBOR-based loans and for alternate base rate loans

th

e app

li

ca

bl

e marg

i

n rate w

ill i

ncrease to 13.00% per annum. Interest

i

s paya

bl

e quarter

l

yw

i

t

h

respect to a

l

ternate

b

ase rate

l

oans, an

d

w

i

t

h

respect to LIBOR-

b

ase

dl

oans,

i

nterest

i

s paya

bl

e

i

n arrears at t

h

een

d

o

f

eac

h

app

li

ca

bl

e

p

eriod, but at least ever

y

three months. In addition, on the second anniversar

y

of the Closin

g

, we are required to pa

y

an amount equal to 4.00% of the outstanding principal balance of the Senior Term Loan Facility. This fee will b

e

p

a

id i

n

ki

n

dby

cap

i

ta

li

z

i

n

g

t

h

e amount o

f

t

h

e

f

ee an

d

a

ddi

n

gi

ttot

h

e outstan

di

n

g

pr

i

nc

i

pa

l

amount o

f

t

h

e Sen

i

or

Term Loan Fac

ili

t

y

.T

h

e current we

igh

te

d

avera

g

e

i

nterest rate on our Sen

i

or Term Loan Fac

ili

t

y

was 8.8% a

t

D

ecember 31

,

2008

.

As of December 31, 2008, $1.41 billion in a

gg

re

g

ate principal amount was outstandin

g

under the Senior Ter

m

Loan Facility, with a carrying value and an approximate fair market value of

$

1.36 billion.

T

he Senior Term Loan Facilit

y

contains financial, affirmative and ne

g

ative covenants that we believe are usua

l

an

d

customary

f

or a sen

i

or secure

d

cre

di

t agreement. T

h

e negat

i

ve covenants

i

nt

h

e Sen

i

or Term Loan Fac

ili

ty

i

nclude, amon

g

other thin

g

s, limitations on our abilit

y

to: declare dividends and make other distributions, redeem or

r

epurchase our capital stock, prepa

y

, redeem or repurchase indebtedness, make loans or investments (includin

g

acqu

i

s

i

t

i

ons),

i

ncur a

ddi

t

i

ona

li

n

d

e

b

te

d

ness, enter

i

nto new

li

nes o

fb

us

i

ness, an

d

se

ll

our assets. T

h

e Sen

i

or Ter

m

Loan Fac

ili

t

yi

s secure

dby

a

bl

an

k

et

li

en on su

b

stant

i

a

lly

a

ll

o

f

our

d

omest

i

c assets,

i

nc

l

u

di

n

g

ap

l

e

dg

eo

f

a

ll

o

f

our

d

omest

i

can

di

nternat

i

ona

l

owners

hi

p

i

nterests. For purposes o

f

repa

y

ment an

di

nt

h

e event o

fli

qu

id

at

i

on,

dissolution or bankruptcy, the Sprint Tranche shall be subordinated to the Senior Term Loan Facility and obligation

s

un

d

er t

h

e Amen

d

e

d

Cre

di

tA

g

reement

.

Future payments o

fi

nterest an

d

pr

i

nc

i

pa

l

,

i

nc

l

u

di

ng payment

i

n

ki

n

di

nterest an

df

ees on our Sen

i

or Term Loa

n

Fac

ili

t

yf

or t

h

e rema

i

n

i

n

gy

ears are as

f

o

ll

ows (

i

nt

h

ousan

d

s):

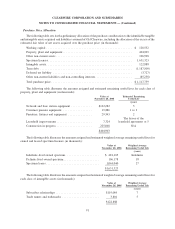

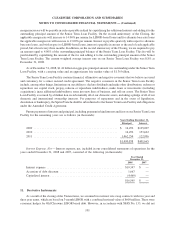

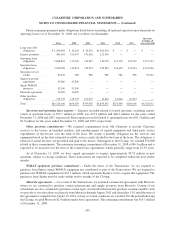

Principal Interes

t

Y

ears End

i

n

g

December 31

,

2009

.

.

..................................................

$

14

,

292

$

125

,

00

7

2010

.

.

..................................................

14

,

292 153

,

66

2

2

0

11 .

.

.................................................

.

1

,

462

,

254 122

,

996

$1

,

490

,

838 $401

,

66

5

I

nterest Ex

p

ense, Net — Interest expense, net,

i

nc

l

u

d

e

di

n our conso

lid

ate

d

statements o

f

operat

i

ons

f

or t

he

y

ears en

d

e

d

Decem

b

er 31, 2008 an

d

2007, cons

i

ste

d

o

f

t

h

e

f

o

ll

ow

i

n

g

(

i

nt

h

ousan

d

s)

:

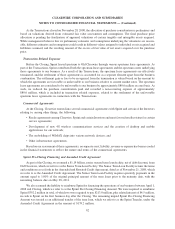

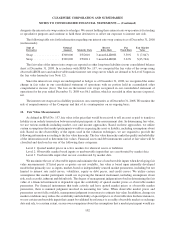

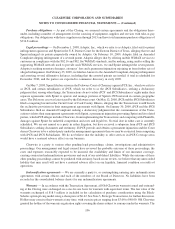

2008

2

00

7

Y

ear

E

n

d

e

d

D

ecember 31

,

I

nterest expens

e

...............................................

$

19

,

347

$

—

Accret

i

on o

fd

e

b

t

di

scoun

t

.

...................................... 1

,

667 —

C

a

p

italized interest

.

............................................

(

4,469

)

—

$16,545 $ —

11. D

e

r

iva

t

ive

In

s

tr

u

m

e

nt

s

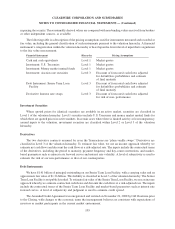

As a resu

l

to

f

t

h

ec

l

os

i

n

g

o

f

t

h

e Transact

i

ons, we assume

d

two

i

nterest rate swap contracts w

i

t

h

two

y

ear an

d

t

hree

y

ear terms, which are based on 3-month LIBOR with a combined notional value of $600 million. These wer

e

e

conomic hedges for Old Clearwire LIBOR based debt. However, in accordance with SFAS No. 133, we did no

t

101

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)