Clearwire 2008 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

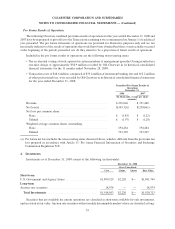

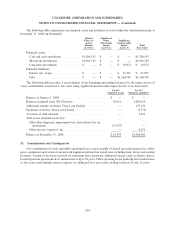

I

nterest cap

i

ta

li

ze

d

was as

f

o

ll

ows (

i

nt

h

ousan

d

s)

:

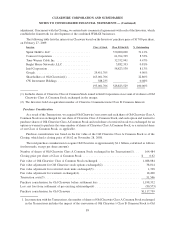

2008 2007

Y

ear Ende

d

D

ecember

31,

$4,469 $

—

D

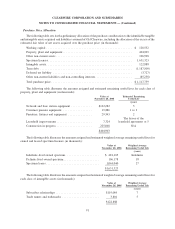

epreciation and amortization expense related to propert

y

, plant and equipment was as follows (in thousands)

:

2008 2007

Yea

r

E

n

ded

D

ecember 31

,

$54,811 $3,936

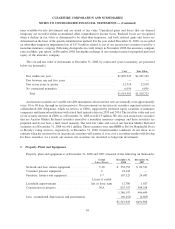

As of January 1, 2007, Sprint transferred to us approximately

$

1.7 million of property, plant and equipmen

t

w

ith a

g

ross asset value of approximatel

y

$2.4 million and an accumulated depreciation balance of approximatel

y

$667,000 to be used in our next

g

eneration of wireless broadband services.

6.

Sp

ectrum License

s

O

wne

d

an

dl

ease

d

spectrum

li

censes as o

f

Decem

b

er 31, 2008 an

d

2007 cons

i

ste

d

o

f

t

h

e

f

o

ll

ow

i

ng (

i

n

th

ousan

d

s)

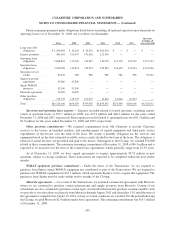

:

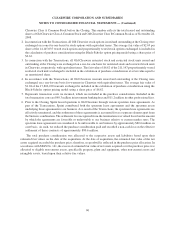

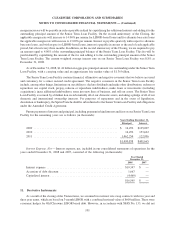

Wtd

A

v

g

L

ease Life

G

ross Carryin

g

V

alu

e

A

ccumulated

A

mortizatio

n

Net Carryin

g

Value

G

ross Carryin

g

Value

A

ccumulate

d

A

mortizatio

n

Net Carryin

g

V

alu

e

December

31

,

2008

December

31

,

2007

In

d

e

fi

n

i

te-

li

ve

d

owne

d

s

pectrum . .

.

...........

I

ndefinite $3

,

035

,

473 $ — $3

,

035

,

473 $2

,

418

,

246 $— $2

,

418

,

24

6

De

fi

n

i

te-

liv

e

d

o

w

ne

d

sp

ec

t

rum . . .

.

..........

1

7-

20

y

ears

112

,

303 (9

7

4) 111

,

329

——

—

Spectrum

l

eases an

d

prepa

id

sp

ectrum . . .

...........

2

7

y

ears 1,270,0

5

8(

5

,039) 1,26

5

,019 180,863 — 180,863

Pendin

g

spectrum and transition

costs

.

...............

6

0,041 — 60,041 43,481 — 43,481

T

otal s

p

ectrum licenses . . . . $4,477,875 $(6,013) $4,471,862 $2,642,590 $— $2,642,590

I

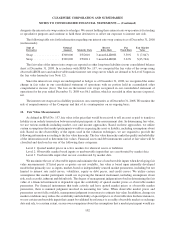

n

d

efinite an

d

Definite-

l

ive

d

Owne

d

Spectrum Licenses — Spectrum

li

censes, w

hi

c

h

are

i

ssue

d

on

b

ot

h

as

i

te-

s

pecific and a wide-area basis, authorize wireless carriers to use radio frequenc

y

spectrum to provide service t

o

c

ertain

g

eo

g

raphical areas in the United States and internationall

y

. These licenses are

g

enerall

y

acquired as an asse

t

p

urc

h

ase or t

h

roug

h

a

b

us

i

ness com

bi

nat

i

on. In some cases, we acqu

i

re

li

censes

di

rect

l

y

f

rom t

h

e governmenta

l

aut

h

or

i

t

yi

nt

h

e app

li

ca

bl

e countr

y

.T

h

ese

li

censes are cons

id

ere

di

n

d

e

fi

n

i

te-

li

ve

di

ntan

gibl

e assets, except

f

or t

h

e

licenses acquired in Poland, Spain, German

y

and Romania, which are considered definite-lived intan

g

ible asset

s

due to limited license renewal history in these countries.

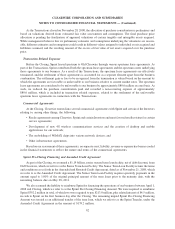

Sp

ectrum Leases and Pre

p

aid S

p

ectrum — We also lease s

p

ectrum from third

p

arties who hold the s

p

ectru

m

li

censes. T

h

ese

l

eases are accounte

df

or as executory contracts, w

hi

c

h

are treate

d lik

e operat

i

ng

l

eases

i

n

accor

d

ance w

i

t

h

SFAS No. 13. Up

f

ront cons

id

erat

i

on pa

id

to t

hi

r

d

-party

h

o

ld

ers o

f

t

h

ese

l

ease

dli

censes at t

he

i

nception of a lease a

g

reement is capitalized as prepaid spectrum lease costs and is expensed over the term of the

l

ease agreement,

i

nc

l

u

di

ng expecte

d

renewa

l

terms, as app

li

ca

bl

e. As part o

f

t

h

ec

l

os

i

ng o

f

t

h

e Transact

i

ons, we

assume

d

spectrum

l

eases

f

rom O

ld

C

l

earw

i

re t

h

at

h

ave rema

i

n

i

ng use

f

u

lli

ves

d

epen

d

ent on t

h

e terms o

f

t

h

e

l

ease

.

T

hese terms, some of which include expected renewal periods, have a wei

g

hted avera

g

e remainin

g

useful life o

f

twenty-seven years. As part o

f

t

h

e purc

h

ase account

i

ng

f

or t

h

e Transact

i

ons,

f

avora

bl

e spectrum

l

eases o

f

$

1.0 billion were recorded at the Closing of the Transactions. The favorable component of the acquired spectru

m

l

eases

h

as

b

een ca

pi

ta

li

ze

d

as an asset an

di

s amort

i

ze

d

over t

h

e

l

ease term

.

95

C

LEARWIRE

CO

RP

O

RATI

O

N AND

SU

B

S

IDIARIE

S

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)