Clearwire 2008 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F

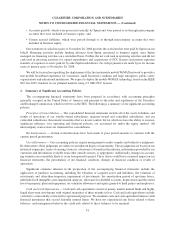

SP No. FAS 142-

3

— In Apr

il

2008, t

h

e FASB

i

ssue

d

FASB Sta

ff

Pos

i

t

i

on, w

hi

c

h

we re

f

er to as FSP

,

No. FA

S 142

-

3,

Determination of t

h

e Usefu

l

Life of Intangi

bl

e Asset

s

,

w

hi

c

h

we re

f

er to as FSP No. 142-3. FS

P

No. 142-3 amends the factors that should be considered in developin

g

renewal or extension assumptions used to

d

eterm

i

ne t

h

e use

f

u

l lif

eo

f

a recogn

i

ze

di

ntang

ibl

e asset un

d

er SFAS No. 142. FSP No. 142-3

i

s

i

nten

d

e

d

to

i

mprove t

h

e cons

i

stency

b

etween t

h

e use

f

u

l lif

eo

f

an

i

ntang

ibl

e asset

d

eterm

i

ne

d

un

d

er SFAS No. 142 an

d

t

he

p

eriod of ex

p

ected cash flows used to measure the fair value of the asset under SFAS No. 141, and other U.S. GAAP

.

FSP No. 142-3 is effective for financial statements issued for fiscal years beginning after December 1

5

, 2008, an

d

i

nter

i

m per

i

o

d

sw

i

t

hi

nt

h

ose

fi

sca

ly

ears. We

d

o not expect t

h

ea

d

opt

i

on o

f

FSP No. 142-3 w

ill h

ave a mater

i

a

l

e

ff

ec

t

on our

fi

nanc

i

a

lp

os

i

t

i

on an

d

resu

l

ts o

f

o

p

erat

i

ons.

3

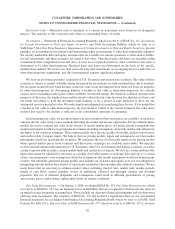

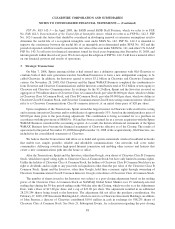

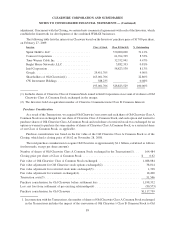

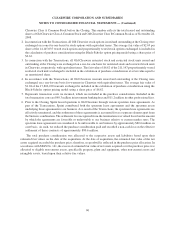

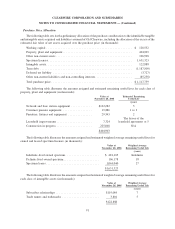

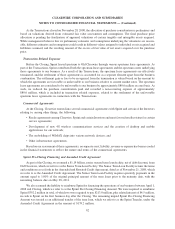

. Strategic Transactions

On May 7, 2008, Sprint announced that it had entered into a definitive agreement with Old Clearwire to

c

om

bi

ne

b

ot

h

o

f

t

h

e

i

rnext

g

enerat

i

on w

i

re

l

ess

b

roa

db

an

db

us

i

nesses to

f

orm a new

i

n

d

epen

d

ent compan

y

to

b

e

c

alled Clearwire. In addition, the Investors a

g

reed to invest $3.2 billion in Clearwire and Clearwire Communi

-

c

ations. On November 28, 2008, Old Clearwire and the S

p

rint WiMAX Business com

p

leted the combination t

o

form Clearwire and Clearwire Communications and the Investors contributed a total of

$

3.2 billion of new equit

y

to

Clearwire and Clearwire Communications. In exchan

g

e for the $3.2 billion, Sprint and the Investors received a

n

a

gg

re

g

ate of 530 million shares of Clearwire Class A Common Stock, par value $0.0001 per share, which we define

as Clearwire Class A Common Stock, and Class B Common Stock, par value

$

0.0001 per share, which we define a

s

C

l

earw

i

re C

l

ass B Common Stoc

k

,an

d

C

l

earw

i

re Commun

i

cat

i

ons C

l

ass B non-vot

i

n

g

common

i

nterest, w

hi

c

h

w

e

r

efer to as Clearwire Communications Class B common interests, at an initial share

p

rice of $20

p

er share.

Upon comp

l

et

i

on o

f

t

h

e Transact

i

ons, Spr

i

nt owne

d

t

h

e

l

ar

g

est

i

nterest

i

nC

l

earw

i

re w

i

t

h

an e

ff

ect

i

ve vot

i

n

g

and economic interest in Clearwire and its subsidiaries of approximatel

y

53%, based on the initial purchase price o

f

$

20.00 per share prior to the post-closing adjustment. The combination is being accounted for as a purchase in

accor

d

ance w

i

t

h

t

h

e prov

i

s

i

ons o

f

SFAS No. 141 an

dh

as

b

een accounte

df

or as a reverse acqu

i

s

i

t

i

on w

i

t

h

t

h

e Spr

i

nt

Wi

MAX Bus

i

ness cons

id

ere

d

t

h

e account

i

n

g

acqu

i

rer. As a resu

l

t, t

h

e

hi

stor

i

ca

lfi

nanc

i

a

l

statements o

f

t

h

e Spr

i

nt

W

iMAX Business have become the financial statements of Clearwire effective as of the Closin

g

. The results o

f

operat

i

ons

f

or t

h

e per

i

o

d

Novem

b

er 29, 2008 t

h

roug

h

Decem

b

er 31, 2008 o

f

t

h

e acqu

i

re

d

ent

i

ty, O

ld

C

l

earw

i

re, are

i

nc

l

u

d

e

di

nt

h

e conso

lid

ate

d

statements o

fCl

ear

wi

re.

We believe that the Transactions will allow us to build and operate nationwide wireless broadband networks

t

h

at ena

bl

e

f

ast, s

i

mp

l

e, porta

bl

e, re

li

a

bl

ean

d

a

ff

or

d

a

bl

e commun

i

cat

i

ons. Our networ

k

sw

ill

cover ent

i

re

c

ommun

i

t

i

es,

d

e

li

ver

i

n

g

aw

i

re

l

ess

high

-spee

d

Internet connect

i

on an

d

ena

bli

n

g

ot

h

er serv

i

ces an

df

eatures t

h

at

c

reate a new communications

p

ath into the home or office

.

A

f

ter t

h

e Transact

i

ons, Spr

i

nt an

d

t

h

e Investors, ot

h

er t

h

an Goo

gl

e, own s

h

ares o

f

C

l

earw

i

re C

l

ass B Common

S

tock, which have equal votin

g

ri

g

hts to Clearwire Class A Common Stock, but have onl

y

limited economic ri

g

hts.

U

n

lik

et

h

e

h

o

ld

ers o

f

C

l

earw

i

re C

l

ass A Common Stoc

k,

t

h

e

h

o

ld

ers o

f

C

l

earw

i

re C

l

ass B Common Stoc

kh

ave n

o

ri

g

h

tto

di

v

id

en

d

san

d

no r

i

g

h

t to any procee

d

son

li

qu

id

at

i

on ot

h

er t

h

an t

h

e par va

l

ue o

f

t

h

eC

l

earw

i

re C

l

ass B

Common Stock. Sprint and the Investors, other than Goo

g

le, hold their economic ri

g

hts throu

g

h ownership of

C

l

earw

i

re Commun

i

cat

i

ons C

l

ass B Common Interests. Goog

l

e owns s

h

ares o

f

C

l

earw

i

re C

l

ass A Common Stoc

k

.

The number of shares issued to the Investors was sub

j

ect to a post-closin

g

ad

j

ustment based on the tradin

g

p

rices of the Clearwire Class A Common Stock on NASDAQ Global Select Market over 1

5

randomly-selected

tra

di

n

gd

a

y

s

d

ur

i

n

g

t

h

e 30-

d

a

y

per

i

o

d

en

di

n

g

on t

h

e 90t

hd

a

y

a

f

ter t

h

eC

l

os

i

n

g

,w

hi

c

h

we re

f

er to as t

h

eA

dj

ustmen

t

D

ate, with a floor of $17.00 per share and a cap of $23.00 per share. The ad

j

ustment resulted in an additiona

l

28,23

5

,294 shares bein

g

issued to the Investors. The ad

j

ustment did not affect the purchase consideration. On

Fe

b

ruary 27, 2009, CW Investment Ho

ldi

ngs LLC, w

hi

c

h

we re

f

er to as C

l

earw

i

re Investment Ho

ldi

ngs, an a

ffili

at

e

of John Stanton, a director of Clearwire contributed

$

10.0 million in cash in exchan

g

e for 588,235 shares o

f

Clearwire Class A Common Stock. See Note 21, Subsequent Events, for a discussion re

g

ardin

g

the post-closin

g

88

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)