Clearwire 2008 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

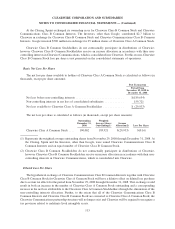

T

h

ere

f

ore, at t

h

e grant

d

ate t

h

ese awar

d

son

l

y

h

a

d

a rema

i

n

i

ng serv

i

ce requ

i

rement an

d

vest

i

ng per

i

o

d

o

f

s

i

x mont

h

s

f

o

ll

ow

i

ng t

h

e

l

ast

d

ay o

f

t

h

e app

li

ca

bl

e quarter. Emp

l

oyees w

h

o were grante

d

RSUs were not requ

i

re

d

to pay

f

or t

he

s

hares but

g

enerall

y

must remain emplo

y

ed with Sprint or a subsidiar

y

, until the restrictions lapse, which was

t

ypically three years or less. At December 31, 2008, there were 2,604,784 unvested options and 907,265 unvested

RSUs outstan

di

ng.

T

he share-based compensation associated with these emplo

y

ees is incurred b

y

Sprint on our behalf and is

accounted for in accordance with SFAS No. 123

(

R

)

and EITF Issue No. 00-12, Accounting by an Investor

f

or Stock

-

Base

d

Compensation Grante

d

to Emp

l

oyees of an E

q

uity Met

h

o

d

Investee

.

Spr

i

nt prov

id

e

d

us w

i

t

h

t

h

e

f

a

i

rva

l

ue o

f

t

he options and RSUs for each reportin

g

period, calculated in accordance with EITF Issue No. 96-18,

A

ccountin

g

f

or E

q

uity Investments That are Issued to Other Than Employees for Ac

q

uiring, or in Conjunction with Selling

,

G

oo

d

s or Service

s

, which we refer to as EITF Issue No. 9

6

-18. EITF Issue No. 9

6

-18 requires remeasurement base

d

on the fair value of the equit

y

instruments at each reportin

g

period until the instruments are vested.

C

ompensat

i

on expense recor

d

e

d

re

l

ate

d

to t

h

e emp

l

oyees w

i

t

h

unveste

d

Spr

i

nt stoc

k

opt

i

ons an

d

RSUs

f

or t

he

y

ear ended December 31, 2008 was $2.8 million. Total unreco

g

nized share-based compensation costs related t

o

unvested stock options and RSUs outstandin

g

as of December 31, 2008 was $292,000 and $493,000, respectivel

y,

and is expected to be recognized over approximately 1.4 years for stock options and 1.0 year for RSUs, respectively

.

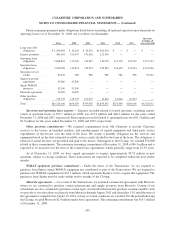

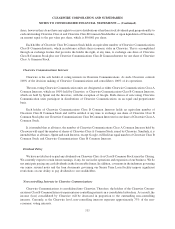

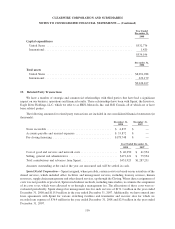

15. Non-controlling Interests and

S

tockholders’ Equity

Pursuant to the Transactions, the followin

g

shares of common stock are authorized, issued and outstandin

g

at

D

ecem

b

er 31, 2008 (

i

nt

h

ousan

d

s, except per s

h

are amounts)

:

P

ar

V

a

l

ue

Au

th

o

riz

ed

S

hare

s

I

ssued and

O

utstandin

g

S

hare

s

Cl

ear

wi

re

Cl

ass A

C

ommon

S

toc

k

.

...................

.

$

0.0001 1

,

300

,

000 190

,

00

2

Cl

ear

wi

re

Cl

ass B

C

ommon

S

toc

k

.

....................

$

0.0001 750

,

000 505

,

000

Preferred Stoc

k

...................................

.

$

0.0001 15

,

000 —

2

,

065

,

000 695

,

00

2

N

os

h

ares were outstan

di

ng pr

i

or to t

h

eC

l

os

i

ng, as we were a w

h

o

ll

y-owne

ddi

v

i

s

i

on o

f

Spr

i

nt.

Cl

ass A

C

ommon

S

toc

k

T

h

eC

l

earw

i

re C

l

ass A Common Stoc

k

represents t

h

e common equ

i

ty o

f

C

l

earw

i

re. T

h

e

h

o

ld

ers o

f

t

he

C

learwire Class A Common Stock are entitled to one vote per share and, as a class, are entitled to 100% of an

y

d

ividends or distributions made b

y

Clearwire, with the exception of certain minimal liquidation ri

g

hts provided to

t

h

eC

l

earw

i

re C

l

ass B Common Stoc

kh

o

ld

ers

,

w

hi

c

h

are

d

escr

ib

e

db

e

l

ow. Eac

h

s

h

are o

f

C

l

earw

i

re C

l

ass A

C

ommon Stoc

k

part

i

c

i

pates rata

bly i

n proport

i

on to t

h

e tota

l

num

b

er o

f

s

h

ares o

f

C

l

earw

i

re C

l

ass A Common Stoc

k

i

ssued b

y

Clearwire. Holders of Clearwire Class A Common Stock have 100% of the economic interest in Clearwir

e

a

nd are considered the controlling interest for the purposes of financial reporting

.

U

pon

li

qu

id

at

i

on,

di

sso

l

ut

i

on or w

i

n

di

ng up, t

h

eC

l

earw

i

re C

l

ass A Common Stoc

k

w

ill b

e ent

i

t

l

e

d

to an

y

a

ssets remainin

g

after pa

y

ment of all debts and liabilities of Clearwire, with the exception of certain minima

l

li

qu

id

at

i

on r

i

g

h

ts prov

id

e

d

to t

h

eC

l

earw

i

re C

l

ass B Common Stoc

kh

o

ld

ers, w

hi

c

h

are

d

escr

ib

e

db

e

l

ow

.

Clearwire Class B Common Stock

T

h

eC

l

earw

i

re C

l

ass B Common Stoc

k

represents non-econom

i

cvot

i

ng

i

nterests

i

nC

l

earw

i

re an

dh

o

ld

ers o

f

t

hi

s stoc

k

are cons

id

ere

d

t

h

e non-contro

lli

ng

i

nterests

f

or t

h

e purposes o

ffi

nanc

i

a

l

report

i

ng. I

d

ent

i

ca

l

to t

h

e

C

learwire Class A Common Stock, the holders of Clearwire Class B Common Stock are entitled to one vote

p

er

11

0

C

LEARWIRE

CO

RP

O

RATI

O

N AND

SU

B

S

IDIARIE

S

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)