Clearwire 2008 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

t

erm ava

il

a

bl

e-

f

or-sa

l

e

i

nvestments an

d

are state

d

at

f

a

i

rva

l

ue. Unrea

li

ze

d

ga

i

ns an

dl

osses t

h

at are

d

eeme

d

t

emporary are recor

d

e

d

w

i

t

hi

n accumu

l

ate

d

ot

h

er compre

h

ens

i

ve

i

ncome (

l

oss). Rea

li

ze

dl

osses are recogn

i

ze

d

when a decline in fair value is determined to be other-than-temporar

y

, and both realized

g

ains and losses are

d

eterm

i

ne

d

on t

h

e

b

as

i

so

f

t

h

e spec

ifi

c

id

ent

ifi

cat

i

on met

h

o

d

. For t

h

e year en

d

e

d

Decem

b

er 31, 2008, we recor

d

e

d

an other-then-temporary impairment loss of

$

17.0 million related to one of our auction rate securities issued by a

m

onoline insurance compan

y

. Followin

g

down

g

rades in credit ratin

g

s in November 2008, the insurance compan

y

e

xercised their “put option” in December 2008, forcing the exchange of our existing security for perpetual preferred

e

qu

i

t

y

o

f

t

h

e

i

nsurance compan

y.

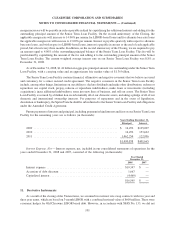

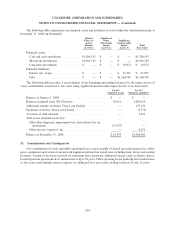

Th

e cost an

df

a

i

rva

l

ue o

fi

nvestments at Decem

b

er 31, 2008,

b

y contractua

l

years-to-matur

i

ty, are presente

d

below (in thousands):

C

ost Fa

i

r Valu

e

D

ue w

i

t

hi

n one

y

ea

r

........................................

$1,899,529 $1,901,74

9

D

ue

b

etween one an

dfi

ve year

s

...............................

——

D

ue

i

n ten years or greate

r

...................................

1

2

,

918 12

,

918

No contractua

l

matur

i

t

i

es

.

...................................

6,

0

5

66

,

0

5

6

Tota

l

.................................................

$1,918,503 $1,920,72

3

Auction rate securities are variable rate debt instruments whose interest rates are normally reset approximately

e

very 30 or 90

d

ays t

h

roug

h

an auct

i

on process. Our

i

nvestments

i

n auct

i

on rate secur

i

t

i

es represent

i

nterests

i

n

c

ollateralized debt obli

g

ations, which we refer to as CDOs, supported b

y

preferred equit

y

securities of insuranc

e

c

ompanies and financial institutions with stated final maturit

y

dates in 2033 and 2034. The total fair value and cost

of our security interests in CDOs as of December 31, 2008 was

$

12.9 million. We also own auction rate securities

t

hat are Auction Market Preferred securities issued b

y

a monoline insurance compan

y

and these securities ar

e

p

erpetual and do not have a final stated maturit

y

. The total fair value and cost of our Auction Market Preferred

s

ecurities as of December 31, 2008 was

$

6.1 million. These securities were rated BBB or Ba1 by Standard & Poor

s

or Moo

dy

’s rat

i

n

g

serv

i

ces, respect

i

ve

ly

, at Decem

b

er 31, 2008. Current mar

k

et con

di

t

i

ons

d

o not a

ll

ow us t

o

e

stimate when the auctions for our auction rate securities will resume, if ever, or if a secondar

y

market will develop

for these securities. As a result, our auction rate securities are classified as long-term investments

.

5

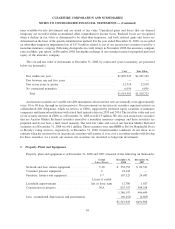

. Property, Plant and Equipmen

t

P

ropert

y

,p

l

ant an

d

equ

i

pment as o

f

Decem

b

er 31, 2008 an

d

2007 cons

i

ste

d

o

f

t

h

e

f

o

ll

ow

i

n

g

(

i

nt

h

ousan

d

s):

U

se

f

ul

Lives (Years

)

December

31,

2008

December

31,

200

7

Network and base station e

q

ui

p

men

t

........... 5-30 $ 353,752 $ 82,531

C

ustomer

p

remise e

q

ui

p

men

t

................. 2

23

,

141

—

Furn

i

ture,

fi

xtures an

d

e

q

u

ip

men

t

..............

3

-7 167,325 24,68

3

Lesser o

f

use

f

u

l

Lease

h

o

ld i

mprovements . .

.

.................

l

ife or lease term 12

,

78

6

1

,

027

C

onstruct

i

on

i

n progress . .

.

................. N

/

A 823

,

193 388

,

2

58

1

,380,197 496,499

Less: accumulated de

p

reciation and amortization . . (60,2

5

2) (4,603)

$

1,319,945 $491,896

94

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)