Clearwire 2008 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

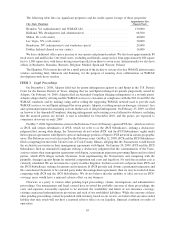

Th

e

f

o

ll

ow

i

ng ta

bl

e

li

sts our s

i

gn

ifi

cant propert

i

es an

d

t

h

e

i

ns

id

e square

f

ootage o

f

t

h

ose propert

i

es

:

City, State

(

Function

)

A

pproximate Siz

e

(

Square Feet

)

H

ern

d

on, VA

(

a

d

m

i

n

i

strat

i

ve an

d

W

i

MAX

l

a

b)

.

..........................

.

1

30

,

000

K

irkland, WA (head

q

uarters and administrative) . . . .......................

.

68

,5

00

Milton, FL (call center

)

.............................................

4

0,000

Las Ve

g

as, NV (call center)

..........................................

30

,

000

H

enderson, NV (administrative and warehouse s

p

ace

)

.......................

29

,

000

D

u

bli

n, Ire

l

an

d(

s

h

are

d

serv

i

ce center

)

..................................

16

,000

We

l

ease a

ddi

t

i

ona

l

o

ffi

ce space

i

n man

y

o

f

our current an

d

p

l

anne

d

mar

k

ets. We a

l

so

l

ease approx

i

mate

ly

8

0

r

etail stores and mall kiosks. Our retail stores, excludin

g

mall kiosks, ran

g

e in size from approximatel

y

480 squar

e

feet to 1,500 square feet, with leases having terms typically from three to seven years. Internationally we also have

o

ffi

ces

i

n Buc

h

arest, Roman

i

a; Brusse

l

s, Be

l

g

i

um; Ma

d

r

id

, Spa

i

nan

d

Warsaw, Po

l

an

d

.

Th

e Hern

d

on, VA

l

ocat

i

on

h

as su

b

-

l

et a sma

ll

port

i

on o

f

t

h

e

f

ac

ili

t

y

to certa

i

no

fi

ts

k

e

y

W

i

MAX

i

n

f

rastructure

vendors, includin

g

Intel, Motorola and Samsun

g

, for the purpose of ensurin

g

close collaboration on WiMAX

develo

p

ment with those vendors.

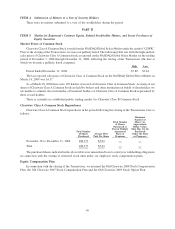

ITEM

3

.

L

e

g

al Proceedin

g

s

O

n Decem

b

er 1, 2008, A

d

apt

i

x

fil

e

d

su

i

t

f

or patent

i

n

f

r

i

n

g

ement a

g

a

i

nst us an

d

Spr

i

nt

i

nt

h

e U.S. D

i

str

i

c

t

Court for the Eastern District of Texas, alleging that we and Sprint infringed six patents purportedly owned b

y

A

daptix. On February 10, 2009, Adaptix filed an Amended Complaint alleging infringement of a seventh patent

.

A

daptix alle

g

es that b

y

offerin

g

mobile WiMAX services to customers in compliance with the 802.1

6

and 802.1

6

e

W

iMAX standards, and b

y

makin

g

, usin

g

and/or sellin

g

the supportin

g

WiMAX network used to provide such

W

iMAX services, we and Sprint infringed the seven patents. Adaptix is seeking monetary damages, attorneys’ fee

s

and a permanent in

j

unction en

j

oinin

g

us from further acts of alle

g

ed infrin

g

ement. On Februar

y

25, 2009, we file

d

an Answer to the Amended Complaint, den

y

in

g

infrin

g

ement and assertin

g

several affirmative defenses, includin

g

t

hat the asserted

p

atents are invalid. A trial is scheduled for December 2010, and the

p

arties are ex

p

ected t

o

c

ommence

di

scovery

i

n ear

l

y 2009.

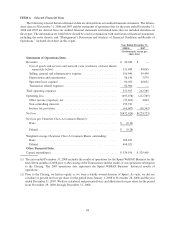

O

n May 7, 2008, Spr

i

nt

fil

e

d

an act

i

on

i

nt

h

eDe

l

aware Court o

f

C

h

ancery aga

i

nst

i

PCS, Inc., w

hi

c

h

we re

f

er t

o

as

i

PCS, an

d

certa

i

nsu

b

s

idi

ar

i

es o

fi

PCS, w

hi

c

h

we re

f

er to as t

h

e

i

PCS Su

b

s

idi

ar

i

es, see

ki

n

g

a

d

ec

l

arator

y

judgment that, among other things, the Transactions do not violate iPCS’ and the iPCS Subsidiaries’ rights unde

r

t

heir separate agreements with Sprint to operate and manage portions of Sprint’s PCS network in certain geographi

c

areas. T

h

eDe

l

aware case was

l

ater sta

y

e

dby

t

h

eDe

l

aware court. On Ma

y

12, 2008,

i

PCS an

d

t

h

e

i

PCS Su

b

s

idi

ar

i

e

s

filed a competin

g

lawsuit in the Circuit Court of Cook Count

y

, Illinois, alle

g

in

g

that the Transactions would breac

h

t

he exclusivity provisions in their management agreements with Sprint. On January 30, 2009, iPCS and the iPCS

S

u

b

s

idi

ar

i

es

fil

e

d

an Amen

d

e

d

Comp

l

a

i

nt see

ki

n

g

a

d

ec

l

arator

yj

u

dg

ment t

h

at t

h

e consummat

i

on o

f

t

h

e Trans-

actions violates their mana

g

ement a

g

reements with Sprint, a permanent in

j

unction preventin

g

Sprint and its relate

d

p

art

i

es, w

hi

c

hi

PCS a

ll

eges

i

nc

l

u

d

eC

l

earw

i

re,

f

rom

i

mp

l

ement

i

ng t

h

e Transact

i

ons an

d

compet

i

ng w

i

t

h

t

he

pl

a

i

nt

iff

s,

d

amages aga

i

nst Spr

i

nt

f

or un

l

aw

f

u

l

compet

i

t

i

on an

d

costs an

dl

ega

lf

ees. No tr

i

a

ld

ate

i

ne

i

t

h

er case

i

s

c

urrentl

y

scheduled. We are not named as a part

y

in either liti

g

ation, but have received a subpoena from iPCS and

th

e

i

PCS Su

b

s

idi

ar

i

es see

ki

ng

d

ocuments an

d

test

i

mony. I

fi

PCS preva

il

san

d

o

b

ta

i

ns a permanent

i

n

j

unct

i

on an

d

th

e court

d

eems C

l

earw

i

re to

b

eare

l

ate

d

party un

d

er t

h

e management agreements, t

h

en we may

b

e restr

i

cte

df

ro

m

c

ompetin

g

with iPCS and the iPCS Subsidiaries. We do not believe that the inabilit

y

to offer services in iPCS

’

c

overage areas would have a material adverse effect on our business.

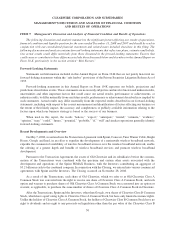

C

learwire is a part

y

to various other pendin

g

le

g

al proceedin

g

s, claims, investi

g

ations and administrative

p

rocee

di

ngs. Our management an

dl

ega

l

counse

lh

ave rev

i

ewe

d

t

h

e pro

b

a

bl

e outcome o

f

t

h

ese procee

di

ngs, t

he

c

osts an

d

expenses reasona

bly

expecte

d

to

b

e

i

ncurre

d

,t

h

eava

il

a

bili

t

y

an

dli

m

i

ts o

f

our

i

nsurance covera

g

e

,

e

xistin

g

contractual indemnification provisions and each of our established liabilities. While the outcome of these

ot

h

er pen

di

ng procee

di

ngs cannot

b

e pre

di

cte

d

w

i

t

h

certa

i

nty,

b

ase

d

on our rev

i

ew, we

b

e

li

eve t

h

at any unrecor

d

e

d

li

a

bili

ty t

h

at may resu

l

tw

ill

not

h

ave a mater

i

a

l

a

d

verse e

ff

ect on our

li

qu

idi

ty,

fi

nanc

i

a

l

con

di

t

i

on or resu

l

ts o

f

o

p

erations

.

45