Clearwire 2008 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.n

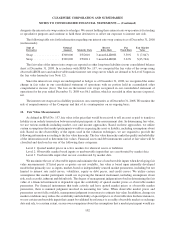

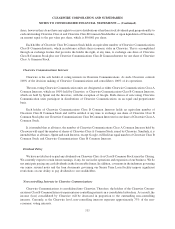

umber of warrants outstanding at December 31, 2008 was 17,806,220. The warrants expire on August 5, 2010, bu

t

th

e term

i

ssu

bj

ect to extens

i

on

i

n certa

i

nc

i

rcumstances.

I

n connect

i

on w

i

t

h

t

h

ere

gi

strat

i

on r

igh

ts a

g

reement, O

ld

C

l

earw

i

re

fil

e

d

a resa

l

ere

gi

strat

i

on statement, w

hi

c

h

was effective on Au

g

ust 28, 2007, on Form S-1 re

g

isterin

g

the resale of shares of Old Clearwire Class A Commo

n

S

tock issuable upon the exercise of the warrants. We are required to also file a re

g

istration statement within 120 da

y

s

a

f

ter t

h

eC

l

os

i

ng, w

hi

c

h

must

b

e

d

ec

l

are

d

e

ff

ect

i

ve w

i

t

hi

n 180

d

ays a

f

ter C

l

os

i

ng. Once t

h

e reg

i

strat

i

on statement

i

s

e

ffective, we must maintain such re

g

istration statement in effect (sub

j

ect to certain suspension periods) as lon

g

a

s

t

he warrants remain outstandin

g

. If we fail to meet our obli

g

ations to maintain that re

g

istration statement, we will b

e

r

equ

i

re

d

to pay to eac

h

a

ff

ecte

d

warrant

h

o

ld

er an amount

i

n cas

h

equa

l

to 2% o

f

t

h

e purc

h

ase pr

i

ce o

f

suc

hh

o

ld

er’

s

warrants. In the event that we fail to make such pa

y

ments in a timel

y

manner, the pa

y

ments will bear interest at a rat

e

of 1% per month until paid in full. This re

g

istration ri

g

hts a

g

reement also provides for incidental re

g

istration ri

g

ht

s

i

n connect

i

on w

i

t

hf

o

ll

ow-on o

ff

er

i

ngs, ot

h

er t

h

an

i

ssuances pursuant to a

b

us

i

ness com

bi

nat

i

on transact

i

on o

r

e

mp

l

o

y

ee

b

ene

fi

tp

l

an. We

d

o not cons

id

er pa

y

ment o

f

an

y

suc

h

pena

l

t

y

to

b

e pro

b

a

bl

easo

f

Decem

b

er 31, 2008,

and have therefore not recorded a liabilit

y

for this contin

g

enc

y

.

As of December 31, 2008, Ea

g

le River Holdin

g

s, LLC held warrants entitlin

g

it to purchase 613,333 shares o

f

Clearwire Class A Common Stock at an exercise

p

rice of $15.00

p

er share and warrants to

p

urchase 375,000 shares

of Clearwire Class A Common Stock at an exercise price of

$

3.00 per share. As of December 31, 2008, the

r

emainin

g

life of the warrants was 4.9

y

ears.

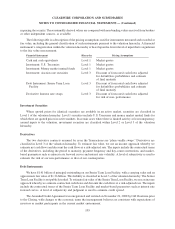

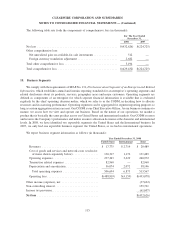

14.

S

hare-Based Pa

y

ments

I

n connection with the Closin

g

, we assumed the Old Clearwire 2008 Stock Compensation Plan, which we refe

r

t

oast

h

e 2008 P

l

an, t

h

eO

ld

C

l

earw

i

re 2007 Stoc

k

Compensat

i

on P

l

an, w

hi

c

h

we re

f

er to as t

h

e 2007 P

l

an, an

d

t

he

O

ld Clearwire 2003 Stock Option Plan, which we refer to as the 2003 Plan. Share

g

rants under the 2008 Pla

n

g

enerall

y

vest ratabl

y

over four

y

ears and expire no later than seven

y

ears after the date of

g

rant. Grants to be

awar

d

e

d

un

d

er t

h

e 2008 P

l

an w

ill b

ema

d

eava

il

a

bl

eatt

h

e

di

scret

i

on o

f

t

h

e Compensat

i

on Comm

i

ttee o

f

t

h

e Boar

d

of Directors from authorized but unissued shares, authorized and issued shares reacquired and held as treasur

y

s

hares, or a combination thereof. At December 31, 2008, there were 78,8

5

9,000 shares available for

g

rant under th

e

2008 P

l

an, w

hi

c

h

aut

h

or

i

zes us to grant

i

ncent

i

ve stoc

k

opt

i

ons, non-qua

lifi

e

d

stoc

k

opt

i

ons, stoc

k

apprec

i

at

i

o

n

righ

ts, restr

i

cte

d

stoc

k

, restr

i

cte

d

stoc

k

un

i

ts, an

d

ot

h

er stoc

k

awar

d

s to our emp

l

o

y

ees,

di

rectors an

d

consu

l

tants.

S

ince the adoption of the 2008 Plan, no additional stock options will be

g

ranted under the 2007 Plan or the 200

3

P

lan.

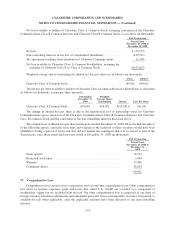

We appl

y

SFAS No. 123(R) to new awards and to awards modified, repurchased, or cancelled. Share-base

d

c

ompensat

i

on expense

i

s

b

ase

d

on t

h

e est

i

mate

d

grant-

d

ate

f

a

i

rva

l

ue an

di

s recogn

i

ze

d

net o

f

a

f

or

f

e

i

ture rate o

n

t

hose shares expected to vest over a

g

raded vestin

g

schedule on a strai

g

ht-line basis over the requisite service perio

d

f

or eac

h

separate

l

y vest

i

ng port

i

on o

f

t

h

e awar

d

as

if

t

h

e awar

d

was,

i

n-su

b

stance, mu

l

t

i

p

l

e awar

d

s

.

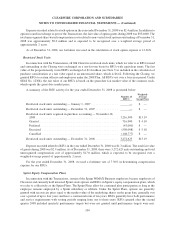

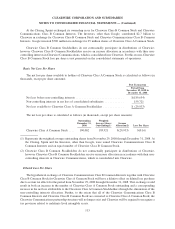

Stock Option

s

I

n connect

i

on w

i

t

h

t

h

e Transact

i

ons, a

ll

O

ld

C

l

earw

i

re stoc

k

opt

i

ons

i

ssue

d

an

d

outstan

di

ng at t

h

eC

l

os

i

n

g

were exchan

g

ed on a one-for-one basis for stock options with equivalent terms. The fair value of the vested an

d

p

roportionatel

y

vested stock options exchan

g

ed of $38.0 million (see Note 3) is included in the calculation of

p

urchase consideration using the Black-Scholes option pricing model with a share price of

$

6.62. Following th

e

Closin

g

,we

g

ranted options to certain officers and emplo

y

ees under the 2008 Plan. All options vest over a four-

y

ea

r

p

eriod. Under SFAS No. 123(R), the fair value of option

g

rants is estimated on the date of

g

rant usin

g

the Black-

S

c

h

o

l

es opt

i

on pr

i

c

i

ng mo

d

e

l

.

107

CLEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)