Clearwire 2008 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Accounts paya

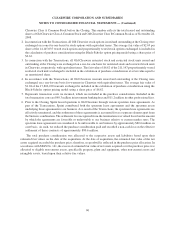

bl

e, w

hi

c

h

were processe

d

centra

ll

y

b

y Spr

i

nt an

d

were passe

d

to us t

h

roug

hi

ntercompan

y

accounts t

h

at were

i

nc

l

u

d

e

di

n

b

us

i

ness equ

i

ty; an

d

• Certa

i

n accrue

dli

a

bili

t

i

es, w

hi

c

h

were passe

d

t

h

rou

gh

to us t

h

rou

gh i

ntercompan

y

accounts t

h

at were

i

ncluded in business equity.

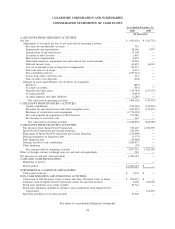

O

ur statement of cash flows prior to November 28, 2008 presents the activities that were paid b

y

Sprint on our

b

e

h

a

lf

.F

i

nanc

i

ng act

i

v

i

t

i

es

i

nc

l

u

d

e

f

un

di

ng a

d

vances

f

rom Spr

i

nt, presente

d

as

b

us

i

ness equ

i

ty, s

i

nce Spr

i

nt

m

ana

g

e

d

our

fi

nanc

i

n

g

act

i

v

i

t

i

es on a centra

li

ze

db

as

i

s. Furt

h

er, t

h

e net cas

h

use

di

n operat

i

n

g

act

i

v

i

t

i

es an

d

t

h

ene

t

c

ash used in investin

g

activities for capital expenditures and acquisitions of FCC licenses and patents represent

t

rans

f

ers o

f

expenses or assets pa

id f

or

b

yot

h

er Spr

i

nt su

b

s

idi

ar

i

es. No cas

h

payments were ma

d

e

b

yus

f

or

i

ncom

e

t

axes or

i

nterest pr

i

or to Novem

b

er 28, 2008.

We w

ill b

e

f

ocuse

d

on expe

di

t

i

n

g

t

h

e

d

ep

l

o

y

ment o

f

t

h

e

fi

rst nat

i

onw

id

emo

bil

eW

i

MAX networ

k

to prov

id

e

a

t

rue mobile broadband experience for consumers, small businesses, medium and lar

g

e enterprises, public safet

y

organizations and educational institutions. We expect to deploy the mobile WiMAX technology, based on the IEEE

802.16e-2005 standard, in our planned markets usin

g

2.5 GHz FCC licenses.

2.

S

ummary of

S

i

g

nificant Accountin

g

Policies

Th

e accompany

i

ng

fi

nanc

i

a

l

statements

h

ave

b

een prepare

di

n accor

d

ance w

i

t

h

account

i

ng pr

i

nc

i

p

l

es

g

enera

lly

accepte

di

nt

h

eUn

i

te

d

States o

f

Amer

i

ca an

d

pursuant to t

h

eru

l

es an

d

re

g

u

l

at

i

ons o

f

t

h

e Secur

i

t

i

e

s

and Exchange Commission, which we refer to as the SEC. The following is a summary of our significant accounting

p

olicies

:

P

rincip

l

es of Conso

l

i

d

atio

n

—

T

h

e conso

lid

ate

dfi

nanc

i

a

l

statements

i

nc

l

u

d

ea

ll

o

f

t

h

e assets

,li

a

bili

t

i

es an

d

r

esu

l

ts o

f

operat

i

ons o

f

our w

h

o

ll

y-owne

d

su

b

s

idi

ar

i

es, ma

j

or

i

ty-owne

d

an

d

contro

ll

e

d

su

b

s

idi

ar

i

es, an

d

ou

r

c

ontrolled subsidiaries. Investments in entities that we do not control, but for which we have the abilit

y

to exercise

si

gn

ifi

cant

i

n

fl

uence over operat

i

ng an

dfi

nanc

i

a

l

po

li

c

i

es, are accounte

df

or un

d

er t

h

e equ

i

ty met

h

o

d

.A

ll

i

ntercompany transact

i

ons are e

li

m

i

nate

di

n conso

lid

at

i

on.

Rec

l

assifications — Certa

i

n rec

l

ass

ifi

cat

i

ons

h

ave

b

een ma

d

etopr

i

or per

i

o

d

amounts to con

f

orm w

i

t

h

t

he

c

urrent

p

er

i

o

dp

resentat

i

on.

U

se o

f

Estimates — Our accountin

g

policies require mana

g

ement to make complex and sub

j

ective

j

ud

g

ments

.

By

their nature, these

j

ud

g

ments are sub

j

ect to an inherent de

g

ree of uncertaint

y

. These

j

ud

g

ments are based on our

hi

stor

i

ca

l

exper

i

ence, terms o

f

ex

i

st

i

ng contracts, o

b

servance o

f

tren

d

s

i

nt

h

e

i

n

d

ustry,

i

n

f

ormat

i

on prov

id

e

db

you

r

c

ustomers and information available from other outside sources, as appropriate. Additionall

y

, chan

g

es in account

-

i

ng est

i

mates are reasona

bl

y

lik

e

l

y to occur

f

rom per

i

o

d

to per

i

o

d

.T

h

ese

f

actors cou

ld h

ave a mater

i

a

li

mpact on ou

r

fi

nanc

i

a

l

statements, t

h

e presentat

i

on o

f

our

fi

nanc

i

a

l

con

di

t

i

on, c

h

anges

i

n

fi

nanc

i

a

l

con

di

t

i

on or resu

l

ts o

f

o

p

erations

.

S

ig

n

ifi

cant est

i

mates

i

n

h

erent

i

nt

h

e preparat

i

on o

f

t

h

e accompan

yi

n

gfi

nanc

i

a

l

statements

i

nc

l

u

d

et

h

e

application of purchase accounting, including the valuation of acquired assets and liabilities, the valuation of

i

nvestments an

d

ot

h

er-t

h

an-temporary

i

mpa

i

rment o

fi

nvestments, t

h

e amort

i

zat

i

on per

i

o

d

o

f

spectrum

l

eases,

i

n

d

e

fi

n

i

te

li

ve

di

ntan

gibl

e asset

i

mpa

i

rment ana

ly

ses, a

ll

owance

f

or

d

ou

b

t

f

u

l

accounts,

d

eprec

i

at

i

on an

d

t

h

e use

f

u

l

lives for propert

y

, plant and equipment, tax valuation allowances and equit

yg

ranted to third parties and emplo

y

ees

.

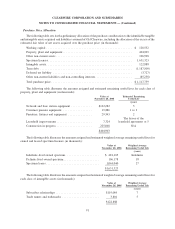

C

ash and Cash E

q

uivalent

s

— Cash and cash equivalents consist of mone

y

market mutual funds and hi

g

hl

y

li

qu

id

s

h

ort-term

i

nvestments w

i

t

h

or

i

g

i

na

l

matur

i

t

i

es o

f

t

h

ree mont

h

sor

l

ess. Cas

h

an

d

cas

h

equ

i

va

l

ents exc

l

u

de

c

as

h

t

h

at

i

s contractua

lly

restr

i

cte

df

or operat

i

ona

l

purposes. We ma

i

nta

i

n cas

h

an

d

cas

h

equ

i

va

l

ent

b

a

l

ances w

i

t

h

financial institutions that exceed federall

y

insured limits. We have not experienced an

y

losses related to these

balances, and management believes the credit risk related to these balances to be minimal.

81

C

LEARWIRE CORPORATION AND

S

UB

S

IDIARIE

S

N

OTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)