Clearwire 2008 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F

oreign Currenc

y

Exc

h

ange Rate

s

We are expose

d

to

f

ore

i

gn currency exc

h

ange rate r

i

s

k

as

i

tre

l

ates to our

i

nternat

i

ona

l

operat

i

ons. We current

ly

d

o not

h

e

dg

e our currenc

y

exc

h

an

g

e rate r

i

s

k

an

d

, as suc

h

, we are expose

d

to

fl

uctuat

i

ons

i

nt

h

eva

l

ue o

f

t

h

eUn

i

te

d

S

tates dollar a

g

ainst other currencies. Our international subsidiaries and equit

y

investees

g

enerall

y

use the currenc

y

o

f

t

h

e

j

ur

i

s

di

ct

i

on

i

nw

hi

c

h

t

h

ey res

id

e, or

l

oca

l

currency, as t

h

e

i

r

f

unct

i

ona

l

currency. Assets an

dli

a

bili

t

i

es ar

e

t

rans

l

ate

d

at exc

h

an

g

e rates

i

ne

ff

ect as o

f

t

h

e

b

a

l

ance s

h

eet

d

ate an

d

t

h

e resu

l

t

i

n

g

trans

l

at

i

on a

dj

ustments ar

e

r

ecorded within accumulated other com

p

rehensive income (loss). Income and ex

p

ense accounts are translated at the

average mont

hl

yexc

h

ange rates

d

ur

i

ng t

h

e report

i

ng per

i

o

d

.T

h

ee

ff

ects o

f

c

h

anges

i

nexc

h

ange rates

b

etween t

h

e

d

es

ig

nate

df

unct

i

ona

l

currenc

y

an

d

t

h

e currenc

yi

nw

hi

c

h

a transact

i

on

i

s

d

enom

i

nate

d

are recor

d

e

d

as

f

ore

ig

n

c

urrenc

y

transaction

g

ains (losses) and recorded in the consolidated statement of operations. We believe that th

e

fl

uctuat

i

on o

ff

ore

i

gn currency exc

h

ange rates

did

not

h

ave a mater

i

a

li

mpact on our conso

lid

ate

dfi

nanc

i

a

l

s

tatements.

I

nvestment Risk

At December 31, 2008, we held available-for-sale short-term and long-term investments with a fair value o

f

$

1.92 billion and a cost of

$

1.92 billion

,

of which investments with a fair value and cost of

$

19.0 million were

auction rate securities and investments with a fair value and a cost of

$

1.90 billion were U.S.

g

overnment an

d

a

g

enc

y

issues. We re

g

ularl

y

review the carr

y

in

g

value of our short-term and lon

g

-term investments and identif

y

an

d

r

ecord losses when events and circumstances indicate that declines in the fair value of such assets below ou

r

account

i

ng

b

as

i

s are ot

h

er-t

h

an-temporary. T

h

e est

i

mate

df

a

i

rva

l

ues o

f

our

i

nvestments are su

bj

ect to s

i

gn

ifi

cant

fluctuations due to volatilit

y

of the credit markets in

g

eneral, compan

y

-specific circumstances, chan

g

es in

g

eneral

e

conomic conditions and use of mana

g

ement

j

ud

g

ment when observable market prices and parameters are not full

y

a

v

a

il

a

bl

e

.

Auct

i

on rate secur

i

t

i

es are var

i

a

bl

e rate

d

e

b

t

i

nstruments w

h

ose

i

nterest rates are norma

ll

y reset approx

i

mate

ly

e

ver

y

30 or 90

d

a

y

st

h

rou

gh

an auct

i

on process. Our

i

nvestments

i

n auct

i

on rate secur

i

t

i

es represent

i

nterests

i

n

c

ollateralized debt obli

g

ations, which we refer to as CDOs, supported b

y

preferred equit

y

securities of insuranc

e

c

ompan

i

es an

dfi

nanc

i

a

li

nst

i

tut

i

ons w

i

t

h

state

dfi

na

l

matur

i

ty

d

ates

i

n 2033 an

d

2034. T

h

e tota

lf

a

i

rva

l

ue an

d

cost

of our security interests in CDOs as of December 31, 2008 was

$

12.9 million. We also own auction rate securities

t

hat are Auction Market Preferred securities issued b

y

a monoline insurance compan

y

and these securities ar

e

p

erpetua

l

an

dd

o not

h

ave a

fi

na

l

state

d

matur

i

ty. T

h

e tota

lf

a

i

rva

l

ue an

d

cost o

f

our Auct

i

on Mar

k

et Pre

f

erre

d

s

ecurities as of December 31, 2008 was

$

6.1 million. These securities were rated BBB or Ba1 by Standard & Poor’s

or Mood

y

’s ratin

g

services, respectivel

y

, at December 31, 2008. Current market conditions are such that we are

unable to estimate when the auctions will resume. As a result, our auction rate securities are classified as long-term

i

n

v

estments.

D

er

i

vat

i

ve Instruments

As part of the closin

g

of the Transactions, we assumed two interest rate swap contracts that were entered int

o

b

y

Old Clearwire. In accordance with SFAS No. 133, we did not desi

g

nate these swap a

g

reements as cash flow

h

e

d

ges as o

f

Decem

b

er 31, 2008. We are not

h

o

ldi

ng t

h

ese

d

er

i

vat

i

ve contracts

f

or tra

di

ng or specu

l

at

i

ve purpose

s

and continue to hold these derivatives to offset our ex

p

osure to interest rate risk.

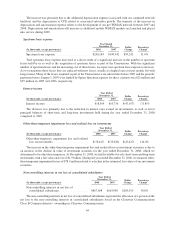

Th

e

f

o

ll

ow

i

n

g

ta

bl

e sets

f

ort

hi

n

f

ormat

i

on re

g

ar

di

n

g

our

i

nterest rate

d

er

i

vat

i

ve contracts as o

f

Decem

b

er 31

,

2008 (in thousands)

:

T

yp

eo

f

Derivativ

e

N

ot

i

onal

A

mount

Matur

i

t

y

Date

R

eceive

I

ndex Rate

P

a

y

Fixed Rate

Fai

rM

a

rk

et

V

alu

e

Swap

$

300,000 3/5/2010 3-month LIBOR 3.50%

$

(7,847

)

Swap

$

300,000 3/5/2011 3-month LIBOR 3.62%

$

(13,744

)

I

na

ddi

t

i

on, we are expose

d

to certa

i

n

l

osses

i

nt

h

e event o

f

non-per

f

ormance

by

t

h

e counterpart

i

es un

d

er t

h

e

i

nterest rate

d

er

i

vat

i

ve contracts. We expect t

h

e counterpart

i

es, w

hi

c

h

are ma

j

or

fi

nanc

i

a

li

nst

i

tut

i

ons, to per

f

orm

fully under these contracts. However, if the counterparties were to default on their obligations under the interest rate

7

2