Clearwire 2008 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

d

es

i

gnate t

h

e

i

nterest rate swap contracts as

h

e

d

ges. We are not

h

o

ldi

ng t

h

ese

i

nterest rate swap contracts

f

or tra

di

n

g

or specu

l

at

i

ve purposes an

d

cont

i

nue to

h

o

ld

t

h

ese

d

er

i

vat

i

ves to o

ff

set our exposure to

i

nterest rate r

i

s

k

.

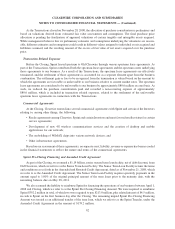

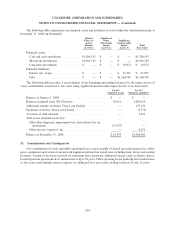

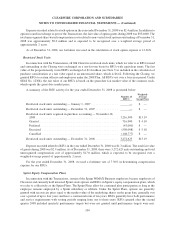

T

he followin

g

table sets forth information re

g

ardin

g

our interest rate swap contracts as of December 31, 200

8

(in thousands)

:

Type o

f

D

e

ri

va

ti

ve

N

otional

Amount Maturity Dat

e

R

eceive

I

n

de

x

Ra

t

e

P

a

y

Fix

ed

R

a

t

e

F

air Marke

t

V

a

l

u

e

Swa

p

...............

.

$

300,000 3/5/2010 3-month LIBOR 3.50%

$(

7,847

)

Swa

p

...............

.

$

300,000 3/5/2011 3-month LIBOR 3.62% $

(

13,744

)

Th

e

f

a

i

rva

l

ue o

f

t

h

e

i

nterest rate swaps are reporte

d

as ot

h

er

l

ong-term

li

a

bili

t

i

es

i

n our conso

lid

ate

db

a

l

anc

e

s

heet at December 31, 2008. In accordance with SFAS No. 157, we computed the fair value of the swaps usin

g

observed LIBOR rates and unobservable market interest rate swa

p

curves which are deemed to be Level 3 in

p

uts in

t

he fair value hierarchy (see Note 12)

.

S

i

nce t

h

e

i

nterest rate swaps are un

d

es

ig

nate

d

as

h

e

dg

es as o

f

Decem

b

er 31, 2008, we reco

g

n

i

ze

d

t

h

e ent

i

re

ch

an

g

e

i

n

f

a

i

rva

l

ue

i

n our conso

lid

ate

d

statement o

f

operat

i

ons w

i

t

h

no port

i

on

h

e

ld i

n accumu

l

ate

d

ot

h

e

r

c

omprehensive income (loss). The loss on the interest rate swaps recognized in our consolidated statement o

f

operations for the year ended December 31, 2008 was

$

6.1 million, which is recorded in other income (expense),

n

et

.

T

he interest rate swaps are in a liabilit

y

position to our counterparties as of December 31, 2008. We monitor the

r

isk of nonperformance of the Company and that of its counterparties on an ongoing basis

.

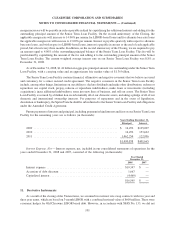

12. Fa

i

r Value Measurement

s

As defined in SFAS No. 157, fair value is the price that would be received to sell an asset or paid to transfer a

liabilit

y

in an orderl

y

transaction between market participants at the measurement date. In determinin

g

fair value,

w

e use var

i

ous met

h

o

d

s

i

nc

l

u

di

ng mar

k

et, cost an

di

ncome approac

h

es. Base

d

on t

h

ese approac

h

es, we ut

ili

z

e

c

erta

i

n assumpt

i

ons t

h

at mar

k

et part

i

c

i

pants wou

ld

use

i

npr

i

c

i

ng t

h

e asset or

li

a

bili

ty,

i

nc

l

u

di

ng assumpt

i

ons a

b

ou

t

r

isk. Based on the observabilit

y

of the inputs used in the valuation techniques, we are required to provide th

e

following information according to the fair value hierarchy. The fair value hierarchy ranks the quality and reliabilit

y

o

f

t

h

e

i

n

f

ormat

i

on use

d

to

d

eterm

i

ne

f

a

i

r

v

a

l

ues. F

i

nanc

i

a

l

assets an

dd

e

b

t

i

nstruments carr

i

e

d

at

f

a

i

r

v

a

l

ue

will be

cl

ass

ifi

e

d

an

ddi

sc

l

ose

di

n one o

f

t

h

e

f

o

ll

ow

i

n

g

t

h

ree cate

g

or

i

es

:

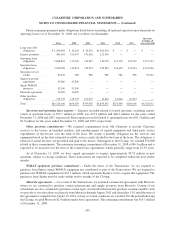

Level 1: Quoted market

p

rices in active markets for identical assets or liabilitie

s

Level 2: Observable market based inputs or unobservable inputs that are corroborated by market dat

a

Leve

l

3: Uno

b

serva

bl

e

i

nputs t

h

at are not corro

b

orate

dby

mar

k

et

d

at

a

We maximize the use of observable inputs and minimize the use of unobservable inputs when developin

g

fai

r

value measurements. If listed prices or quotes are not available, fair value is based upon internally develope

d

m

o

d

e

l

st

h

at pr

i

mar

il

y use, as

i

nputs, mar

k

et-

b

ase

d

or

i

n

d

epen

d

ent

l

y source

d

mar

k

et parameters,

i

nc

l

u

di

ng

b

ut not

li

m

i

te

d

to

i

nterest rate

yi

e

ld

curves, vo

l

at

ili

t

i

es, equ

i

t

y

or

d

e

b

tpr

i

ces, an

d

cre

di

t curves. We ut

ili

ze certa

i

n

assumptions that market participants would use in pricin

g

the financial instrument, includin

g

assumptions about

r

isk, such as credit, inherent and default risk. The degree of management judgment involved in determining the fai

r

va

l

ue o

f

a

fi

nanc

i

a

li

nstrument

i

s

d

epen

d

ent upon t

h

eava

il

a

bili

t

y

o

f

quote

d

mar

k

et pr

i

ces or o

b

serva

bl

e mar

k

e

t

p

arameters. For financial instruments that trade activel

y

and have quoted market prices or observable market

p

arameters, there is minimal

j

ud

g

ment involved in measurin

g

fair value. When observable market prices an

d

p

arameters are not

f

u

ll

yava

il

a

bl

e, management

j

u

d

gment

i

s necessary to est

i

mate

f

a

i

rva

l

ue. In a

ddi

t

i

on, c

h

anges

i

n

m

arket conditions ma

y

reduce the availabilit

y

and reliabilit

y

of quoted prices or observable data. In these instances

,

w

e use certain unobservable inputs that cannot be validated b

y

reference to a readil

y

observable market or exchan

ge

d

ata an

d

re

l

y, to a certa

i

n extent, on our own assumpt

i

ons a

b

out t

h

e assumpt

i

ons t

h

at a mar

k

et part

i

c

i

pant wou

ld

us

e

10

2

C

LEARWIRE

CO

RP

O

RATI

O

N AND

SU

B

S

IDIARIE

S

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)