Clearwire 2008 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2008 Clearwire annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.C

l

earw

i

re C

l

ass A Common Stoc

kb

e

f

ore t

h

eC

l

os

i

ng. T

hi

s num

b

er re

fl

ects t

h

e tota

li

ssue

d

an

d

outstan

di

n

g

sh

ares o

f

O

ld

C

l

earw

i

re C

l

ass A Common Stoc

k

an

d

O

ld

C

l

earw

i

re C

l

ass B Common Stoc

k

as o

f

Novem

b

er 28

,

2008

.

2

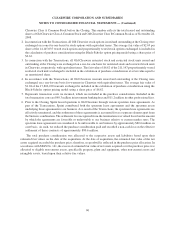

. In connection with the Transactions, all Old Clearwire stock options issued and outstanding at the Closing wer

e

e

xchanged on a one-for-one basis for stock options with equivalent terms. The average fair value of

$

2.69 per

s

hare of the 14,145,035 vested stock options and proportionall

y

vested stock options exchan

g

ed is included i

n

t

he calculation of purchase consideration using the Black-Scholes option pricing model using a share price o

f

$

6.62

.

3. In connect

i

on w

i

t

h

t

h

e Transact

i

ons

,

a

ll

O

ld

C

l

earw

i

re restr

i

cte

d

stoc

k

an

d

restr

i

cte

d

stoc

k

un

i

ts

i

ssue

d

an

d

outstandin

g

at the Closin

g

were exchan

g

ed on a one-for-one basis for restricted stock and restricted stock unit

s

i

n Clearwire, respectivel

y

, with equivalent terms. The fair value of $6.62 of the 211,147 proportionatel

y

vested

r

estr

i

cte

d

stoc

k

un

i

ts exc

h

ange

di

s

i

nc

l

u

d

e

di

nt

h

eca

l

cu

l

at

i

on o

f

purc

h

ase cons

id

erat

i

on at a

f

a

i

rva

l

ue equa

l

t

o

an unrestricted share

.

4

. In accordance with the Transactions, all Old Clearwire warrants issued and outstandin

g

at the Closin

g

were

e

xc

h

ange

d

on a one-

f

or-one

b

as

i

s

f

or warrants

i

nC

l

earw

i

re w

i

t

h

equ

i

va

l

ent terms. T

h

e average

f

a

i

rva

l

ue o

f

$

1.04 of the 17,806,220 warrants exchan

g

ed is included in the calculation of purchase consideration usin

g

th

e

B

lack-Scholes option pricin

g

model usin

g

a share price of $6.62.

5

.Re

p

resents transaction costs we incurred, which are included in the

p

urchase consideration. Included in th

e

t

otal transaction costs are

$

40.3 million in investment banking fees and

$

11.2 million in other professional fees

.

6

. Prior to the Closing, Sprint leased spectrum to Old Clearwire through various spectrum lease agreements. As

p

art of the Transactions, Sprint contributed both the spectrum lease a

g

reements and the spectrum assets

un

d

er

l

y

i

ng t

h

ose agreements to our

b

us

i

ness. As a resu

l

to

f

t

h

e Transact

i

ons, t

h

e spectrum

l

ease agreements ar

e

eff

ect

i

ve

l

y term

i

nate

d

,an

d

t

h

e sett

l

ement o

f

t

h

ose agreements

i

s accounte

df

or as a separate e

l

ement apart

f

ro

m

t

he business combination. The settlement loss reco

g

nized from the termination was valued based on the amoun

t

by which the agreements are favorable or unfavorable to our business relative to current market rates. The

s

pectrum lease agreements are considered to be unfavorable to our business by approximately

$

80.6 million on

a net

b

as

i

s. As suc

h

,were

d

uce

d

t

h

e

p

urc

h

ase cons

id

erat

i

on

p

a

id

an

d

recor

d

e

d

a non-cas

hl

oss on t

h

ee

ff

ect

i

v

e

s

ettlement of these contracts of approximately

$

80.6 million

.

T

he total

p

urchase consideration was allocated to the res

p

ective assets and liabilities based u

p

on thei

r

e

st

i

mate

df

a

i

rva

l

ues on t

h

e

d

ate o

f

t

h

e acqu

i

s

i

t

i

on. At t

h

e

d

ate o

f

acqu

i

s

i

t

i

on, t

h

e est

i

mate

df

a

i

rva

l

ue o

f

t

h

ene

t

assets acquired exceeded the purchase price; therefore, no

g

oodwill is reflected in the purchase price allocation. I

n

accordance with SFAS No. 141, the excess of estimated fair value of net assets ac

q

uired over the

p

urchase

p

rice was

a

ll

ocate

d

to e

li

g

ibl

e non-current assets, spec

ifi

ca

ll

y property, p

l

ant an

d

equ

i

pment, ot

h

er non-current assets an

d

i

ntan

gibl

e assets,

b

ase

d

upon t

h

e

i

rre

l

at

i

ve

f

a

i

rva

l

ues

.

9

0

C

LEARWIRE

CO

RP

O

RATI

O

N AND

SU

B

S

IDIARIE

S

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS —

(

Continued

)